The consolidated general budget ended the first five months of 2017 with a deficit of -0.27% of the estimated GDP for the current year, according to data released by the Ministry of Finance.

The consolidated general budget ended the first five months of 2017 with a deficit of -0.27% of the estimated GDP for the current year, according to data released by the Ministry of Finance.

The balance of government finances deteriorated by almost half percent of GDP in a single month (the balance was + 0.17% of GDP at the end of April 2017).

Compared to the same period last year, both public revenues increased by slightly more than 7 billion lei and public expenditures by almost 9 billion lei.

However, CURRENT revenues increased by only 4.4%, well below the rate of total revenues (+ 7.9%). While CURRENT expenditures advanced by 11.3%, significantly above the rate of + 4.4% recorded for total expenditures.

*

- Total revenues (million lei) 5 months of 2016 5 months of 2017 Differences

- Total expenditure (million lei)

- Current revenues (million lei)

- Current expenditure (million lei)

*

If we look at the difference in growth rate between total revenues and total expenditure, we do not see such a big difference, but if we do the same with the current revenues and expenditure, the gap increases almost five times. This shows that there is a major trend problem occurring in covering the current expenditure based on the current revenues.

„The budgetary doping” has been made by a strong wage increase in the public sector (+ 18.1% in personnel costs representing a two and a half times higher pace than for the total state revenues, and almost four times higher in relation to the increase rate of the current revenues) and without a basis in the productivity growth registered in the real economy.

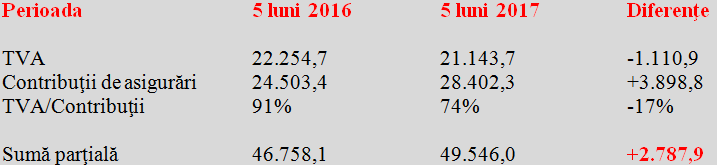

If selecting the most important components of budget revenues, one can see the effect of the economic policies presented during the election campaign and subsequently implemented. Practically, they bet on a more than controversial strategy of strong labour taxation and reduction of tax on consumption (incidentally, not quite on the left side from the political point of view).

*

- Period 5 months of 2016 5 months of 2017 Differences

- VAT

- State insurance contributions

- VAT/contributions

- Partial amount

*

The result of this mix implemented in the first five months of the current year was about 2.8 billion lei in addition to the budget, representing about 70% of the current revenue growth officially registered to almost 4 billion lei.

Which would not have been a problem if the money in question did not come to a large extent from the wage increases granted with an extra 19.1% in the public sector, obviously, without any relation to the labour productivity. More specifically, the extra amount allocated to salaries in the public sector was 4,391.7 million lei, most of which went back to the budget as contributions and VAT.

So, as we can see, instead of a miraculous Perpetuum mobile (clearly unachieved since more money has been spent than obtained, in the absence of a connection to the domestic economic activity to take over the extra demand for products and services), the national wealth has been redistributed from the private to the public sector and the national currency weakened, as well as the GDP estimated in euro for the end of the year at an average exchange rate of 4.49 lei/euro.

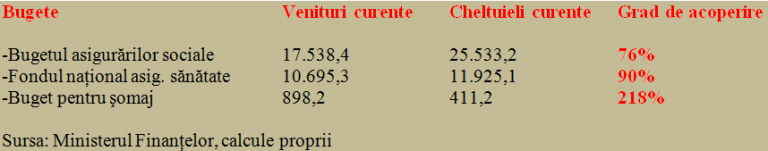

At the same time, taxing the state wage increases on the system of moving more money from a pocket to another induced an increase of the coverage rate in social insurance budgets (up to 76% and with a slight increase since the beginning of the year), health insurance budget (reached 90%) and the unemployment budget (pushed to an unlikely and unnecessary 218%!).

Regarding the relative mega-surplus of the unemployment budget, it might be useful if someone would explain why do not increase somewhat more consistently the amounts paid to people temporarily lacking an employment commitment and/or their share in the total number of unemployed, which got close to one in four people looking for work. Especially that the family budget indicators show a clear concentration of poverty in the families of unemployed.

