The consolidated budget ended the first two months of 2018 with a deficit of 0.59% of the estimated GDP for the current year, according to the data released by the Ministry of Finance.

The consolidated budget ended the first two months of 2018 with a deficit of 0.59% of the estimated GDP for the current year, according to the data released by the Ministry of Finance.

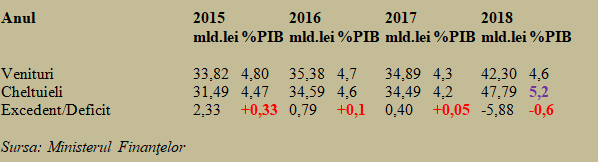

It is for the first time in the last four years when Romania registers a deficit at the end of February, the previous case being recorded in February 2014 (but only -0.46% of GDP) at the end of the economic crisis.

*

- Year

- Revenues

- Expenditures

- Surplus/ deficit

*

Compared to the same period of last year, there have been registered relatively significant increases both in total public revenues (+ 21.3%) and total public expenditures (+ 38.5%!).

The major difference in terms of growth rate led to a transition toward the deficit, after the trend of decreasing the small surplus at the beginning of the year (due to the contextual higher payments received, related in fact to the fourth quarter of the previous year) has been already shaped in the previous years.

To be reminded, the difference in the growth rate between CURRENT revenues and expenditures is even bigger („score” 13.1% – 30.9%), which does not justify a too optimistic view on a possible recovery in the coming months. Moreover, tax revenues advanced by only 3.8% in nominal terms, below the annual inflation (4.32% in January and 4.72% in February), which means that they decreased in real terms.

The situation has been masked by the European amounts transferred through the budget and on both categories of financial flows, amounting to about RON 3 billion both in revenues and expenditures (the growth rates published reached an increase of 2,285.2% in the amounts received from the EU, compared to the same period of the previous year and 1,473.3% in projects implemented with financing from external non-reimbursable funds).

Somehow surprisingly for an economy that has seen a growth provisionally announced at 7%, state revenue from corporate tax fell by 5.6% in the first two months of the year, while revenues from taxes on salaries and income stagnated (0%), in the context of the tax rate change from 16% to 10%.

On the side of indirect taxes with major impact on the budget, the results were mixed. VAT revenues were 7.8% higher in nominal terms, but a 6.2% drop has been registered in revenues from excise duties.

Significantly more money came to social security contributions, where over RON 3 billion have been collected in the same period of 2017 (or + 28.3%). For the first time, they have exceeded, in terms of volume, VAT and excise duties and their importance increased to almost one-third of total state revenues.

In this context, the question arises as to what use is the economic growth from the society’s perspective, as long as it does not bring more money to the budget to ensure some lagging social services in terms of volume and quality compared to the practice of more developed countries. Or for pressing investment needs, including at local level, for improving the infrastructure and business environment (highways and eGovernment are at the top of the list).

Increasingly weaker state, with ever greater obligations

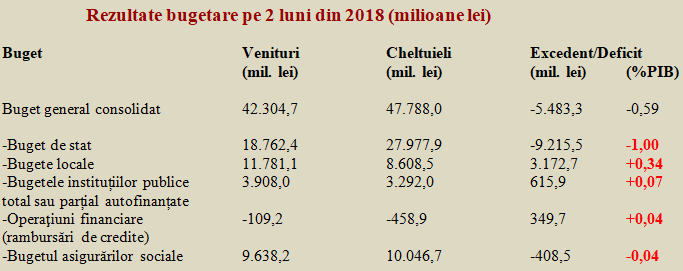

To find out how surpluses and deficits are organised in the consolidated budget, we present a selection of its main components. We should pay attention though to the share of state budget revenues in total public finances, which dropped to less than 45%, while expenditures are getting closer to 60%.

*

- Budget results for two months of 2018 (million lei)

- Budget revenues expenditure surplus/deficit

- Consolidated budget

- – state budget

- – local budgets

- – public institutions budget, entirely or partially self-financed

- – financial operations (loan reimbursement)

- – social assurance budget

*

With a decreasing financial strength in relation to GDP, the state assumes (based on deficits that are not sustainable in time) increasing obligations. It should also be noted that local budgets had no benefit from the economic growth. The amount allocated to them in the first two months was even lower in 2018 than in 2017, and their use to mitigate the significant deficit of the state budget became even more obvious than in previous years.

In fact, the state budget has already reached a deficit of 1% of the estimated GDP, which is not sustainable in time and that will be seen before the end of this year. When it should be very serious the issue of how much tax collections can be increased or how (and if) there can be adjusted the obligations to social categories that are larger and larger and increasingly dissatisfied with the incomes below the expectations created.

Wages in public sector rising above social assistance

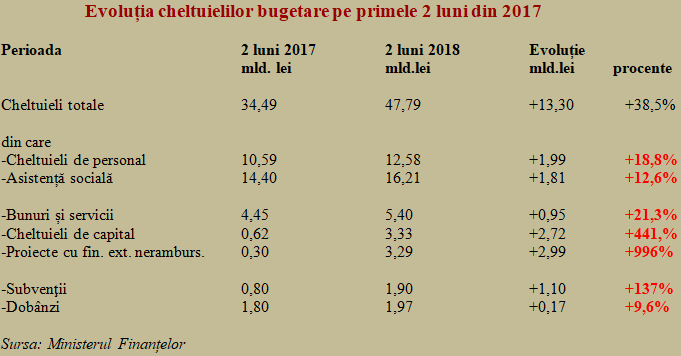

A selection of expenditures in the first two months of the year also shows a positive development, in principle. Less than four billion lei out of the extra spending of more than RON 13 billion were for payments to public servants and social assistance, while about seven billion lei were allocated additionally to projects with non-reimbursable foreign financing, capital expenditures, goods and services.

*

- Evolution of budget expenditure in first two months of 2018

- Period

- Total expenditure

- Of which

- – staff expenditure

- – social assistance

- – goods and services

- – capital expenditures

- – projects with non-reimbursable foreign financing

- – subsidies

- – interests

*

It is also worth mentioning the payment made earlier for subsidies, which contributed to deepening the deficit recorded based on the operative data by more than RON 1 billion.

At the same time, however, it is worth noting the structure of increases in staff expenditure (+18.8%) and social assistance (12.6%).

That, in the context in which the first will exceed the 7% of GDP, threshold previously recommended by international institutions, and the latter will remain below the EU average.