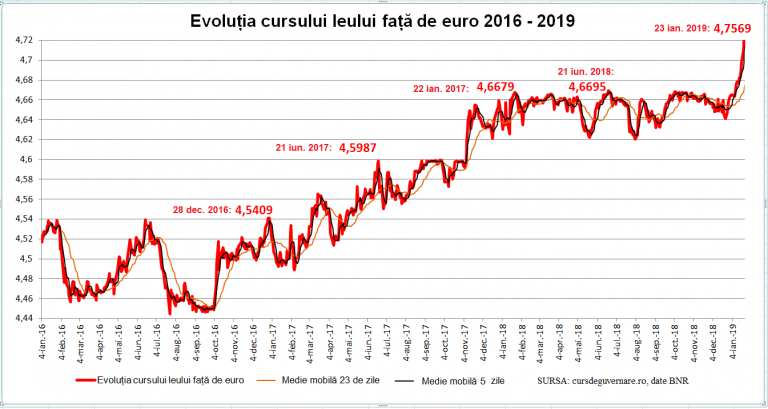

The average euro exchange rate, calculated by the National Bank of Romania (BNR), suddenly climbed sharply to a new record level of 4.7569 RON / euro, 0.91% higher than on Tuesday, at the end of a day in which the interbank market started with quotes over 4.78 RON.

The average euro exchange rate, calculated by the National Bank of Romania (BNR), suddenly climbed sharply to a new record level of 4.7569 RON / euro, 0.91% higher than on Tuesday, at the end of a day in which the interbank market started with quotes over 4.78 RON.

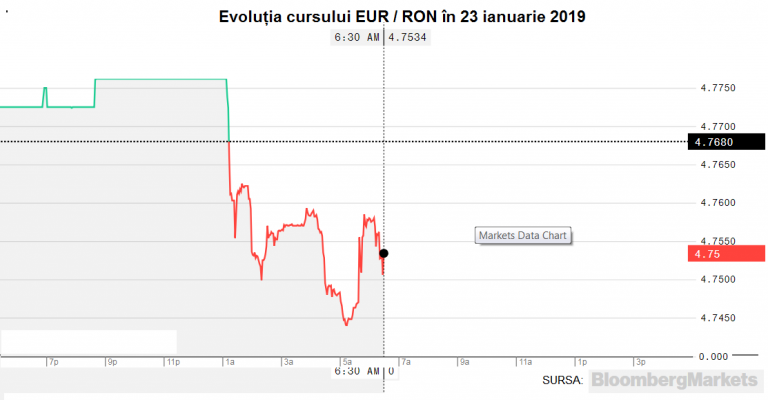

The market then had the evolution of a day during which the speculative attack prepared right in the morning faced obvious tempering operations.

And Tuesday, quotes fell sharply by about five Romanian bans in 10 minutes and the BNR was suspected of having intervened on the market to calm the spirits.

On Wednesday, however, several waves of growth and declines occurred, a sign that operations for tempering the depreciation were more elaborate, given that in the coming days, the RON-denominated liquidity would decrease as a result of the tax payment period.

*

- Evolution of EUR/RON rate on January 23, 2019

*

The retail Forex market has already exceeded the threshold of 4.80 RON/EUR, which exceeded the most severe forecasts for this year.

CFA Romania analysts have just published the results of their monthly survey, according to which the exchange rate could reach 4.7168 RON/EUR in six months, but to 4.7883 RON/EUR in 12 months.

Other estimates of the largest banks in Romania place this year’s maximum levels between 4.73 and 4.80 RON/EUR.

Romanian Leu lost 1.87% compared to the worst exchange rate registered before the current depreciation wave (4.6695 on 21 June 2018) and 2% this year.

*

- Evolution of EUR/RON rate between 2016 – 2019

*

„We do not know what’s next. It is difficult to estimate both the impact of the asset tax and the budgetary uncertainty. It is a mutual test, market’s tolerance toward BNR and BNR’s estimates on it,” said the economist of a large bank in Romania last week.

Speculators are attracted by the unfavourable context of Romanian finances, aggravated by Government Emergency Ordinance 114/2018, which has reduced the force of BNR’s policies by linking a tax on bank assets to the market interest rate.

Mechanism of spiralling depreciation

The speculative attacks take advantage of the unfavourable context characterized by high inflation, the deficit of public finances and Romania’s external imbalances, expressed by the trade deficit and the deficit of the balance of payments, according to the economists asked by cursdeguvernare.ro.

The initial source of imbalances was the increase in the RON amount in the market following wage increases, as well as the reduction of taxation over the last three years.

The excess of RON was not sustained by the increase in the volume of domestic goods and then imports explosively increased against the pace of exports, and the need for foreign currency has become chronic.

Speculators have been waiting for the right moment to trigger attacks against the Romanian Leu even since the consolidation of the upward trend in the trade deficit and the deficit of the balance of payments (current account).

The initiation moment has been created by the „ordinance on greed” and by the impasse of the Ministry of Finance in drafting the budget with a maximum deficit of 3%.

„Vilcov-Teodorovici” Ordinance, which announced the bank assets taxing based on the average market interest rate for RON, makes the monetary policy interest rate tool used by the BNR inoperable to calm down inflation.

The BNR can no longer raise the interest rate applied for lending to banks because it will contribute to the deterioration of their balance sheets because of the new tax.

Nor can BNR intervene in any speculative circumstances by acquisitions on the foreign exchange market, because it would only encourage speculators: they would sell it the euro, the rate would fall, only to give them the chance to buy cheaper RON with which they would resume euro acquisitions to bring it to a new level, where the depreciation spiral would go on.

The attack mechanism is also based on the technique of settling some RON-euro exchange instruments (swap). Speculators bet on depreciation, buy RON at a certain quote and rely on their subsequent settlement after they will have sold euro to profit.

This way the spiral of depreciation is self-fuelled with resources.

Finally, the state itself needs both RON and euro to cover its deficit. As a result:

- either it recourses to local banks, but for an increasing interest rate, because they are considering the additional tax they will have to pay,

- or recourses to foreign loans in EUR, but they may also be expensive because the BNR can no longer make Romanian Leu attractive enough by use of its own interest rate.

In fact, the major depreciation waves of the past two years have occurred (see chart above):

- before elections in autumn of 2016 and at the expense of the government program of future election winners;

- on the occasion of state budgets of the following two years, or their amendments, respectively because of the delay in 2019 budget.

In conclusion, the BNR cannot preserve RON and interest rate at the same time (and speculators know that) but only diminish the disaster.