The data included in the autumn report of the World Bank „COVID-19 and Human Capital” which brings the forecast for Europe and Central Asia countries up to date shows the scepticism of this institution’s specialists regarding a rapid recovery of the Romanian economy, by reference to official estimates issued locally.

The data included in the autumn report of the World Bank „COVID-19 and Human Capital” which brings the forecast for Europe and Central Asia countries up to date shows the scepticism of this institution’s specialists regarding a rapid recovery of the Romanian economy, by reference to official estimates issued locally.

Thus, the National Commission forecasted an economic recoil of -3.8% this year, followed by a recovery of 4.9%, which would bring GDP level in 2021 to + 0.9% above that registered in 2019.

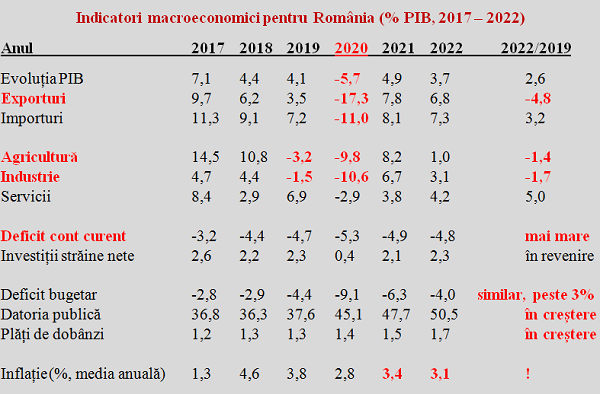

WB data show a significantly sharper decline (-5.7%), which, followed by the same growth figure in 2021, will not allow the economy to return to the pre-pandemic level until 2022.

Significant for the balance in the foreign trade exchanges, which was problematic even before the onset of the crisis, the level of exports would remain even in 2022 by almost five percentage points below that of 2019.

At the same time, imports, which saw a much smaller decrease during the crisis (-11% compared to -17.3% in exports), will increase by more than three percentage points.

*

- Romania’s macroeconomic indicators (% of GDP, 2017- 2022)

- Year

- GDP evolution

- Exports

- Imports

- Agriculture

- Industry

- Services

- Current account deficit

- Net foreign investment

- Budget deficit

- Public debt

- Interest payments

- Inflation (%, annual average)

*

How economic sectors will recover

The National Commission for Strategy and Forecast (CNSP) did not provide figures for 2022 in the forecast published in August 2020, but showed a decrease in exports by only -10.3% in 2020, followed by an almost full recovery in 2021 (+9.7%). As for imports, if the WB does not foresee their return in 2021 to the level of 2019 (-3.8%), the CNSP data lead to an increase of 2.7% (which would not be a good thing if export recovery is not confirmed as well).

A return that we all want, it also matters but on what economic structure, as, unfortunately, we can see from the WB estimate, again more sceptical than the governmental one.

It is important that neither industry (-1.7%) nor agriculture (-1.4%) will reach in 2022 the same production level from 2019. Worse, they will not even reach the level of 2018, because the decrease in these key sectors began before and was unrelated to the pandemic crisis.

The segment of the economy that will recover quickly in 2021 is that of services, where the figures provided by the WB are close to the official ones, with a slightly more optimistic result in government statistics (+1.2% CNSP compared to +0.8% WB for 2021 – we remind that we do not have updated national data for 2022 forecast – with + 5% 2022/2019 according to the WB).

Exceeding 50% of GDP threshold in foreign debt

The current account deficit is also an indicator where estimates are divergent, with significantly higher values in the WB forecast. Here the problem is that we have already exceeded the limit allowed by macro-stability indicators (-4% the average over the last three years, -4.1% has been reached in 2019) and, if the figures advanced by the WB are confirmed, the situation will worsen towards 5% of GDP in 2022.

As expected, the support coming through foreign direct investment, conjecturally diminished by the problems faced by investors in their own countries, will resume gradually, to reach in 2022 back the (not very great) level of 2019.

Under these conditions, the budget deficit would rise to 9.1% of GDP this year (8.6% in the official forecast) and would recover towards -6.3% of GDP in 2021 (anyway much better than what both the European Commission and its own Fiscal Council, which advances double-digit values if a 40% increase in pensions is implemented, warn).

However, the 50% threshold in public debt will be crossed in 2022 and public debt interest payments (presented as the difference between implementation and the primary balance indicated by the WB) would increase significantly. From 0.2 percentage points below the middle of the 3% fiscal range allowed by Maastricht criteria (suspended for 2021 but not for 2022), we will go towards 0.2 pp. above, which is not at all a good sign for the amounts remained available for investment.

Inflation and prices. Getting out of relative poverty – 4 years of going round in circles

Finally, surprisingly, although the value for 2020 is similar, values presented for the average price increase in the next two years are significantly higher in WB’s assessment than that of BNR by 3.4% compared to 2.6% (quarterly average) in 2021 and 3.1% compared to 2.5% (average for H1 2022).

As a result, the shares of the population below the international poverty thresholds will return after the pandemic-induced increase shock, but will not reach in 2022 back where they were in 2019. Thus, below the international threshold of $ 1,900 (PPP), the rate targeted by the World Bank will be 3% in 2022 compared to 2.8% last year, below the middle-low income line ($ 3,200 PPP) we will have 5.6% instead of 5.2% (we will return to the situation in 2018) and for the middle-high income line ($ 5,500 PPP) we will reach 11.4%, compared to 10.2% (11.5% in 2018).

In essence, the population will feel a four-year cycle during which it went round in circles, in terms of getting out of relative poverty.