The concentration of the economic activity in increasingly fewer large companies, their distribution in the territory and the capitalization problems of most Romanian firms are all Romania’s vulnerabilities to external shocks and competition.

The concentration of the economic activity in increasingly fewer large companies, their distribution in the territory and the capitalization problems of most Romanian firms are all Romania’s vulnerabilities to external shocks and competition.

Analysts’ warnings, supported by worrying statistics, find no answer in the authorities’ economic and tax policies.

Dramatic figures: 1% of companies produce 67% of total revenue

- About 3% of Romanian firms generate 68% of total sales and employ 41% of total employees, according to a recent study by the consulting group CITR.

The companies considered have assets of over one million euros and are „impact companies in Romania„, according to the study.

- More precisely, only 1% of Romanian companies account for 67% of the total revenues reported, and the first half of the top companies represent 98% of these revenues, according to a Coface study.

- The best-performing companies in Romania, in a sustainable way (2.1% of the total) generate 41% of the gross added value created by the non-financial sector, says a study by a group of economists from BNR.

- There are about 52,500 „veteran companies in power” which have managed to keep on growing for 20 years, covering almost 90% of the firms that form the critical mass of high-performing companies in the economy. However, they have little potential for adaptation to offer innovative products to resist competition in the future.

Local companies, issue of geographic polarization

- Only 12 of the 65 Romanian companies that made it to Top 500 Coface of the largest companies in Central and Eastern Europe have domestic capital.

- Economic polarization leads to social polarization. Romania is the country with the highest proportion (21.5%) of poor employees within the EU, according to the Eurostat data quoted in a study from Cursdeguvernare.

- The economic polarization also has dramatic territorial effects: Bucharest (+ Ilfov) contributes over 27% to GDP in 2017 (more than double compared to 1985), and the following counties are far away: Constanta (5%), Prahova (4.7%, both benefiting from a good infrastructure connection to the capital city), Cluj (4.6%), Timis (4.5%), according to the data of the National Prognosis Commission (CNP).

- 26% of the Romanian population in the five areas mentioned produces 46% of GDP

- the poorest counties register average values of debt and saving four times lower than the richest counties

- Four of the eight so-called Romania’s development regions are among the poorest 20 in the EU

In response to these realities, the Government and policy makers have adopted a set of tax relief measures and wage increases in the public sector, sacrificing public investment, despite the vulnerabilities identified in the National Strategy for Competitiveness until 2020, approved by the Government Decision 752/2015.

Threats of polarization: SMEs – usual victims

The CITR Group survey analysed the „impact companies” (with assets of over one million euros) and found that „their number has sharply fallen by 17%” from 2013 to 2015, while their consolidated turnover increased by 4%, „which results in higher sales made by fewer firms.”

„The Romanian economy is dependent on a small number of large companies, and the small and mid-sized companies, which represent the vast majority of Romanian companies, are extremely vulnerable”, because they depend on the orders placed by the former, warns Rudolf Vizental, General Manager of CIT Resources.

So „Romania remains as fragile as in 2007-2008 and the experience of the previous crisis does not create any comfort because we are not better prepared now for the eventuality of a rebound,” concludes Rudolf Vizental.

