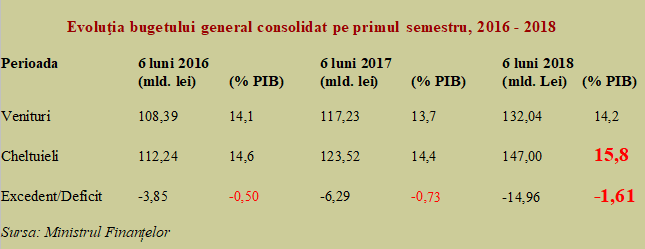

At the end of the first half of the year, the general consolidated budget registered a deficit of about RON 15 billion, an amount equivalent to 1.61% of the GDP estimated for the current year.

The result was weaker by about RON 8.7 billion lei compared to the first half of 2017, when the budget deficit was only 0.73% of GDP. That’s less than half the result for 2018!

This is very worrying from the perspective of the similar targets set for the end of both years right below 3% of GDP (a near-missed target in 2017).

Simply put, this negative evolution of almost 0.9% of GDP was solely the consequence of the increase in spending by about 1.4% of GDP, although revenues increased by 0.5% of GDP. By influences, the positive one of almost 50% of the final result was undone by the negative one, which accounted for 150%.

That shows that commitments met by the state did not have the funding secured (though increasing) from taxes.

Furthermore, while both revenue and expenditure should have increased to about 14% compared to last year, according to the budget law, revenues increased by only 12.6%, while spending advanced by 19%.

*

- Evolution of general consolidated budget in the first half of the year, 2016-2018

- Period six months 2016 (billion RON) (%GDP) six months 2017 (billion RON) (%GDP) six months 2018 (billion RON) (%GDP)

- Revenue

- Expenditure

- Surplus/deficit

*

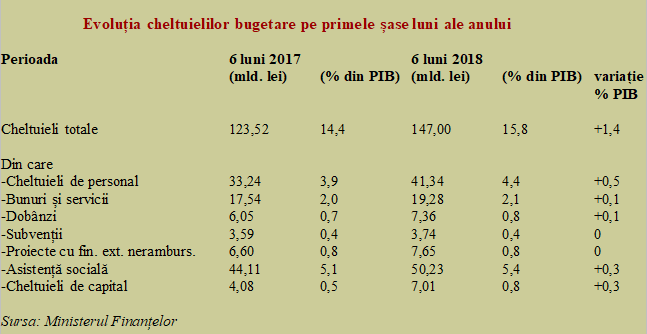

The 6-month budget implementation confirms the unsustainability of the simultaneous significant increase in the amounts allocated to salaries in the public sector (+ 24.4%, namely RON 8.1 billion, respectively 93% of the budget deficit) and the amounts for social assistance, to a level (13.9%) that, for now, is twice the economic growth in 2017 and, beware, before the 10%increase of the pension point, as of July 1, 2018.

Noteworthy, there has also been a significant increase in the amounts representing the interest payments compared to previous years when they fluctuated somewhere around RON 6 billion lei.

We reached RON 7.36 billion, although the level of public debt decreased from over 39% in 2014 to less than 35% in the first quarter of 2018, according to official figures released by Eurostat.

*

- Evolution of interest expense in the first six months (million RON, 2012-2018)

- Year

- Interest expenditure

*

The explanation for this apparent paradox is the substantial increase in costs of loans for Romania in the last period, partly in the context of a general increase in the market interest rates, partly due to the deterioration of investors’ perception of the prospects for the medium- and long-term economic evolution.

By expenditure sections, we notice the excess of the wage expenditure over the 7% of GDP recommended a few years ago by international institutions and assumed at that time by our country, precisely because we place our budget revenues somewhere around 30% of GDP and at two-thirds of the EU average.

*

- Evolution of budget expenditure in the first six months of the year

- Period six months 2017 (billion RON) (%GDP) six months 2018 (billion RON) (%GDP)

- Total expenditure

- Of which

- – personnel costs

- -goods and services

- – interest

- -subsidies

- – projects with non-reimbursable financing

- – social assistance

- – capital expenditure

*

At the same time, there is an increase of about six billion RON in social assistance, resulting in a significant increase of its share in GDP (+ 0.3% or almost 60% of the deficit recorded after the first half of the year) and an increase of three billion RON in capital expenditure, which is basically beneficial but do not fit any longer together with the increase of the other amounts.

The difference between these three categories of expenditure that contributed the most to deepening the budget deficit (which had no more space for deepening if we take into account the experience of the last year) is that wages and pensions are firmly committed and there will be nobody to reduce them, while investments are not necessarily mandatory.

Which, in the context of the increasing monthly payables in the social security account with the money representing the ten percentage points increase in pensions, already shapes the way the budget tightening will try to look in the second half of the year, to achieve our performance of being able to zip our trousers after we ate more than our wallet allowed and more than the economy’s health recommended.