The level of use of saving and investment products by the population is low compared to the overall level of saving, although this is comparable to the average for the countries in the region.

The level of use of saving and investment products by the population is low compared to the overall level of saving, although this is comparable to the average for the countries in the region.

The total bank deposits of the population increased more than 3.5 times over the last 10 years, reaching almost 168 billion lei in May 2017 and counts as much as 20% of this year’s forecasted GDP.

Instead, other figures indicate the indifference, if not the aversion that Romanians have for the value of their money and the methods available to increase it:

- 36% of households’ savings are in current accounts (overnight deposits, in the BNR terminology), virtually free of interest, according to the BNR data. Ten years ago, the proportion was lower, 29.7%;

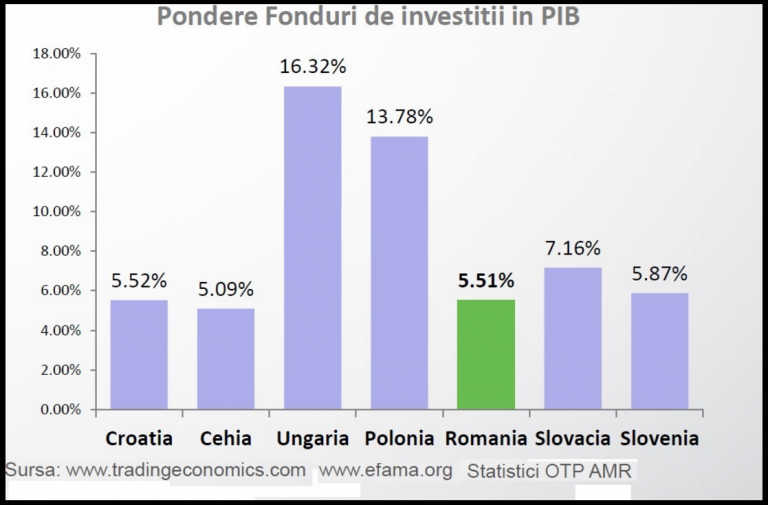

- Romanians merely have the equivalent of 5.5% of GDP in investment funds, three times less than Poles or Hungarians, according to the investment managers.

In addition, the population saves, namely invests at a low degree for developing a business or in education and at a very small degree for investment, according to the latest financial stability report by the National Bank of Romania (BNR).

Money in banks

The equivalent of over 60.6 billion lei of the households’ money held in banks, namely 36% of the total, is in current accounts and overnight deposits. This money „is sacrificed because it does not bring any value to depositors nor to the economy as a whole,” said Mihai Purcarea, General Manager of BRD Asset Management.

The proportion was 29.7% in 2007 and 21.2% in 2010 when the crisis hijacked the money from the banking route. „It is enormous. A third, basically, of the Romanians’ wealth is in overnight deposits at a zero-interest rate. Can you imagine, in time, what a loss of capital for Romanians and for the economy is this?”, asks rhetorically the investment manager.

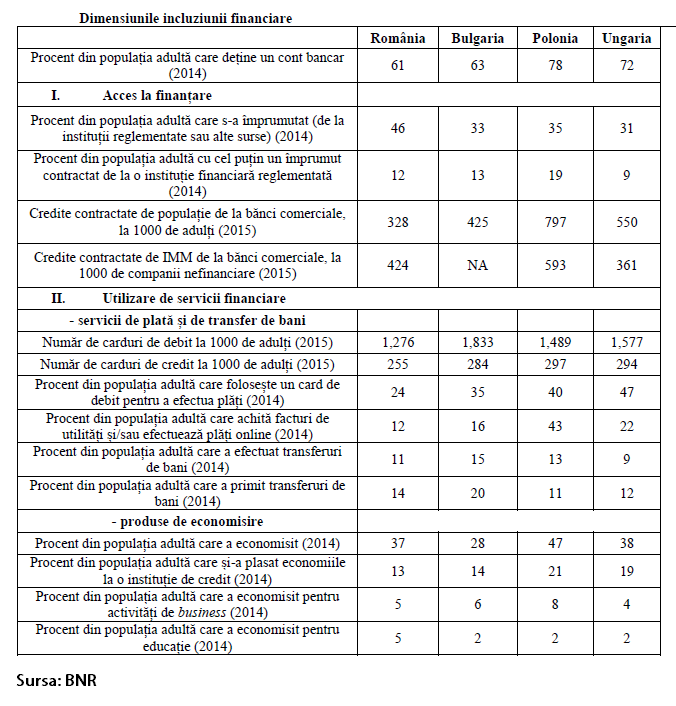

In fact, only 37% of the adult Romanian population saves, compared to 47% in Poland and 38% in Hungary. Moreover, not all Romanians keep their money in banks: only 13% of the adult population placed their savings at a credit institution (21% in Poland, 19% in Hungary and 14% in Bulgaria – the most recent data are from 2014).

Only 831 Romanians out of a thousand had bank deposits in 2015, according to the most recent report on the financial stability by the National Bank of Romania (BNR).