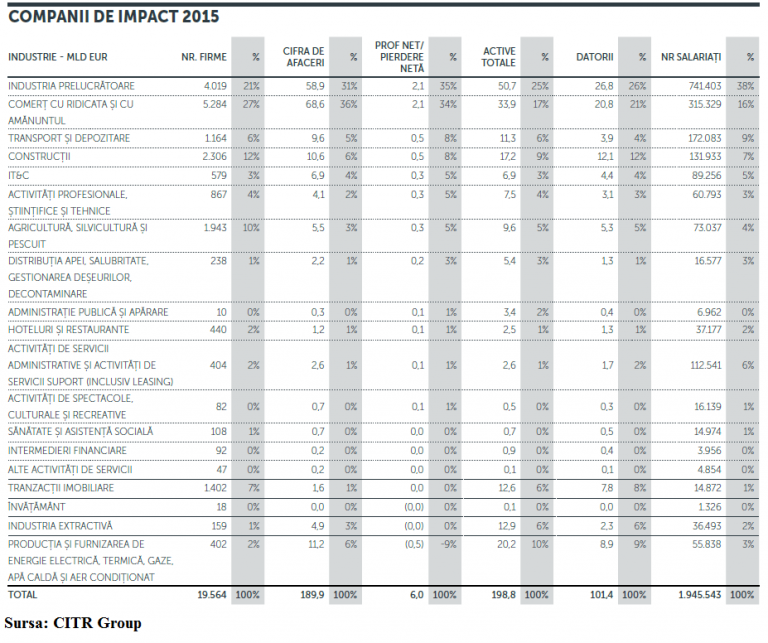

The 19,564 „impact companies” identified by CITR in 2015 had a turnover of EUR 189.9 billion, obtained with nearly two million employees (1.945.543 and declining), with a median productivity of 74,000 euro per employee.

Evolution: year after year even worse

The economic sectors that contribute the most to the cumulative profit in 2015 are those active in the manufacturing and retail sectors, by 35% and 34%, respectively. These two have also a major contribution to the cumulative values of other indicators such as the number of companies, turnover, total assets, debts and number of employees.

*

- Impact companies 2015

- Industry – billion euro number of companies turnover net profit/loss total assets debts employees

- Manufacturing

- Retail and wholesale trade

- Transportation and storage

- Construction

- IT&C

- Professional, scientific and technical activities

- Agriculture, forestry, fish farming

- Water distribution, sanitation, waste management, decontamination

- Public administration and defence

- Hotels and restaurants

- Administration services and support services (including leasing)

- Shows, cultural and recreational activities

- Health and social assistance

- Financial intermediation

- Other service activities

- Real estate

- Education

- Extracting industry

- Production and supplying electricity, heat, natural gas, hot water and air conditioning

*

The business environment is affected by a strong polarization phenomenon, as the largest 1,000 Romanian companies generated almost 49% of the added value in the economy at the end of 2015 compared to only 35% in 2008. In this context, the rich become richer and the poor get even poorer,” remarks Iancu Guda, President of the Association of Financial and Banking Analysts of Romania (AAFBR).

On the other hand, only about 6,900 veteran and „vigorous” companies are part of the elite of the best-performing companies, according to the methodology of the survey „Ready for the Future? A New Perspective on Romania’s Economy”. The survey has been published in the BNR study books and was conducted by Florian Neagu, Florin Dragu and Adrian Costeiu.

To the critical mass on which the future of the economy depends, another 6,200 companies are added from the Romanian corporate elite. From all of them, the economy has the highest expectations to help narrow the gap with the average of the EU, so that Romania to have chances to get a position as good as possible within the future European architecture.

On the other hand, only 360 companies have domestic capital of the 1,000 best performing firms identified by the Coface survey. Companies with domestic capital also have the biggest financing problems, on the one hand, and problems of adaptation to the modern, technological challenges and the challenges of product and service innovation.

Incidentally, no company with domestic capital is among the best placed 10 Romanian companies in the Coface Top 500 of the largest companies in Central and Eastern Europe, by the 2016 turnover.

Moreover, three of them are large retail chains (Kaufland, Carrefour and Lidl), another one is British American Tobacco, four of them are subsidiaries of OMV Petrom and Rompetrol (two each), and finally, the best positioned is Automobile Dacia.

Romania also stands out in the same ranking with other retail chains (Auchan, Metro Cash & Carry, Mega Image and REWE), energy distribution companies (E.On Energie and Engie subsidiaries), or fuel distribution companies (MOL Romania Petroleum Products) (152/167) and telecom operators (Orange, Vodafone and Telekom subsidiaries).

Major issues: capitalization – steady decrease

The status of a major multinational organization’s subsidiary makes the financing and upgrading capacity of a company easier. Most Romanian companies have though major capitalization problems.

