The value and economic impact of the Romanian projects to attract resources from the so-called „Juncker Plan” of European investments are much lower, compared to those of the countries from Central and Eastern Europe, according to the European Commission’s reports made in May.

The value and economic impact of the Romanian projects to attract resources from the so-called „Juncker Plan” of European investments are much lower, compared to those of the countries from Central and Eastern Europe, according to the European Commission’s reports made in May.

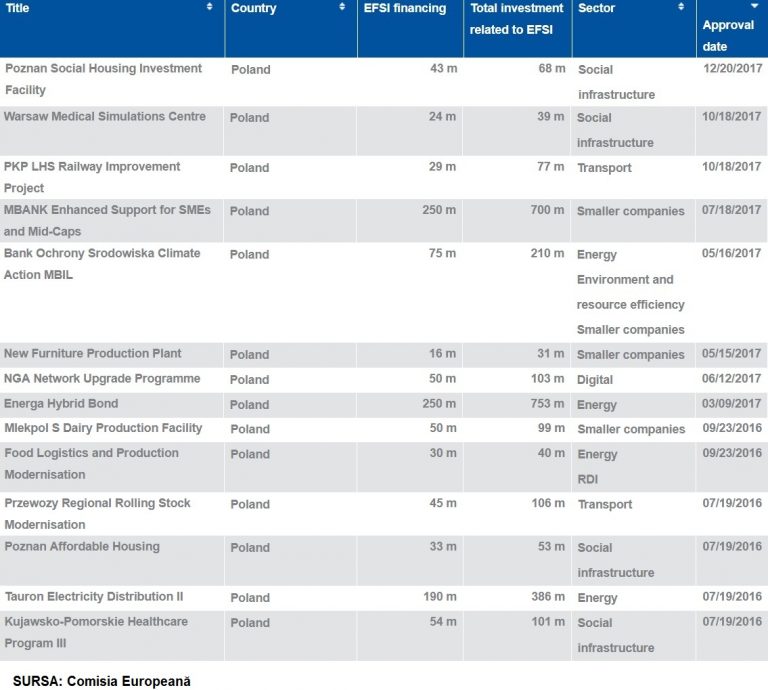

Several projects from Central and Eastern Europe are relevant to the use of resources provided by the Juncker Plan, through the European Investment Fund (EIF) and the European Investment Bank (EIB):

- Slovakia will build the ring road of Bratislava capital city. (Romania is far from succeeding the same for Bucharest).

- Poland will develop a regional hospital, improve and expand its electricity grid and build housing facilities for citizens with low incomes. (Romania has a new law on the public-private partnership, which would also be used for regional hospitals).

- Bulgaria will develop its business in the agro-veterinary field through the research project of a company with international exposure, including on animal vaccines. (In Romania, Cantacuzino Institute is still undergoing restructuring).

- Approved hospital construction projects in developed countries such as Austria, the Netherlands, Italy, and the United Kingdom are also remarkable.

- Romania’s most remarkable project is one that is part of a larger, pan-European one: 40% of the Romanian segment of BRUA gas pipeline. Pressures from the European Commission will be significant for Transgaz to properly prepare the application file.

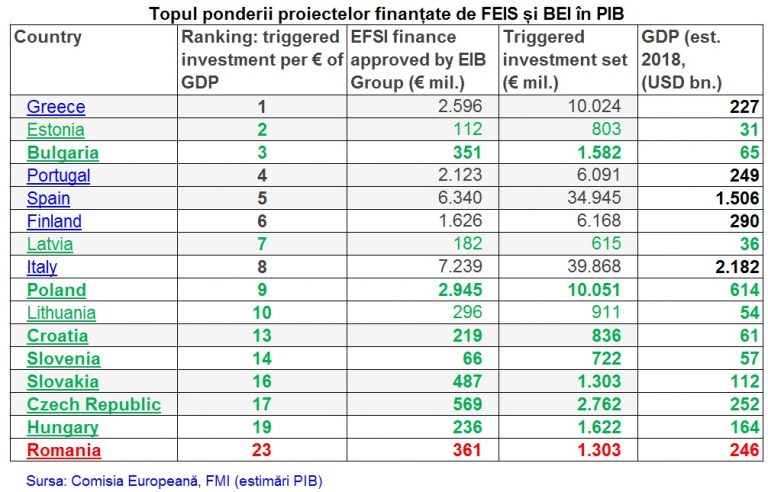

Share of projects in GDP: Bulgaria – 3rd position, Romania – 23rd position

The recent type of Romania’s economic growth (GDP) proves to be fragile also from the point of view of the capacity of using resources made available by Juncker Plan and provided by the European Investment Fund (EIF) and the European Investment Bank (EIB).

Our country also ranks 23rd in the top of project values, by the share of GDP of the investments provided by EIF and EIB, according to data released by the European Commission in May.

Bulgaria, Croatia and Slovenia have a lower economic power than Romania (according to the nominal GDP, estimated for 2018 by the IMF at about a quarter of Romania’s GDP), but rank 3rd, 13th and 14th, respectively.

Hungary ranks 19th, although its nominal GDP is 67% of Romania’s GDP.