- Dimensions of financial inclusion

*

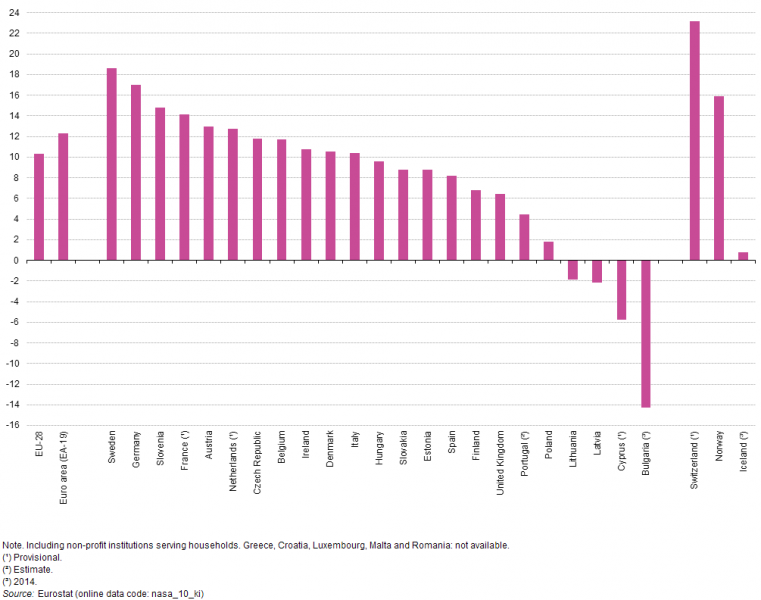

The saving rate of Romanian households (net savings as a percentage of the net income available) decreased from 26.7% in 2012 to 8.4% in 2014, according to the latest Eurostat data. The average of 2004-2008 was 20.7%, then fell to 10% in 2009.

The highest gross saving rate for European households was in Switzerland (over 23% in 2015), followed by Sweden (almost 19%), Germany (17%), Slovenia (almost 15%) and France (14%). The Czech Republic could boast about 12%, Hungary with over 9%, and Poland with 2%, according to the latest Eurostat report in the field.

A big statistical hole is drawn at Romania’s position. Banca Transilvania reported 14% in 2016 but based on a different method.

A big statistical hole is drawn at Romania’s position. Banca Transilvania reported 14% in 2016 but based on a different method.

Money in personal investment

Things are even worse when it comes to the next saving level after the gross cash accumulation through bank deposits, that is, the investment in mutual funds.

Despite the huge potential of personal savings (167.7 billion lei), Romanians’ wealth kept in open (mutual) investment funds barely amounts to 25.3 billion lei (EUR 5.6 billion), namely only 3.1 % of GDP, down compared to 2016 (5.5%). In Hungary, the same share in GDP has grown to more than 16%, in Poland to almost 14% and in Slovakia to more than 7%.

*

- Investment funds as share of GDP

*

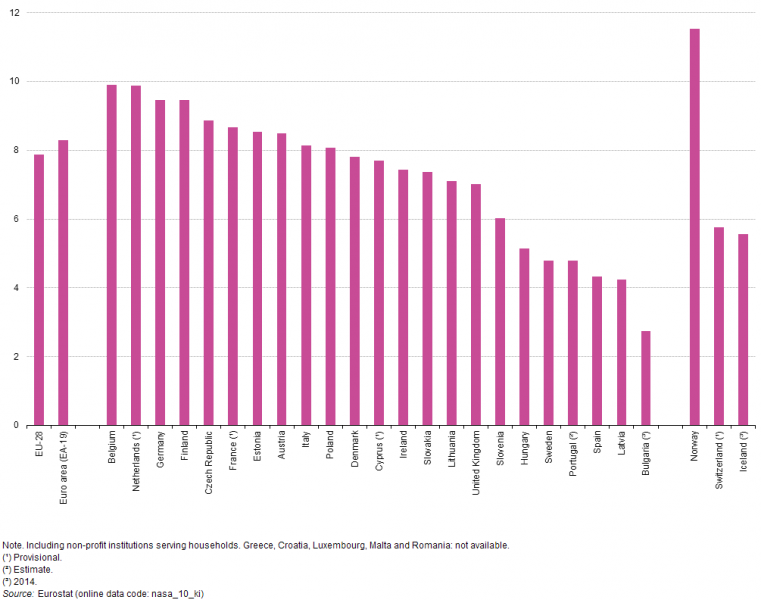

The gross investment rate of the European households ranges between 9.9% in Belgium and the Netherlands and 2.7% in Bulgaria. Germans and Finns invest 9.5% of what they earn. Poland is approaching the maximum levels (almost 9%), with more than 8%. Hungary has a rate of over 5%. Eurostat also considers the services of the specialized non-profit entities. Here is the chart from Eurostat:

Of the Romanians’ total assets in mutual funds, more than 2.8 billion lei (in equivalent) have been attracted by the foreign mutual funds offered in Romania. In addition, 574 million lei is placed in Romanian closed investment funds (without a continuous issue of securities).

