With an evolution labelled as a “new negative record” and “the national currency continues to decline” after the reference exchange rate announced by the BNR reached 4.8722 RON / euro on September 24, the situation is, in fact, shown in a broader context.

With an evolution labelled as a “new negative record” and “the national currency continues to decline” after the reference exchange rate announced by the BNR reached 4.8722 RON / euro on September 24, the situation is, in fact, shown in a broader context.

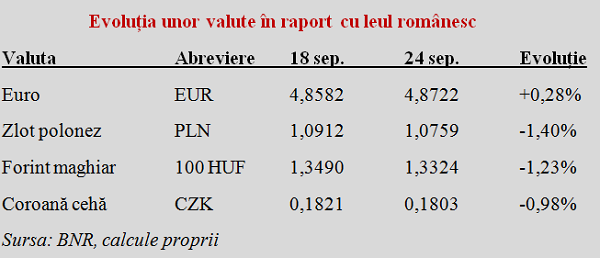

Although it is declining marginally against the euro, the Romanian currency has significantly increased against the zloty, forint and koruna.

That means, for example, it has increased five times more against the Polish zloty than it depreciated against the single European currency.

The three Central European countries were chosen for reference because they have a similar currency regime to ours, as they are outside the Eurozone with the option we strategically chose during the 1997 crisis, that of the floating exchange rate (although Bulgaria gave in to external pressures and adopted a fixed exchange rate, joining the so-called Monetary Council).

*

- Evolution of some currencies compared to Romanian leu

- Currency Abbreviation Sep 18 Sep 24 Change

- Euro

- Polish zloty

- Hungarian forint

- Czech koruna

*

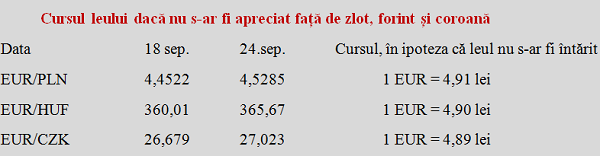

For clarification, let’s also present what the exchange rate would have looked like if the Romanian leu had maintained its parity in relation to the three currencies mentioned above.

With the observation that a stronger RON keeps our instalments in euros lower but does not benefit us in the trade of goods and services billed in RON, which leads to higher deficits compared to our colleagues from the former socialist bloc.

*

RON exchange rate if it would have not appreciated in relation to zloty, forint and koruna

Date Sep 18 Sep 24 Exchange rate, assuming that RON would have not become stronger

*

We should therefore note the (major) difference between a little significant depreciation and a really serious one. Rather, the resilience of our national currency is surprising within a difficult international economic context and a turbulent domestic political one.

At the same time, given the potential expansion of the foreign deficit (with countries with which we already have significant deficits, of about 40% of the total negative balance) we should somehow take a break from the income growth. Precisely to avoid getting our pockets filled with, as once called, „tram-RON”.