The policy of stimulating consumption has also distorted the degree of indebtedness in the territorial distribution, and rich counties are competing with the poor ones in the ranking of outstanding loans rate, according to data from the National Bank of Romania.

The policy of stimulating consumption has also distorted the degree of indebtedness in the territorial distribution, and rich counties are competing with the poor ones in the ranking of outstanding loans rate, according to data from the National Bank of Romania.

BNR data indicate the increase in outstanding loans at a monthly rate of 1.1% in April compared to March, the highest level since October, reaching RON 7.8 billion.

The rate of total outstanding loans (population and businesses) climbed from 3% in March to 3.02% in April, according to a report by Banca Transilvania (BT).

The indicator launches this way a warning signal on the current trend of over-indebtedness, especially in the population category, whose loans account for 60% of total current loans of over EUR 164.6 billion, even though the indicator has declined by 17.1% compared to April 2018.

„We are expecting a gradual increase in the rate of outstanding loans in the short term, in the context of the economic post-crisis cycle end and the increase in financing costs,” wrote Andrei Radulescu, director of macroeconomic analysis of BT, in the report mentioned.

Territorial discrepancies

The counties with the highest rates of outstanding loans in RON are among the poorest: Botosani (9.5%), Caras – Severin, (6.6%), Mehedinti (5.5%), far above the national rate of 2.9%. Teleorman county is not missing from this ranking, with a rate of 3% of outstanding loans in total loans.

However, Bucharest is also present in the ranking (including Ilfov County), with a rate equal to that registered by the country, but also rich counties such as Sibiu (4.4%), Prahova (4.3%), Contanta (3.7%) or Timis (3.2%), which reinforces the idea that stimulating consumption has led to over-indebtedness.

*

- Map of outstanding loans in RON

- April 2019

- Country total

- Bucharest, including Ilfov

*

And while the presence of Vaslui county (3.9%) does not surprise, the score of Valcea county (4.7%) is a surprise. The map of the delayed debtors backs the idea that the appetite for indebtedness has contaminated both the poor and the rich.

Foreign exchange indications

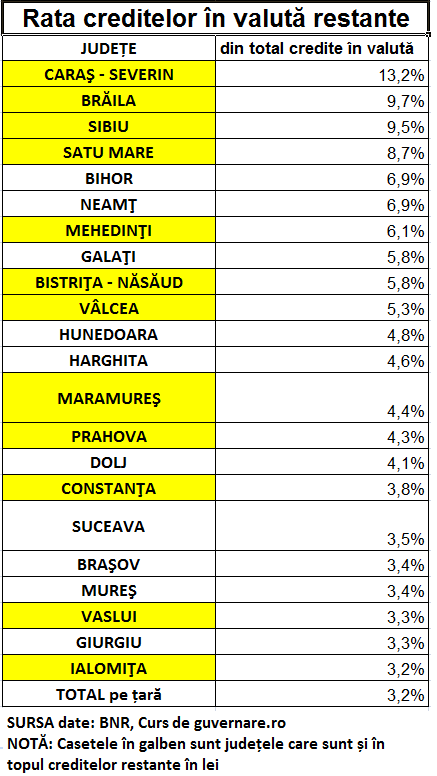

Some poor counties with poor economic development, such as Botosani or Teleorman, and those with a developed economy (Timis, Bucharest – Ilfov), where companies have results that allow them timely payments of loans, are no longer in the ranking of counties with the highest proportions of outstanding loans in foreign currency.

Forex loans are mainly part of the companies’ arsenal, especially those with foreign relations. In this respect, companies have most of the loans, 57% of total current loans in April, of EUR 86.5 billion.

Otherwise, poor counties such as Harghita or Giurgiu, whose economy does not represent an excuse that companies would be the cause of payment delays, rank among the firsts in terms of rate of arrears in foreign currency exceeding the country level. Therefore, the population is again the cause for a large proportion of arrears.

*

- Rate of outstanding forex loans

- Counties out of total forex loans

- Note: yellow highlight represents counties also present in the ranking of outstanding loans in RON

*

Over-indebtedness in foreign currency is also present in the population category, either as a result of the same increased government policy appetite.

Government measures gave this way the illusion of higher borrowing capacity, or due to long-term mortgage loans, committed before BNR’s campaign to discourage foreign currency lending.