Of the Romanians’ total assets in mutual funds, more than 2.8 billion lei (in equivalent) have been attracted by the foreign mutual funds offered in Romania. In addition, 574 million lei is placed in Romanian closed investment funds (without a continuous issue of securities).

The countries in the Central Europe with which Romania is compared usually have better performances. In March, when mutual funds in Romania had almost EUR 4.9 billion, those in Poland had EUR 30.1 billion, in Hungary – EUR 13.99 billion, and funds in the Czech Republic reached EUR 8.9 billion, according to the EFAMA data (European Fund and Asset Management Association).

Total assets of the European mutual funds amounted to EUR 14,000 billion at the end of last year, according to EFAMA.

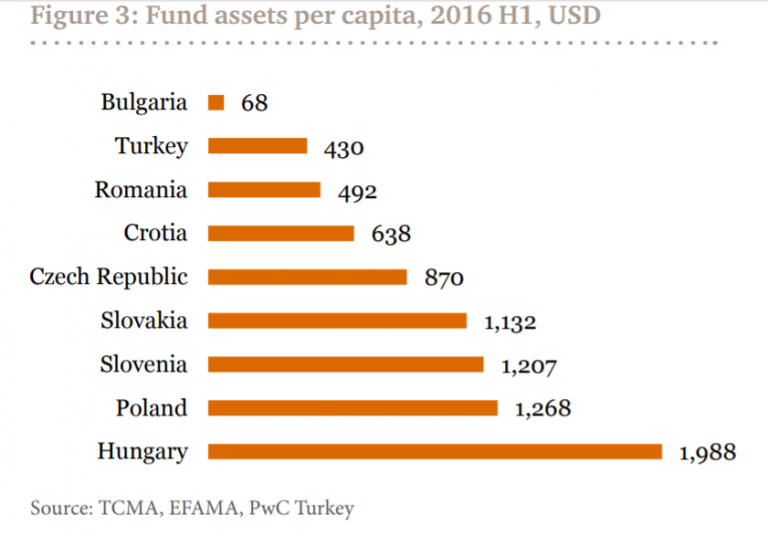

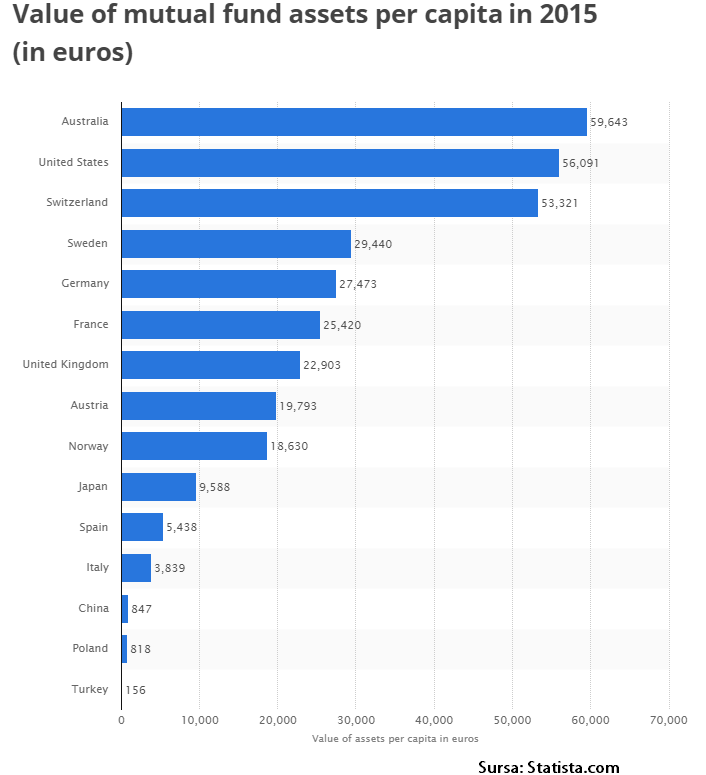

Romania is at the bottom of the ranking of the mutual fund assets “per capita” with 492 dollars, compared with Hungary (1,988) and Poland (1,268), according to the PwC Turkey statistics for the first half of last year.

Other statistics show the top hierarchy in the previous year: Germany with 27,243 euros per capital, followed by France (25,240), according to Statista.com.

Other statistics show the top hierarchy in the previous year: Germany with 27,243 euros per capital, followed by France (25,240), according to Statista.com.

Romanians’ direct placements on the stock exchange are small enough not to concern the statisticians. In fact, things are so bad that the Financial Supervisory Authority (ASF) does not even calculate the share of individuals’ investment in GDP or GDP/inhabitant.

Romanians’ direct placements on the stock exchange are small enough not to concern the statisticians. In fact, things are so bad that the Financial Supervisory Authority (ASF) does not even calculate the share of individuals’ investment in GDP or GDP/inhabitant.

*

*