The dividends proposed to stockholders by the management of the companies listed on the Bucharest Stock Exchange (BSE) are very likely to place Romania also this year at the top of the world ranking of the yields of investments made for this purpose.

The dividends proposed to stockholders by the management of the companies listed on the Bucharest Stock Exchange (BSE) are very likely to place Romania also this year at the top of the world ranking of the yields of investments made for this purpose.

Bucharest’s capital market ranked first last year among the world’s highest average yields, according to a report by the German investment bank Berenberg.

The average of the 20 largest dividend yields is 8.78%, down from 9.56% last year at the prices of the shares in question, registered on 31 March on BSE. This year’s average is though above the estimation made in December, of 7.21%, according to a report by the brokerage firm Prime Transaction, published Tuesday.

The profitability of the stock market investment is thus almost 10 times higher than the average deposit interest rate for the population, for term deposits of less than a year in December, which was 0.9% and much higher than the interest rate of deposits made in February 2017 (0.83%, according to the National Bank).

Even the lowest net dividend yield is higher than the average interest rate on deposits.

The main reason for the above-expected yields is a higher allocation rate of the state-owned profits to dividends, following the Government’s decision that this rate should be at least 90%, according to the report mentioned, published on the news and analysis aggregator InvestingRomania.com, also launched by the BVB on Tuesday.

Six companies have net dividend yields of over 10%, including Fondul Proprietatea (FP), which will distribute shares capital to shareholders. Net yield is calculated taking into account a 5% tax on dividend, provided by the Tax Code. The FP allocation is non-taxable, as it is a return of capital, technically speaking.

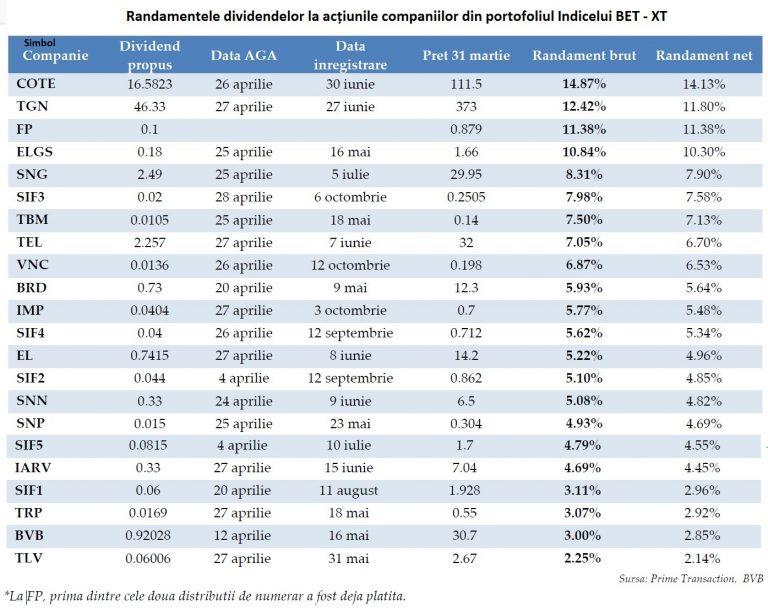

Top yields recorded by 25 most important shares listed on BSE, included in BET – XT index basket:

*

- Dividend yields of shares from the BET – XT portfolio

- Company Dividend proposed General Shareholders’ Meeting scheduled on Date of registration Price at 31 March Raw yield Net yield

*

- Conpet Ploiesti pipeline transportation company (COTE) is for the second year in a row the leader of the dividend proposed, this time with a yield of 14.87%, lower than last year. „Then, the proposal to allocate dividends from the retained earnings has been rejected by the General Shareholders’ Meeting, but the probability of success is much higher this year,” say the Prime Transaction analysts.

- Transgaz (TGN) had a much higher than expected profit last year, and the 90% allocation rate required by the Government brings the dividends to not less than 46 lei/share, almost twice as high as the dividend paid last year. The yield of 12.42% of the closing price on 31 March is the fourth highest on BVB.

- Fondul Proprietatea (FP) will allocate this year 0.1 lei/share to the shareholders, twice as high as in the previous years.

- Household appliances producer Electroarges Curtea de Arges (ELGS) adds to the list of issuers from the BET-XT index with yields higher than 10%. „The financial results of the company have continued to improve, but the share price has also increased dramatically, so the dividend yield is down from nearly 15% last year.”

- Romgaz (SNG) has almost fully allocated in recent years the profit to dividends.

- SIF Transilvania (SIF3) is again the SIF company with the best dividend proposal, „while the other SIFs seem to have reoriented to buying back their own shares, based on the model of Fondul Proprietatea.”

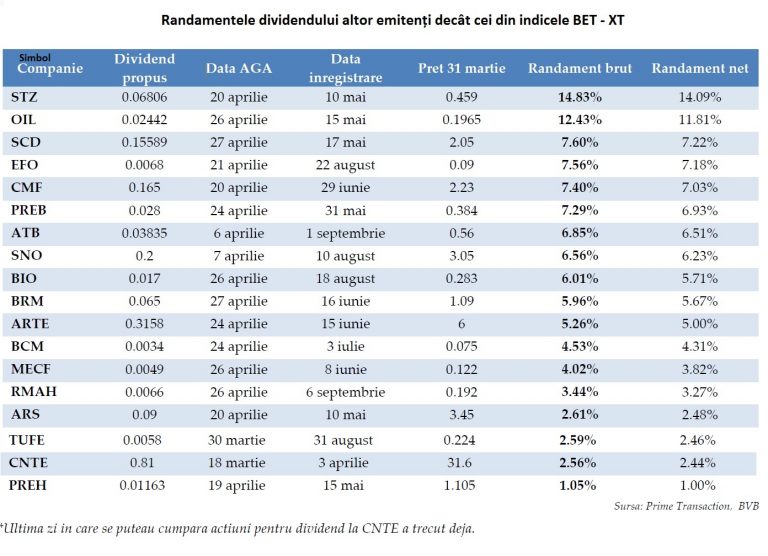

Top of yields for issuers other than those from BET – XT index

*

- Dividend yields of shares other than those from BET – XT portfolio

- Company Dividend proposed General Shareholders’ Meeting scheduled on Date of registration Price at 31 March Raw yield Net yield

*

- At the top of companies outside of BET-XT is surprisingly Sinteza Oradea (STZ), which decided to pay this year an additional dividend from the profits of the past years.

- Oil Terminal (OIL) shareholders also benefit from the state’s decision regarding the 90% allocation. The profit „well above expectations and the Government’s decision doubled the OIL share price in a quite short time, which is why the dividend yield is not higher.

- Zentiva (SCD), THR Marea Neagra (EFO), Comelf (CMF) and Prebet (PREB) have almost equal yields, but far away from STZ and OIL. Even so, „the yields are quite high, over 7% for all four actions,” consider the Prime Transaction analysts.

Perspectives

„Dividend yields maintain at a very good level on the Romanian capital market, despite the price increases registered in most of the listed shares, in recent months. In most of the cases, it is about the energy monopolies, which maintain a similar capacity to generate profit after cash allocation, unlike other types of companies.

„We can expect for the prices to return to the range where they are now, after the adjustment caused by the registration of dividend data. This particularity makes the risk-benefit ratio to be a very good one for the BSE-listed issuers that pay dividends,” concludes the Prime Transaction report.