Prime Minister Tudose announced on Thursday that the split VAT measure will apply only to companies with problems:

Prime Minister Tudose announced on Thursday that the split VAT measure will apply only to companies with problems:

A fair decision: not the split payment would have solved the (VERY BIG) problem of the VAT in Romania.

cursdeguvernare.ro offers you an exhaustive analysis of these severe budget issues – starting from two figures. Two known and another one presented for the first time.

And then we will also see where it is – quantifiable – the VAT of Romania that the government does not go to recover.

Figures first: In the reference year 2015, state collected more VAT than declared

1-, the MFP officially considers that the VAT gap is about EUR 3 billion. The European Commission believes that Romania’s VAT gap was EUR 7.6 billion in 2015.

The difference comes from the fact that the Romanian Government ignores much of the definition the Commission gives to this gap.

2- The Government puts the gap on the account of the delays in the VAT payments of companies that still declare it, and hopes that the split payment measure will bring about 2 billion to the next budget.

The figure seems to have no basis. That is because:

3-, The figure presented for the first time: in 2015 (the year for which the European Commission calculated a VAT gap of EUR 7.6 billion), Romanian companies declared a total VAT amount of 73.8 billion and the state collected in the same year 74.6 billion.

The data are from ANAF – as we can see in the answer given by the institution at the request of cursdeguvernare.ro.

Question:

What is trying the Government to hide though behind the split VAT?

Here is the answer, or the answers:

Where VAT actually goes

In the European Commission’s analysis of the VAT gap, with the reference year 2015, there are:

1- Fraud and tax evasion

2- Insolvency of companies

3- Bankruptcy of companies

4 – Poor tax administration

5- Tax optimizations

To the Commission’s analysis, the specificities of a rudimentary economy such as the Romanian economy should be added, though, specificities that we shall present below.

But before that, let’s note that at none of the points monitored by the European Commission we find the VAT fraud through non-payment by those who have declared it.

This point became a measure of the Ministry of Finance through a source of policies that we shall remind below.

Until then, the situation of the VAT that the Government was keen to split:

Where collected VAT figures do not fit declared VAT:

The official justification of the Ministry of Finance for the introduction of the split VAT:

In the explanatory memorandum of the draft ordinance, the ministry’s officials clearly write: „As regards the payment compliance, the VAT paid in time compared to the VAT declared in the VAT returns submitted by the taxable persons registered for VAT purposes was: 81.05% in 2015, which means that out of RON 73,818.59 million, RON 59,832.72 million have been collected„.

In documenting the series of materials for the split VAT payment, cursdeguvernare.ro requested some data from ANAF. Among them, the VAT amount declared in 2015 and the amount of VAT collected in 2015.

The official response sent by the institution’s communication service is:

„The declared VAT amount for 2015 was RON 73.81 billion and the VAT collected in 2015 was RON 74.66 billion”.

Essentially, the figure communicated by ANAF not only does not correspond to the one announced by the Ministry of Finance but basically cancels out one of the official justifications according to which the split VAT payment was legislated.

Essentially, the figure communicated by ANAF not only does not correspond to the one announced by the Ministry of Finance but basically cancels out one of the official justifications according to which the split VAT payment was legislated.

Where the Government DOES NOT look for VAT: some striking figures

Closing this bracket, which still contains a matter that is worth clarifying officially, back to the matter.

