Romanian taxpayers waiting for ANAF reform

Romanian taxpayers waiting for ANAF reform

The World Bank found that ANAF’s modernization process stalled immediately after the first stage of the acquisition of the revenue management system, completed in October 2017.

Under these circumstances, after a review of the structural problems faced by the Romanian tax authority, the World Bank communicated to the government: „These challenges remain important regardless of what happens to the RAMP project.”

World Bank – explicit language: this is a „lack of political commitment”

In the first week of February, the Ministry of Finance received the World Bank report on the state of the implementation of the project for ANAF’s modernization. This is the tenth revision of the project signed with the international financing body on May 8, 2013.

In his report, the World Bank first reviews the good parts of the collaboration with the Romanian authorities:

„During the implementation of the project, RAMP has managed to improve ANAF’s business processes and provide training to over 500 employees.

ANAF’s analysis capacity has been improved and the tax gap is now calculated on annual basis. The revenue forecasting capacity has increased, the voluntary compliance strategy has been developed. ANAF has strengthened its management integrity, internal controls, audit techniques, and anti-fraud measures have improved.”

But after this preamble, World Bank experts say:

„However, the project has stalled since completing the first stage of the revenue management system procurement around October 2017. Since then no further initiatives have moved forward due to a weak political commitment to reforms.

However, Romania still faces a number of challenges in tax administration as it continues to raise the least amount of revenue as a percentage of GDP and faces the largest VAT tax gap in the EU.

ANAF must centralize its taxpayer information and introduce a sophisticated risk analysis system to support anti-fraud efforts.

Finally, ANAF needs to upgrade its mission-critical IT systems including urgently addressing IT maintenance, licensing, hardware needs, data security and staffing issues.

These challenges remain important regardless of what happens to the RAMP project.”

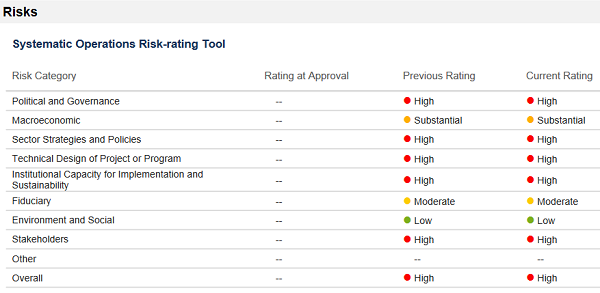

A solid argument in support of the idea that the project is blocked is the stagnation in the bad ratings of the project systemic evaluation. It should be noted that the ratings of the previous evaluation were set a year ago.

Tax authority reform, where the money went

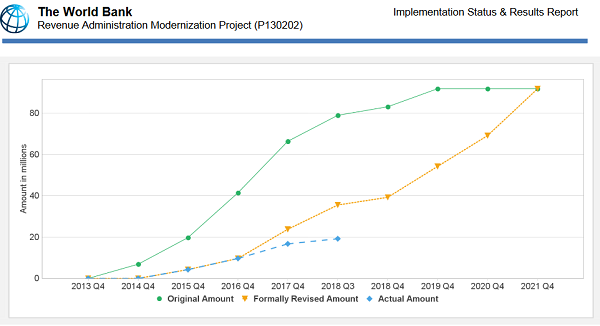

The amount spent on reforming the tax authority is less than one-third of the initial payment schedule.

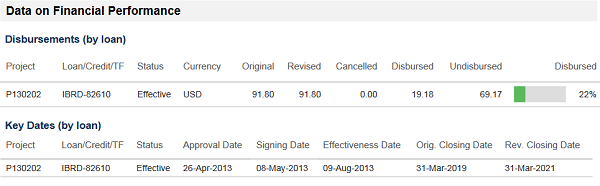

According to the World Bank’s analysis, the Romanian state has so far used USD19.18 million, or 22% of the total amount made available to the Ministry of Finance – USD 91.8 million.

According to the World Bank’s analysis, the Romanian state has so far used USD19.18 million, or 22% of the total amount made available to the Ministry of Finance – USD 91.8 million.

The share of money spent – 22%, as stated by the World Bank on February 7, is lower than the one announced by former Finance Minister Ionut Misa, who expressed in January 2018 his disappointment that „ANAF has not spent any penny on the IT system, following the implementation of the program with the World Bank and all the money spent has been allocated to consulting services.”

The share of money spent – 22%, as stated by the World Bank on February 7, is lower than the one announced by former Finance Minister Ionut Misa, who expressed in January 2018 his disappointment that „ANAF has not spent any penny on the IT system, following the implementation of the program with the World Bank and all the money spent has been allocated to consulting services.”

The statement of the Minister of Finance, pay attention, in charge of the project implementation, was made at the hearings in the Economic Committee of the Senate and is not in line with the reality.

In January 2018, for example, the World Bank paid the Ministry of Finance a tranche of USD 689,482.74.

cursdeguvernare.ro asked ANAF for information on how this amount was used. According to the institution’s response, the activity domains for which payments have been made are as follows:

- maintenance services for purchased goods for ANAF data centres

- vocational training services on the civil code and criminal code

- consulting services for developing the anti-fraud and tax information activity

- the development of the internal control function

- developing and implementing the new concept of assistance provided to the taxpayer

- project implementation

- acquisition of the integrated IT system for the tax revenue management

More important, though, the Romanian Government is due to pay back between 2018 and 2025 the amounts from the credit line that have been spent starting October 2018.

And the money will be paid for nothing given that the project is not successfully completed.