*

- Begets Current revenues Current expenditure Coverage rate

- Social insurance budget

- National health insurance fund

- Unemployment budget

*

How exactly does the deficit of the National health insurance fund of 505.7 million lei get along with the increases in wages and pensions of those who do not find vital medicines or do not have access to medical care (which has already placed us in the first position in the EU in terms of avoidable deaths), that remains to be explained by who will implement in the future the government strategies.

Budget deficit went crazy in May

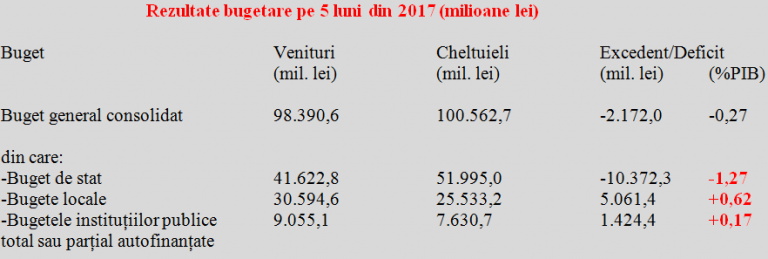

To identify the arrangement of surpluses and deficits in the consolidated general budget, we made a selection of its main components. Compared to the data released at the end of April 2017, it is striking the increase of the state budget deficit from 6 billion lei to over 10 billion lei, representing not less than -1.27% of the estimated GDP for the current year.

*

- Budget results in 5 months of 2017 (millions lei)

- Budget

- Consolidated general budget

- Of which:

- – state budget

- – local budgets

- – budgets of fully or partially self-financed public institutions

*

It should also be noted that, as a direct result of the tax cuts, the share of state budget revenues in the total public finances dropped to only 42%, while expenditure was at 52%. The contrast between the resources weakened by the tax cuts and the obligations undertaken at the social level deepens, which characterizes a sort of left-right policy.

Salaries and social protection granted exceed resources

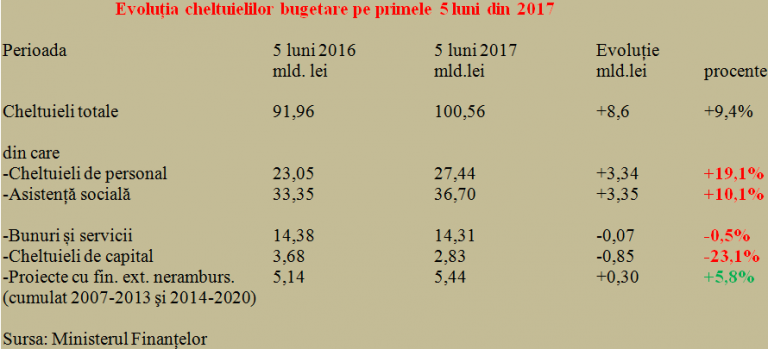

A selection of expenditure in the first five months of the year shows an excessive increase of the wage bill, more than three times higher than the economic results, as well as a too high increase rate of social assistance (10.1% compared to the GDP advance of 5.7%, the signal value for Q1 2017) in relation to the possibilities resulting from the increase in the budget receipts.

*

- Evolution of budget expenditure in the first five months of 2017

- Period

- Total expenditure

- Of which

- – staff costs

- – social assistance

- – goods and services

- – capital expenditure

- – projects with foreign non-reimbursable financing (cumulated 2007-2013 and 2014-2020)

- Source: Ministry of Finance

*

In contrast, the expenditure on goods and services, and especially the capital expenditure recorded negative nominal values compared to the same period of the previous year.

The only positive mention can be made regarding the change of trend in the non-reimbursable projects segment, which resumed the positive trend after the difficulty from the first third of the year (but, noteworthy, in relation to the not-so-good results of the former technocrat government).