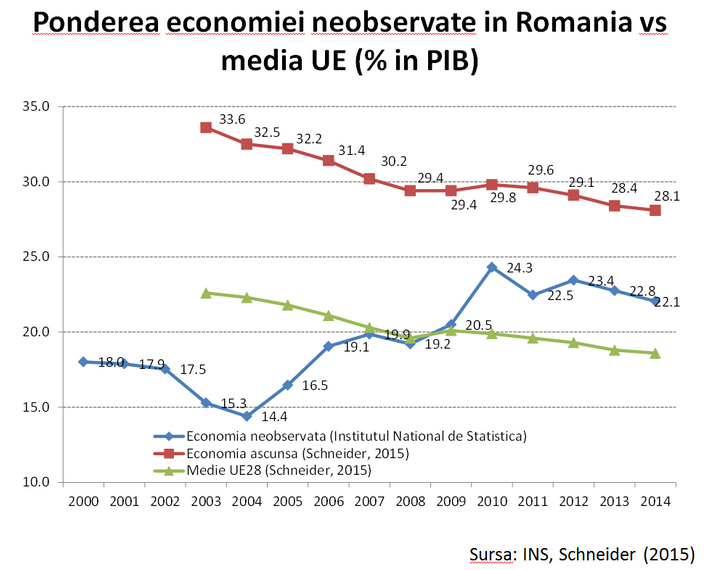

1– Economic evasion and fraud, according to the European Commission’s 2014 Moneyval Report, accounted for 29.6% of GDP, or about EUR 20 billion.

- The unseen economy is officially recognized, according to INS data, as accounting for 22.1% of GDP. In figures, this is about EUR 17 billion

3- Insolvencies and bankruptcies, according to ANAF data, produced in 2015 (the reference year in the report on the VAT gap published by the European Commission in September 2017) generated budget arrears worth over EUR 12 billion.

To the above list the damage caused to the state budget should be added as well as a 4th point:

4 – „tax maladministration”, an indicator used by the European Commission, which the Ministry of Finance officially translates as the VAT revenue loss caused by „erroneous calculations.”

A figure for this type of loss is impossible to estimate. We know, however, because the World Bank, not some Romanian official, has communicated that, for example, the program for reforming ANAF, including the IT component, is totally behind the schedule. And that has a meaning: someone has NO interest for ANAF to become an institution digitalized by the book, that is, transparent.

Non-observed economy and Vosganian’s egg. Or vice versa

The non-observed economy has officially caused a loss of EUR 17 billion in 2015 – shows the INS data.

But it depends on who calculates these data:

- INS estimates the unseen economy at 1% of GDP in 2015

- Schnider research places this type of economy for the same year at 1% of GDP

According to the OECD Handbook on Non-Observed Economy Measurement (2002 edition), this is defined by:

- underground production: productive and legal activities but deliberately hidden to authorities to avoid compliance

- illegal production (prohibited by law)

- production of the informal sector – activities in the household sector or other units that are not registered

- production of households for own final consumption

We find here the famous „egg” of Varujan Vosganian, ALDE member of the Chamber of Deputies, who, in full debate about the utility of the split VAT, was warning against the issue of the consumption of own production.

As a principle, fairly, the consumption of own production damages the budget revenues.

This damage, however, is much lower, than for example, the damage the state suffers because all products sold at the marketplace are not subject to taxes.

We just look at what is happening in Bucharest, either in the „luxury” neighbourhoods, Dorobanti or Domenii, or in the „popular” markets, Obor or Rahova – those who stay at the fruit and vegetable stalls are but producers.

Obvious conclusion:

By not declaring the sales in the markets for taxes, the decision making political structure gets benefits through its representatives, that is, the head of the marketplace, his network of influence, perhaps even the mayor who appointed him.

It is worth mentioning, as officially accepted figure, that the non-taxed production for own consumption amounts to about 5-6% of GDP in Romania.

Share of non-observed economy in Romania vs EU average (% of GDP)

Share of non-observed economy in Romania vs EU average (% of GDP)

About insolvency, bankruptcy and passivity

State budget loses significantly, not only from VAT, insolvency, and bankruptcy. The official figures communicated by ANAF: „In 2015, 11,805 taxpayers under the insolvency procedure have been identified by ANAF, which registered arrears of RON 20.64 billion. There were also 34,178 bankrupt taxpayers with arrears of RON 33.60 billion.”