*

- Ranking of investment projects financed by EIF and EIB, as a share of GDP

*

The capacity of Romania’s authorities and companies to use the Juncker Plan funds proves therefore much weaker than expected based on its economic growth if this growth were healthy.

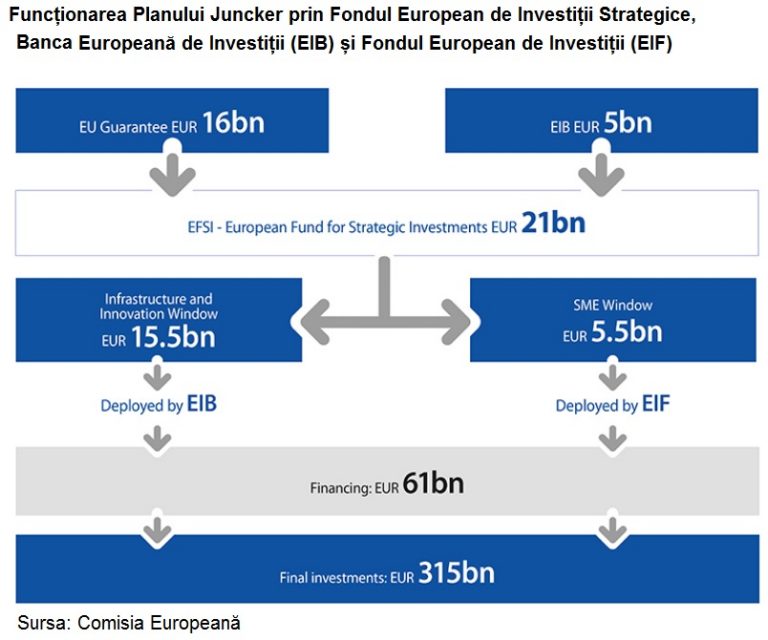

What „Juncker Plan” is

The Investment Plan for Europe initiated by EC President Jean Claude-Juncker four years ago and launched in May 2015, is the response of the European executive to the investment decline following the economic crisis.

The plan is based on 3 pillars, according to CE:

- The European Fund for Strategic Investments (EFSI), which provides guarantees for the European Investment Bank (EIB) loans. In September 2016, there has been decided an extension from three to five years, until 2020, and an extension of the investment target from EUR 315 to 500 billion.

- The European technical assistance platform and the European portal for investment projects, in association with the EIB Group.

- Improvement of the business environment by removing regulatory barriers to investment.

The operating mechanism is the same as originally set (even if the figures below were not updated after the investment targets have increased).

How Juncker Plan operates through the European Investment Fund, the European Investment Bank (EIB) and the European Investment Fund (EIF)

How Juncker Plan operates through the European Investment Fund, the European Investment Bank (EIB) and the European Investment Fund (EIF)

We and the others

Romania has gained its 23th position among the 28 EU member states, with a financing approved by EFSI of EUR 361 million, which can raise total project investment to a little over EUR 1.3 billion.

Besides Transgaz – BRUA project, Romanian companies that stand out because they succeeded to sign with EFSI and the EIB for financings under the Juncker Plan are:

- Unirea Medical Center, which received a grant from the EFSI of EUR 15 million and will invest a total of EUR 57 million in expanding Regina Maria‘s private health network.

- GreenFiber International SA, with an EUR 7.5 million loan (EFSI), to finance a recycling project that facilitates the transition to a circular economy. Total investment planned is EUR 20 million.

- Agricover, an IFN with expertise in loans for agriculture, will receive EUR 15 million from the EFSI (Tranche 1) to further finance SMEs in the agricultural sector. The total investment planned is EUR 54 million.

- Two projects have also been approved: the National Radiocommunications Company for the transition to a digital broadcasting infrastructure, amounting to EUR 10 million, and a research project, with no details, of the White Goods Factory.

As in most countries, Romanian banks also access EIF funds to finance SMEs.

The lenders in Romania have 5 financing agreements amounting to EUR 83 million and total investments would amount to EUR 471 million, for about 2,599 small firms.

Of all the projects of other emerging EU countries, we can also note:

Bulgaria

- Company Biovet will be funded for developing the production, including of animal vaccines, with EUR 100 million (the same amount as the one received by Transgaz from EFSI for BRUA gas pipeline).

- Oliva, a company that manufactures sunflower oil, will receive EUR 31 million to expand its production capacity. Total investments supported this way will be EUR 62 million.

- Financial intermediaries have twice as many agreements as those in Romania. They receive financing of EUR 70 million to support an investment of EUR 930 million in 6,033 SMEs, including start-ups.

Slovakia

- The Slovak public transport infrastructure institution (IES) will receive EUR 426 million for the plan, construction and operation of a 27 km section of the Bratislava motorway ring road. The total investment planned is estimated at EUR 639 million.

- Five loan agreements with financial intermediaries, of EUR 37 million, for crediting 7,621 SMEs with EUR 267 million.

Croatia

- The national energy company Hrvatska Elektroprivreda DD will receive EUR 50 million to build a capacity for electricity and heat cogeneration for Zagreb capital city. Total investment will be EUR 195 million.

- The project for developing tourism in the Istria peninsula from the Adriatic Sea will receive EUR 16 million.

Poland

A selection of Polish projects with already signed financing agreements looks like this: