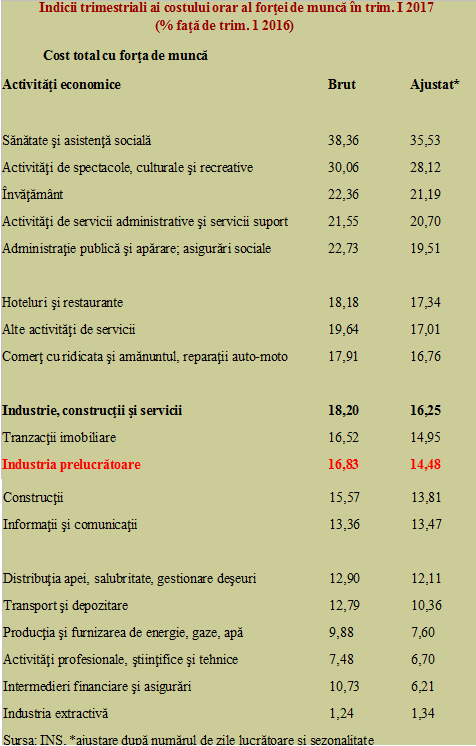

Hourly labour cost has already increased this year by 18.20%, in gross terms, in the first quarter of 2017, compared to the same period of 2016, according to the data announced by INS.

Hourly labour cost has already increased this year by 18.20%, in gross terms, in the first quarter of 2017, compared to the same period of 2016, according to the data announced by INS.

The increase is 16.25% if adjusted for the number of working days and seasonality (to ensure comparability of this indicator with the values recorded during the year).

In the context of the requests for salary increases and the postponement of the increase measures in the budget sector, initially planned for 1 July 2017, we present the current situation.

More precisely, the increase in the labour cost by various economic sectors, organized according to the international norms (see table).

*

- Quarterly hourly labour cost indicators in Q1 2017 (% compared to Q1 2016)

- Total labour cost

- Economic activities Gross Adjusted*

- Healthcare and social assistance

- Arts, entertainment and recreation

- Education

- Administrative and support service activities

- Public administration and defence; social insurance

- Hotels and restaurants

- Other service activities

- Wholesale and retail trade, auto repairs

- Industry, construction, services

- Real estate

- Manufacturing industry

- Construction

- IT&C

- Water supply, sewerage, waste management

- Transportation and storage

- Electricity, gas and water production and distribution

- Professional, scientific and technical activities

- Financial and insurance activities

- Extractive industry

- Source: INS, *adjusted for the number of working days and seasonality

*

It can be easily noticed that the state sector has already positioned significantly above the average for the economy, with the healthcare sector having a more than double growth rate compared to the average of the economy. It is also confirmed that, overall, the theoretical principle of faster wage increases in the services sector than in production is observed (the so-called Balassa- Samuelson effect).

The question is whether these values are alright and whether the economy can take on this real wage shock without losing the economic balances hardly stabilized over this decade. Even if the labour market is becoming increasingly affected by the lack of available workforce, following the years of departures to the West because of the lacking jobs.

The bad news is that double digits wage increases (let alone 18%) are extremely rare in a settled economy. The share of salary in the cost of products has already led, by means of wage increases, to an advance of 3.8% in the industrial production prices, which is expected to be noticed sometime soon, including in the stores and/or in the exchange rate.

The news neither bad nor good is that before the assault of the wage increases, there was a buffer (about to be ended, if not already consumed) from the relatively low share of the economic result corresponding to the employees. We should keep in mind that it is a rapidly diminishing resource that can no longer be used in the next years.

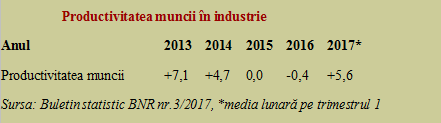

The good news is that we have again a robust advance of the industrial labour productivity (the benchmark for the whole economy, as it can be accurately calculated) after four years of consecutive drops by the following trend:

*

- Labour industrial productivity

- Year

- Labour productivity

- Source: BNR statistics bulletin 3/2017, * monthly average in Q1

*

It is therefore important to maintain this robust labour productivity growth, incidentally or not equal to the announced GDP growth in the first quarter of the year. It would be an extremely important change by a shift of focus at the qualitative level of the way of growing, from the extensive way, based on an increased number of employees, to increasing the results per employee.

In one way or another, it might be necessary to refine the evaluation methods in this respect also in the public sector, where measuring the social productivity of the work done is more difficult and subjected to more subjective criteria.

A solution for the Government might be to transfer an important share of the future salary increases burden to local authorities, but only based on the increase of local taxes with the necessary amounts. So that the population from each city to feel involved and can match the extra money paid with the public services offered.