The number of bankrupt and insolvent companies is high in Romania compared to figures from neighbouring states, of course, considering the proportions of the economy and the size of the business environment. And that says something about the quality of this business environment.

But something else is important: losses caused by insolvency or bankruptcy are uneven – some „favoured” are allowed to run free in the economy for years, without any control, without preventive measures, without guidance. Until 2-3-7 insolvency or bankruptcy situations account for as many as 25,000 SMEs in a similar situation.

Notorious examples:

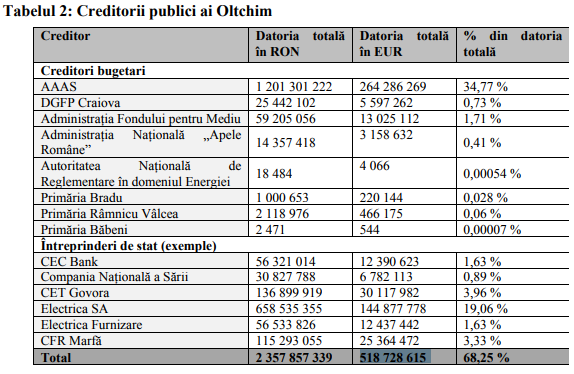

Oltchim.

It entered the insolvency proceedings in January 2013. It has a reorganization program with a final approval in the court in September 2015. Only the debts to public creditors reach almost EUR 519 million

*

- Table 2 – public creditors of Oltchim

- Creditor total debt in RON total debt in EUR % of total debt

*

What the reorganization plan means: writing off a debt of RON 2.3 billion (about EUR 550 million)

- EUR 250 million were debts written off from the account of AAAS and other public creditors

- the remaining EUR 300 million are claims by private investors (EUR 50 million were written off – BCR, for example, agreed for about 30% of the guaranteed claim to be written off)

Last year, the European Commission opened an in-depth investigation to verify whether the debt cancellation decided by the Romanian state and Oltchim’s continued supply by state-owned enterprises, despite the deterioration in its financial situation, complied with the EU state aid rules.

Complexul Energetic Hunedoara

It entered and went out of insolvency several times over the past year. At present, there are new insolvency claims from creditors.

In April 2015, the European Commission approved a temporary rescue aid amounting to EUR 38 million (RON 167 million) that the company needed to continue its operation of its power plants in the following six months. Year-end debt, according to the Ministry of Finance, showed a figure of more than RON 1.2 billion.

However, debts increased and in early 2016 CEH management demanded the insolvency because they could not repay debts of RON 1.7 billion, of which RON 556 million were only to ANAF.

It received a state aid of almost RON 200 million this year for the closure of Lonea and Lupeni mines. The aid has been authorized by the European Commission.

Teamnet and Asesoft

The largest local IT&C players – Teamnet International and Asesoft International – have entered the insolvency, but cannot be liquidated. DNA intervened in the lawsuit and succeeded in obtaining the ban, to recover the possible damage accepted by the courts at the end of Sebastian Ghita’s criminal cases.

Both companies have been established by fugitive Sebastian Ghita and entered the insolvency proceedings when former Chamber of Deputies member’s problems with the law became worse (Asesoft at the end of 2015 and Teamnet demanded for starting the insolvency proceedings in March 2017).

The total amount claimed by the creditors in the Teamnet case was RON 328.42 million, but the creditors’ table approved by the bankruptcy judge mentions only RON 284 million.

Of this total:

- RON 3.7 million are debts to ANAF

- RON 16.3 million – debts to the Ministry of Regional Development

- RON 0.92 million – debts to the European Commission – through the Research Executive Agency

- RON 0.97 million – to the European Commission

According to data held by the Ministry of Finance, Asesoft International had debts of over RON 110 million and receivables of RON 60.9 million.

Constanta Port, big wholesalers: abyss where no government has the interest to look

Again, split VAT was enacted because the state says too many do not pay this tax. We must repeat: it’s about companies with transparent businesses that declare taxes.

