Despite the recent fiscal relaxation, the biggest problem for Romanian companies remains the (high and unpredictable) taxation and not the access to financing, according to the June edition of the National Bank of Romania (BNR) Survey on the companies’ access to financing, between October 2016 and March 2017.

Despite the recent fiscal relaxation, the biggest problem for Romanian companies remains the (high and unpredictable) taxation and not the access to financing, according to the June edition of the National Bank of Romania (BNR) Survey on the companies’ access to financing, between October 2016 and March 2017.

For more than 80% of the 11,000 companies surveyed by the BNR, the level of taxation and its unpredictability are „the most pressing problems” in June 2017, the same as in December 2016.

On the other hand, almost the same share of companies (81%) are not interested in getting financing from credit institutions (banks and IFNs) – show the results of the survey.

At the same time, 64% of the companies surveyed by the BNR do not consider that the access to financing would be a pressing problem.

An explanation

Almost half of the Romanian active companies (268,000) have a negative equity, so they are non-bankable and the bank credit is inaccessible for them, according to the most recent BNR report on the financial stability.

So, many of the companies that do not want loans would be denying what is not accessible for them.

That is how most companies choose to reinvest profits to finance their activity or sell assets when they have profits or assets for sale – of course. This is the case for 45% of SMEs and less than 40% of corporations, according to the BNR survey.

Also, instead of approaching the bank, companies resort to loans from shareholders and, if they have the required availability, to the share capital increase (27% of SMEs and 16% of corporations).

Whether they use the bank loans or not, companies mention the following biggest difficulties in obtaining the loans:

- „too high interest rates and commissions,

- requirements for the value or type of collateral

- terms of contract and

- the bureaucracy and the maximum debt ratio allowed by the credit institution,” according to the June 2017 BNR survey.

Vicious circle

The higher appetite of entrepreneurs for loans from their shareholders and not for bank loans has an explanation in the „legislation gaps that make more interesting for the company owner to lend money to the company than to come up with a capital contribution,” was stating Valentin Lazea, BNR Chief Economist at the beginning of June.

„By lending money (to her own company, the owner) can deduct the tax and so she gets to consume from the company’s equity. Why does the owner choose to lend rather than contribute to the company’s share capital? If the firm goes bankrupt or is closed, the owner may enter the statement of affairs as a creditor,” explains Valentin Lazea.

Shareholders’ behaviour is not solely responsible, though, for the poor financing of companies. The destinations of companies’ sources of financing give the measure of the low degree of economic development, respectively the development of companies.

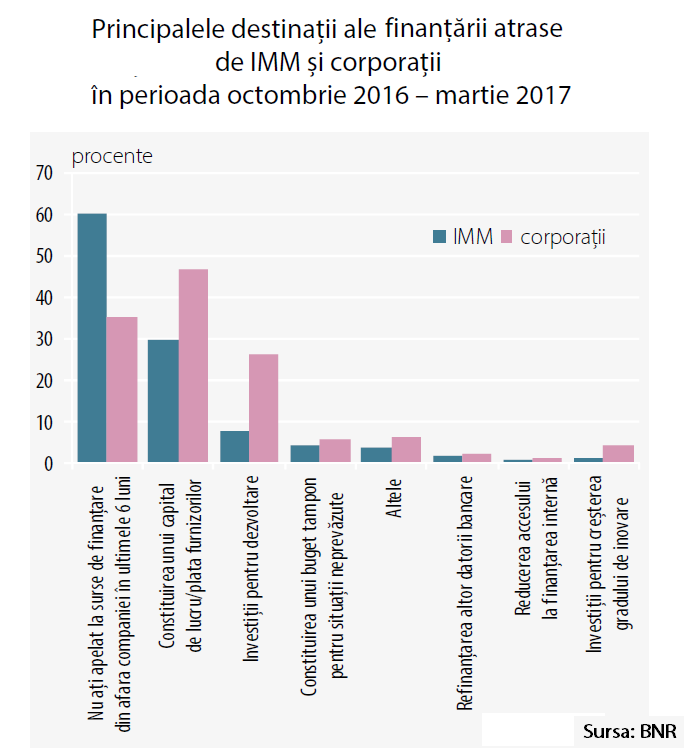

Money is mainly directed to working capital and payments for suppliers: 47% of corporations proceed like that and 29% of SMEs, according to the BNR survey. Proportions are lower for investments: 26% of corporations that made use of external funds, respectively 7% of SMEs.

*

- Main destinations of financing attracted by SMEs and corporations between October 2016- March 2017

- You have not made use of external sources of financing in the last six months

- Formation of working capital/payments for suppliers

- Investment for development

- Formation of a buffer capital for unforeseen situations

- Other

- Refinancing other bank debts

- Decrease of access to internal financing

- Investment for increasing the innovation level

*

In other words, companies rather survive than develop, which is also indicated by the share of commercial credit, the third largest source of financing, if excluding the „Other” section.

It is relevant, in this context, the conclusion of a study published by BNR in March saying that the future of the Romanian economy still depends on aging companies that have managed to keep growing but have a low adaptation potential to offer innovative products as the competition demands.

There are about 52,500 „veteran companies in power” representing almost 90% of the companies that make up the critical mass of high-performing businesses in the economy.

It is therefore not surprising that after taxation, the most pressing problems facing Romanian companies are competition and the lack of demand.

This is only then followed up by finding the qualified personnel, especially for the companies from the manufacturing industry, according to the June issue of the BNR survey on the companies’ access to financing between October 2016 and March 2017.

In other words, the vicious circle has closed: most Romanian companies have reached or exceeded the indebtedness capacity limit, at least according to the current lending standards. The owners of many of them prefer to lend money, instead of making capital contributions, and companies become this way even less „bankable”. Furthermore, companies pay their bills with delays, which decreases their reputation on the market and they will borrow money increasingly harder until they disappear. But not their owners, who will resume the cycle, using what they have recovered from the loans given to their own companies.

Bank responsibility

It is true, though, BNR has also noticed that banks prefer to earn from the high differences between the interest on loans and the interest on deposits, rather than on the volume of loans.

Interest margins in Romania are among the highest in Europe, although they have decreased, according to the BNR report on the financial stability from May 2017.

Lending based on a business plan or high-performance business projects is a rare practice in the Romanian banking system. This is what BNR also referred to when criticizing „banks’ lack of vision on the evolution of a market that, in the absence of a breath of fresh air in the corporate lending, will continue to shrink,” according to the report on stability.

BNR accuses not only the banks’ appetite for an easy profit, as one of the issues that „limit the corporate lending” and make the volume of loans to the population to exceed the corporate lending.

BNR also lists in the report on the financial stability the following causes:

- „burdensome internal procedures and regulations,

- high degree of dependency on parent banks in approving large loans,

- too low board diversification with people who understand the specifics of the Romanian economy,

- insufficient training and motivation of bank staff directly interacting with clients,

- lack of a mid-term vision on the evolution of a market that, in the absence of a breath of fresh air in the corporate lending, will continue to shrink.”

„Lending is the purpose of the banking activity, and the profit must come from lending, given that in a competitive market the profit is primarily made based on the volume, not on margins. A too high solvency ratio is not only a favourable development but also an indicator that money exists but is not used for lending,” the report also states.

Highly qualified professionals with vision in the field of lending could support business projects with responsibility. The National Bank does not mention, though, which of its own innovative visions did not have any effect on the visionary behaviour of banks.