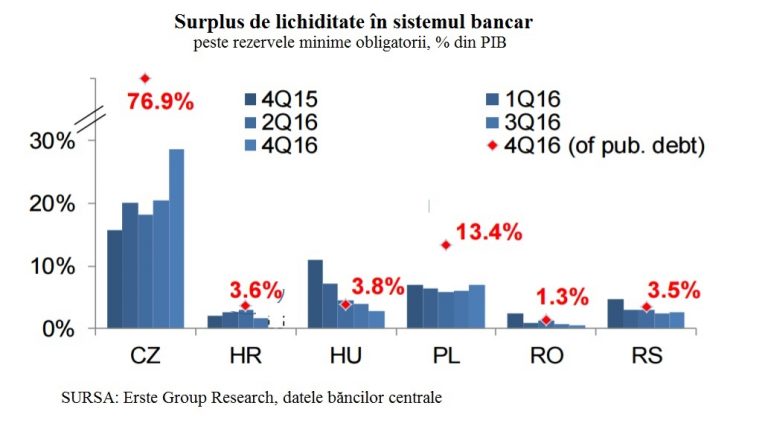

The excess liquidity of the Romanian banking system was 4.5 billion lei in December, or 1.3% of GDP, excepting the minimum reserve holdings from the National Bank of Romania, according to the Erste Group Research estimates (EGR).

The excess liquidity of the Romanian banking system was 4.5 billion lei in December, or 1.3% of GDP, excepting the minimum reserve holdings from the National Bank of Romania, according to the Erste Group Research estimates (EGR).

Comparison with other Central and Eastern European countries does not favour Romania.

The same indicator is 76.9% in the Czech Republic and 13.4% of GDP in Poland.

*

- Excess liquidity of the banking system (excepting the minimum reserve, 5 of GDP)

- Source: Erste Group Research, data from central banks

*

The excess liquidity of the banks is a potential for investment in government securities, but banks in Romania are almost always at the higher exposure level to them.

„The liquidity will improve, probably in January, up to about 14 billion lei (excluding the reserve requirements), following a significant increase in the monthly budget deficit in December, and in the absence of a consistent bond issue”, says the EGR report. Erste analysts consider the „monthly increase of liquidity in January” is temporary.

Added to the banks’ reserve requirement, this liquidity goes up to 32 billion lei, or 4.3% of GDP.

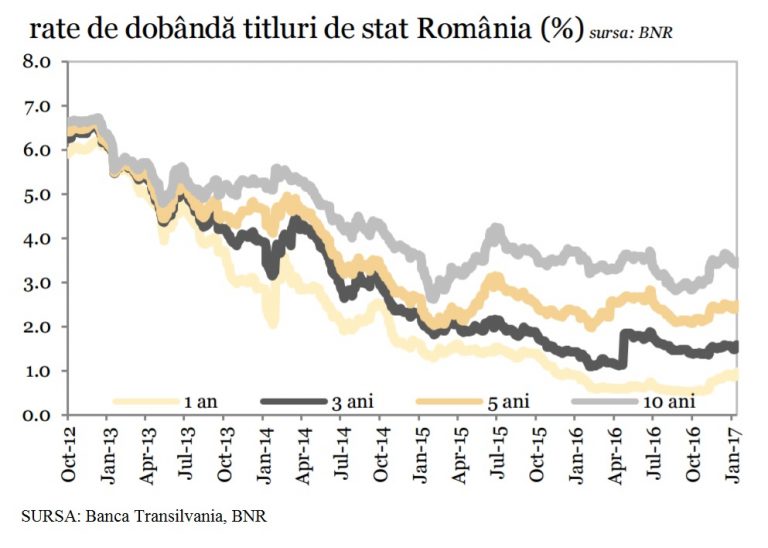

The reserve level leaves room for action to BNR for possibly decreasing them both in lei and foreign currency, „if the liquidity conditions would deteriorate”. “Reducing them would lessen the pressures on yields (of government securities, editor’s note) on short-term,” reads the Erste Group Research (EGR) report.

In the long term, though, the yields are linked to the non-resident investor holdings and „remain susceptible to a possible liquidation of their positions.” Liquidations might be „triggered either by external causes, such as the change in the investor sentiment towards emerging markets or local factors, such as the fiscal risks in 2017,” say the EGR analysts.

*

- Interest rates of Romanian government securities (%) Source: BNR

- Source: Banca Transilvania, National Bank of Romania

*

Late last week, “the yield curve moved upwards, this trend being influenced by the external market dynamics, but also the internal news,” noted on Friday Andrei Radulescu, Senior economist of Banca Transilvania.