The European Central Bank (ECB) has restarted, in the summer of 2019, its rhetoric concerning the necessity of a new round of quantitative easing, i.e. of an expansion of its balance sheet through issuing money against collateral.

The European Central Bank (ECB) has restarted, in the summer of 2019, its rhetoric concerning the necessity of a new round of quantitative easing, i.e. of an expansion of its balance sheet through issuing money against collateral.

In order to justify this option, a series of arguments are brought forward:

- some of which are transparent (an inflation rate below the target; a feeble rate of economic growth),

- some others that are veiled (over-indebtedness of some states, firms, and households; the need to stimulate the euro area exports through a depreciation of the currency).

In a series of articles, starting with this one, we will analyze how pertinent these arguments are.

Inflation rate below target

From the beginning, we must emphasize that meeting the inflation target represents the only statutory objective of the ECB. None of the other objectives, be they transparent or opaque (stimulating economic growth, reducing over-indebtedness, stimulating exports) constitute statutory objectives for this institution. It has come to pursue them by omission, since other public authorities, tasked to manage them, have failed to do so.

At euro’s launching, in the early 2000’s, the definition of price stability was adopted, as an annual inflation of 2 percent. While logically and semantically this definition represents an oxymoron (a contradiction in terms), it was accepted in order to leave, on one hand, enough room of maneuver for the less competitive states from the south of the euro area (EA), and on the other hand, to accommodate eventual price increases due to quality upgrades once innovations are being incorporated.

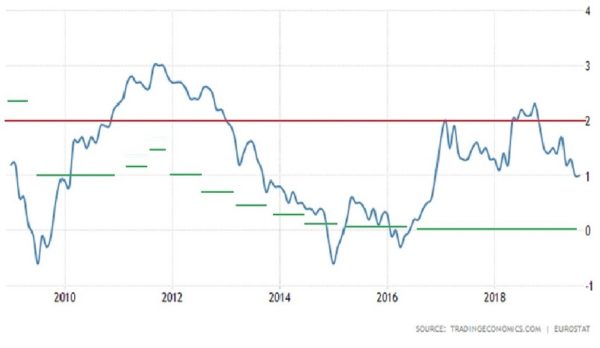

It was also then that the inflation target to be followed by the ECB, of “below 2 percent, but close to it”, was established. Graph 1 shows the evolution of inflation in the EA in the period 2009 – 2019 (the blue line), compared with the inflation target of almost 2 percent (the red line).

Of course, one may wonder what is meant by close to 2 percent. Is 1.7 percent, for instance, good enough? What about 1.5 percent? From ECB’s Board statements one may draw the conclusion that only 1.9 percent is considered close enough, which is absurd: no central bank can meet its target with such a surgical precision.

Surpassing the inflation target in 2011 – 2012 was countered by an increase of the monetary policy rate (the green line), from 1 percent in 2010 to 1.5 percent in 2011. This increase is nowadays blamed on Governor Trichet, as being haphazard and not enough forward looking, given the subsequent fall in inflation. However, it is difficult to argue against that increase, with the then-disposable information, taking into account ECB’s mandate and its inflation target.

Later, the continuous fall in inflation, until its transformation into deflation (negative increase of prices) by the end of 2014, was fought through interest rate reductions, in the first years of Governor Draghi, to 0.25 percent. In 2015, with inflation stubbornly in negative territory, ECB has started its programme of quantitative easing (QE) and forward guidance (FG), previously experienced by the American Fed. Again, until then, everything was done according to the textbook, including the policy rate reduction to 0 percent.

The problem that needs answering is why in 2019, after two years of inflation hovering between 1 and 2.25 percent (i.e. close to the target), the ECB feels compelled to initiate a new round of quantitative easing. Moreover, the instruments at its disposal are scarce: with the monetary policy rate set at 0 percent since 2016 (thanks God it didn’t end up like the central banks in Japan, Sweden, Denmark or Switzerland, with negative nominal rate, i.e. by charging interest for the money deposited with it by commercial banks, instead of remunerating them) and with its balance sheet massively expanded, the ECB has little room left for QE.

We emphasize the fact that any central bank creates money “out of nothing, but not against nothing”. Rather, it does so in exchange for some valuable paper (government bonds, municipal bonds, promissory notes) of certified quality, that can be redeemed in case of need. Or, the supply of such valuable paper seems to have grown scarce in the world, since they have been purchased by several central banks under their quantitative easing programs. And acquiring “junk” paper poses both statutory and legal problems for the central bank, being, in fact an issuance of money uncovered by guarantees.

Not accidentally, at the last Board meeting of the ECB, governors from six member states (representing more than 50 percent of Euro Area’s GDP) have opposed the relaunching of QE, but were outnumbered by the ones in favor, even though the latter represented a minority in terms of GDP.

The fundamental question is: to which extent the inflation target of below, but close to 2 percent, set at the beginning of the century, still corresponds to today’s realities. Already one can witness that, post-crisis, a number of relations that were valid before 2007 do not function anymore. The best known is the Philips curve, which shows the relation of inverse proportionality between unemployment rate and inflation rate. Before 2007, this curve had a pronounced negative slope, meaning that a percentage point reduction of the unemployment rate led to several percentage points of increase in the inflation rate (increasing employment put a pressure on wages, which translated into a price increase).

After the crisis, the Philips curve got flatter, meaning that several percentage points of reduction in the unemployment rate result in an insignificant increase of the inflation rate. Whether this change in pattern is due to the diminished power of trade unions, or to the fact that producers compensate through quantity reduction (e.g. smaller chocolate bars sold at the same price) rather than through price increases, is left for further research.

Fact is that, for a variety of reasons, the inflation rate corresponding to price stability might have fallen from 2 percent to 1.5 percent or, perhaps, 1 percent. And if this phenomenon were true, then ECB’s blindfold pursuit of the 2 percent target might prove illusory and unrealistic. Incidentally, some renowned analysts have drawn attention to this possibility. Thus, according to Mohamed El-Erian:

“….technological innovations – particularly those related to A.I. , big data, and mobility- have ushered in a more generalized breakdown of traditional economic relationships and an erosion of pricing power…..[Its] effect has turbocharged a disinflationary process that began with the acceleration of globalization, bringing far more low-cost production online and reducing the power of organized labor in advanced economies.” (“How inflation could return”).

Or, according to Martin Wolf:

“But there are other significant factors [for low inflation]: high gross savings rates in important emerging economies; ageing in many economies and so a declining demand for physical capital; and de-industrialization in high-income economies”… (“How our low-inflation world was made”).

There is, therefore, a significant probability that the ECB, by pursuing an inflation target established twenty years ago, is chasing a ghost, moreover, without having the necessary ammunition (positive interest rates or valuable disposable paper).

In conclusion, from a strictly formal point of view, the ECB is covered by its statute in its pursuit of a 2 percent inflation through quantitative easing. If we take a closer look at the context, there are however many question marks surrounding this approach.

(to be continued)