Salaries in domestic companies continue to grow as staff shortage widens, but remain half the level registered in foreign firms, according to an analysis by Syndex Romania.

Below is a comparative table for the two types of capital, by the mix of indicators.

Economic parameters:

The total foreign direct investment inflow increased by 4% in 2018, largely due to the increase in new intragroup loans from EUR 829 million in 2017 to EUR 1 billion in 2018, while contributions of own equity remained to four billion euros.

Total foreign direct investment (FDI) balance has thus reached EUR 82 billion, of which approximately one third is in manufacturing:

- the FDI balance in the manufacturing sector reached EUR 24.3 billion in 2017, up 1.8 billion compared to 2016

- the automotive industry continues to attract the highest level of investment; the FDI balance increased by EUR 900 million in 2017 compared to 2016 and by EUR 3.5 billion compared to 2008

- the foreign investment appears to grow again in metallurgy (+EUR 300m in 2017, which does not offset though the negative balance compared to 2008, which is now at – EUR100m)

- construction and real estate transactions, as well as trade, continue to attract major investment flows and 2017 brought some rebound also in the financial intermediation and insurance

- IT sector’s balance is relatively low and tends to decline and the most likely explanation is represented by the low need for fixed investment combined with a low-profit reinvestment rate the sector.

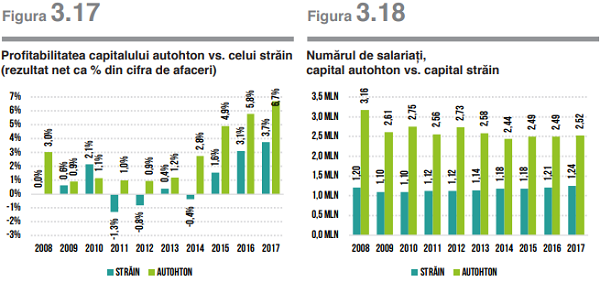

In terms of profitability, domestic capital still performs much better than foreign capital (2017 data):

- net profit accounted for 6.7% of the turnover in the case of domestic capital

- in foreign capital’s case: – 3.7%

The relatively low profitability of foreign capital does not take into account „tax optimizations” that are more accessible to multinational companies, the study notes.

This is also reflected in the data related to employees of the two categories of companies classified by capital

Number of employees

- the number of employees in foreign companies increased by 20% in 2017, to 1.24 million

- domestic companies’ personnel rose by 1.2% and reached 2.52 million

*

- Chart 3.17

- Profitability of domestic capital vs. the foreign one (net result, as % of turnover)

- Foreign Domestic

- Chart 3.18

- Number of employees, domestic capital vs. the foreign one

- Foreign Domestic

*

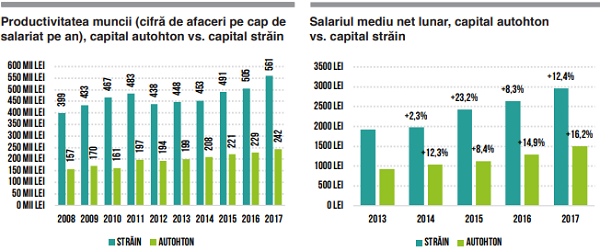

Productivity

Taking into account the much faster growth of turnover in foreign companies, the productivity of employees (measured in terms of turnover per employee) increased by:

- 11% for the foreign capital

- 6% for the domestic capital

Wages

The same as the volume and profitability of economic activities, wages are also on an increasing trend, regardless of the origin of capital, which in 2017 have recorded the most important increases since the end of the post-crisis stagnation.

Increases are higher in companies with domestic capital, but the study points out that the net average wage in foreign companies is still double the one in companies with domestic capital.

- the average increase of wages in companies with domestic capital was 16.2%

- in companies with foreign capital – 12.4%

*

- Labour productivity (turnover per employee per year), domestic capital vs. the foreign one

- Net average monthly wage, domestic capital vs. the foreign one

- Foreign Domestic

*

However, the comparison may be misleading, note the authors of the study, as it does not take into account the foreign capital concentration in more complex, more intensively capitalized sectors, with more stringent requirements in terms of workforce qualification.

In other words, the fact that employees in multinational companies have on average better salaries does not mean that these companies pay their employees better in relation to the productivity and requirements – the comparison with the domestic capital does not say anything in this regard.

The study was conducted for Cartel Alfa by Syndex Romania, member of Syndex group, whose certified experts (auditors, economists, sociologists) have been working for over 40 years with major trade union organizations in Europe (such as the European Trade Union Confederation, CFDT in France, or Solidarnosc in Poland, etc.)