For these situations there are laws, there are procedures for the state to recover the losses.

But what do we do with those who do not declare taxes? We get, periodically, not as often as we would like, let’s face it, news from the ANAF Antifraud: goods or money seized from various evasion networks (unless it happens like in 2015, when the tax authority announced in advance, probably due to the enthusiasm of the communication department, controls at the „Dragonul Rosu”).

The big evasion is close to us – in all the wholesale stores around the capital city, in Constanta Port, at the customs, and the examples can continue.

Instead of examples, figures:

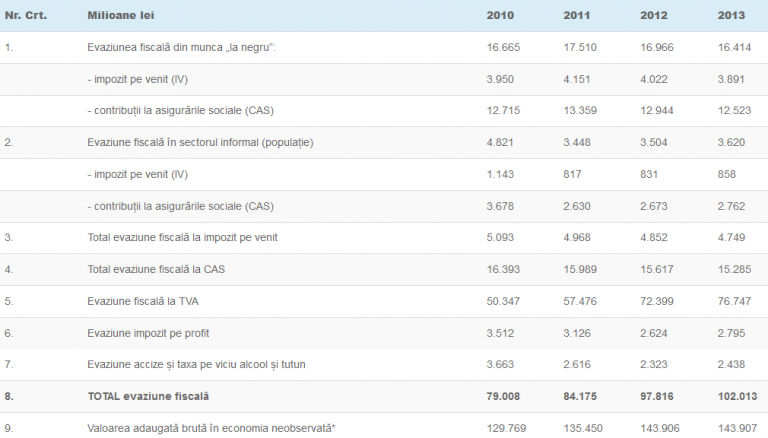

According to the European Commission’s estimates that the share of the underground economy in Romania accounted for 28.4% of GDP in 2013, reaching EUR 40 billion generated by economic frauds and tax evasion.

In 2014, tax evasion and fraud calculated by INACO, based on data of the Fiscal Council and the European Commission, accounted for 29.6% of GDP.

*

- Million RON

- Tax evasion from illegal work

- – income tax

- – CAS contributions

- Tax evasion in the informal sector (population)

- – income tax

- – CAS contributions

- Total income tax evasion

- Total CAS tax evasion

- VAT tax evasion

- Corporate tax evasion

- Evasion in excise duties and vice tax on alcohol and tobacco products

- Total tax evasion

- Gross added value in the non-observed economy

*

Data and vision on fiscal pressure

The data presented in the analysis are official figures – from Romanian or European sources, research firms or official reports exchanged between Romanian authorities and foreign official institutions.

These data were and are also known by those who have proposed, made the technical plan and supported the split VAT measure.

According to cursdeguvernare.ro, it is a group created around the nucleus supported in the BNR Board by the current political coalition, whose economic measures have been throughout this year in a violent debate over the effects on the real economy.

These are economists who know this data, have access to details and nuances that journalists do not always have access to, but whose economic vision on the private economy would have had a chance to improve during their mandates in the Romanian Government:

Mr Florin Georgescu – former Minister of Finance, current Prime Vice-governor and a determined advisor of the PSD-ALDE coalition on the relationship between the state and the private economy;

Mr Gheorghe Gherghina – former Secretary of State and in charge for more than 20 years of the actual technical elaboration of Romania’s budgets all this time. The budget system used by all the governments in which Mr Gherghina served, in which real economy is subordinated in absolutely all aspects to the state exigencies, has been ended even by the former USSR since the implementation of Perestroika and Glasnost policy.

Mr Liviu Voinea – former Minister Delegate for the Budget.

*

cursdeguvernare.ro will return to these issues: the tolerance for tax evasion of the governments so far but especially in 2017 will put pressure on the 2018 budget. It is hard to predict by what taxation or collection procedures the real VAT gap will be offset.