The GDP 2020 estimate has been reduced for the third time in a row in the so-called Preliminary Autumn Forecast for the budget amendment published by the specialised National Commission. From an economic result of RON 1,141.4 billion according to the estimate issued in February, we went to RON 1,082.1 billion in April’s estimate, to RON 1,058.0 billion in August and now we reached RON 1,050.5 billion.

The GDP 2020 estimate has been reduced for the third time in a row in the so-called Preliminary Autumn Forecast for the budget amendment published by the specialised National Commission. From an economic result of RON 1,141.4 billion according to the estimate issued in February, we went to RON 1,082.1 billion in April’s estimate, to RON 1,058.0 billion in August and now we reached RON 1,050.5 billion.

This is to be the reference value for the macroeconomic indicators relative to GDP for the current year and the starting point for 2021budget construction. To be noted, from the mix between the increase by RON 5 billion in the numerator (from -91 billion to RON –96 billion) and the decrease by (additional) RON 7.5 billion in the denominator, the planned deficit for 2020 was revised from -8.6% to -9.1% of GDP.

It should be noted that, given the current uncertainties generated by the evolution of the pandemic, the forecast horizon has decreased significantly, from 2023 in the document presented in February, to only 2021. As well as the first time formulation of a „preliminary” autumn version which leaves room for further revisions, if the regular autumn forecast will also be issued.

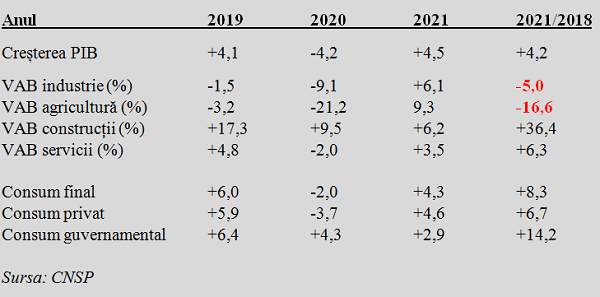

Beyond the hypotheses of economic recovery in V, W, L or another alphabetical form, it would be necessary, based on CNSP data, the remark that an important evolution in the structure of the economy will follow. Thus, if we report the results to the formation of gross value added (GVA) between 2021 and 2018, we can see a significant decline in traditional sectors such as manufacturing (-5%, with a possible return only in 2022) and agriculture (- 16.6%, namely one-sixth less).

*

- Year

- GDP growth

- GVA manufacturing

- GVA agriculture

- GVA constructions

- GVA services

- Final consumption

- Private consumption

- Government consumption

*

The expected recovery is massively based on the constructions sector (+ 36.4% as says the forecast, but let’s see if the effective demand in the field will maintain, despite the increase in the threshold for applying the reduced VAT rate to about EUR 140,000) and on the advance of services (+ 6.3%, but let’s see how the demand will evolve).

It should also be noted that, if GDP were to be higher in 2021 compared to 2018 by about four percentage points, consumption is expected to rise by eight percentage points. Which raises the main question from where the difference between production and consumption will be covered and especially with what subsequent costs.

Of course, the pandemic explains (although not alone, see the increases in pensions and salaries) the more pronounced pace of government consumption (+ 14.2%) compared to the private consumption (+ 6.7%). But it does not explain why we continue to systematically consume more than we produce and why the gap is continuously increasing.

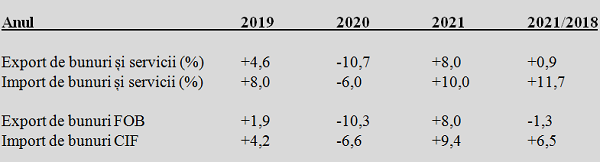

As we can see from the foreign projection when trade relations expand, exports increase less than imports and when they contract, exports fall more than imports. Hence a gap of over ten percentage points in the evolution of only three of them at the level of goods and services, as well as the finding that in 2021 we will export fewer goods than in 2018 but we will import by 6.5% more.

*

- Year

- Goods and services exports

- Goods and services imports

- FOB exports of goods

- CIF imports of goods

*

Therefore, it is not surprising that the trade balance would deteriorate from EUR -17.3 billion in 2019 to EUR 18.7 billion this year and EUR 21.3 billion in 2021 and the current account deficit will return to about EUR 10.5 billion next year, after a temporary decline to EUR 10 billion this year, in the context of declining trade relations.

And this development will put pressure on the exchange rate, although the devaluation against the euro will indirectly be tempered by the declining trajectory of inflation (from 3.83% annual average in 2019 to 2.7% for the current year and 2.3 % in 2021, with the note on the return at the end exactly to the median value of the target range, respectively 2.5%).

*

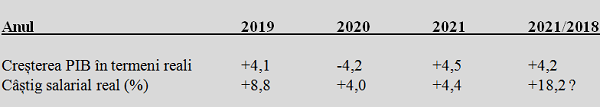

- Year

- GDP increase in real terms

- Real salary gain

*

Last but not least, it should be noted that an end in the systematic increase of wage purchasing power is foreshadowed, whether the GDP increases (and then further pressure is put on speeding up the incomes) or GDP falls.

Next year, real wage income would get again, otherwise naturally, in line with the evolution of the economy from which it is paid.