One of Romania’s vulnerabilities is „the very low degree of capitalization and the trend is a steady decline since the impact of the financial crisis until now, from 32.2% in 2008 to 28.7% at the end of 2016„, according to the analyst Iancu Guda.

In general, „the present macroeconomic picture is similar to that of 2008 and the local business environment has five major differences, all negative:

- a much slower collection of invoice payments

- a higher concentration of revenues, profits and liquidity at the large companies (losses are more widespread among all companies),

- decreasing capitalization,

- the decrease in the working capital (which became even slightly negative at the end of 2016) and

- a more embryonic and less active (less experienced) business environment„, according to the analyst.

*

- The five major differences of the business environment in 2016 compared to 2008 and their implications in terms of sustainability and risk of active companies

- Phenomenon 2008 2016 implications/consequences

- Duration for collecting the claims 60 days 105 days higher interdependency between companies and systemic risk, increasing contagion through the domino effect

- Revenues concentration – top 1% 35% 50% middle-class narrowing, lower capacity of the business environment to cushion the negative shocks

- Capitalization level 32.2% 28.7% higher dependency on the external financing conditions and higher vulnerability of companies

- Present liquidity (working capital) 1.11 0.96 lower self-financing capacity which involves a lower immunity of companies in stressful situations

- Embryonic business environment:

- – companies with a lifespan < 5 years 25% 38% an embryonic business environment, half of the companies did not go through the financial crisis, have a low experience, which means the managers could react emotionally and unpredictably in a negative context

- – companies without activity 20% 28%

- – companies with negative own capital 40% 45%

*

„In essence, we are talking about a business environment less capitalized (more indebted), polarized, inexperienced, vulnerable (with lower self-financing capacity) and more exposed to the contagion effect (domino), of spreading the commercial risk (customer insolvency).

„I do not see how such a business environment can better manage a possible international crisis, compared to what happened in 2008,” also said the AAFBR president

Strategies are vague and not applied. Real vulnerabilities

The Government identified two years ago in a „National Strategy for Competitiveness until 2020”, several vulnerabilities that have maintained until now.

There has been no sign about the implementation of the strategy, except that it has been renewed as promises in the program of the two governments appointed in less than a year.

Here are the untreated maladies, as outlined in the quoted strategy:

- „Low performance in innovation because of a national RDI (research – development-innovation) system only in an early stage of formation, mainly characterised by:

- weak connections between research units and the business environment,

- low RDI spending (as a percentage of GDP), early connections at international level,

- low transfer of the R&D results,

- low demand for R&D from the private sector,

- a very low share of RDI employees in the active population.

- Low level of the population’s computer literacy and use of technology at the level of enterprises and society.

- A slower rhythm of transformation than it is necessary for Romania to overcome the status of less developed country (…) significant delays in developing the supporting factors, especially the transport infrastructure, the exploitation of creativity, strengthening the entrepreneurial initiative.

- The opening of trade takes place at low-performance levels, measured by the level of productivity in the manufacturing industry, the share of high technology products, the innovation index.

- Vulnerabilities of the private environment exist especially related to:

- the international investments of Romanian companies,

- productivity in the manufacturing sector,

- innovation,

- energy efficiency and

- the development of competitive economic agglomerations in the territory

- Vulnerabilities of central and local public administration exist especially in relation to:

- the low absorption of the European funds,

- high corruption index,

- lack of efficiency in the management capacity to solve the procedural difficulties in the business development, including the business infrastructure.

- Contribution to the improvement of competitive advantages is significantly reduced for services, the most important economic sector, with 67% of GDP, whose exports are at a low global market share and slightly decreasing.

- Contribution to the improvement of the competitive advantages at the territorial level, measured by the participation of the counties’ economies in exports, is significantly unbalanced in favour to seven counties from the west and the centre of the country, which, together with Bucharest (17%), account for 60% of Romania’s exports.