Authorities have borrowed EUR 3 billion from foreign markets yesterday to finance the current year’s deficit. Much: both for one day and in general. A thing that should make us think about how revenues are made in our society.

Authorities have borrowed EUR 3 billion from foreign markets yesterday to finance the current year’s deficit. Much: both for one day and in general. A thing that should make us think about how revenues are made in our society.

Of course, we first look at taxation and we make that by comparison in terms of what other people are heading to and where we are going.

Data published by Eurostat show that Romania was in the period 2014-2017 precisely contrary to developments in countries from the same region and EU member.

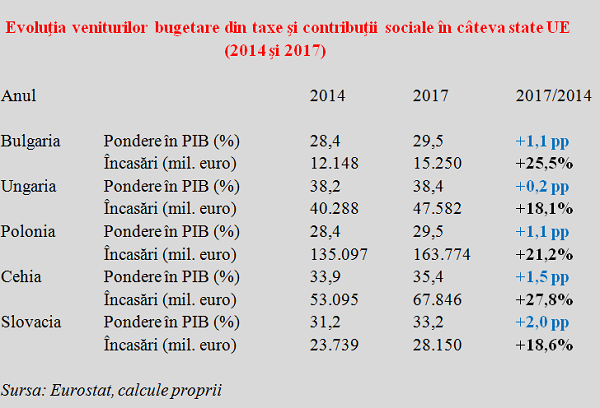

Unlike the situation in Bulgaria, Hungary, Poland, the Czech Republic or Slovakia, the share represented by tax revenues and social contributions in the budget has decreased and the percentage increase in the amounts available to the state from these sources (about 90% of total public revenues) had the lowest increase, despite the fact that we had the highest economic growth and recovered the most from the gap with the West.

Moreover, the increase in wages from the public sector and pensions was the highest in the region, which led to a budget deficit placed at the 3% threshold set as a Maastricht criterion for joining the Eurozone, for recession situations and not a steady economic growth with values well above the European average.

*

- Evolution of budget revenues from tax and social contributions in Romania (2014-2017)

- Year

- Share of GDP

*

Even our EU accession wave colleague Bulgaria, placed at only 49% of the EU average in terms of GDP per capita at the standard purchasing power parity (compared to our 63%) has considerably increased the state’s ability to supports its obligations. Our neighbours’ revenues based on the taxation applied have been increasing by more than 25% (value in euro) in just four years.

*

- Evolution of budget revenues from tax and social contributions in some EU states (2014-2017)

- Year

- Bulgaria Share of GDP

- Revenues (million euros)

- Hungary Share of GDP

- Revenues (million euros)

- Poland Share of GDP

- Revenues (million euros)

- Czech Republic Share of GDP

- Revenues (million euros)

- Slovakia Share of GDP

- Revenues (million euros)

*

It is thus enough to look at the values recorded in all of these countries and the general trend in the EU (where the increase was slightly more stabilized, from 39.8% of GDP in 2014 to 40.2% of GDP in 2017, based on the fact that a level of 41.2% has been maintained within the Eurozone, which is the centre of gravity of the Union).

After 20 years: we and others

Incidentally, as a coincidence that should give us food for thought, we are in terms of the revenue share of GDP almost exactly where we are in terms of GDP/capita adjusted to the purchasing power, that is to say about 62%. Perhaps, in view of adopting the euro, we should broaden the convergence criteria we are observing.

For example, based on a similarity with the social purpose and budget sustainability, what you would say to consider the increase in the share of taxes and social contributions to at least 70%, 75% or a desirable 80% of the Eurozone average not only in terms of GDP per capita but also of budget revenues.

Translated into figures, there would be a minimum of almost 29% of GDP, that is no more than Poland or Bulgaria already have, a reference of 31% to Slovakia five years ago (interestingly, we would also have five years to go according to the already announced intention of adopting the euro) or 33%, where the Czech Republic already was in 2014 and where Slovakia reached in 2017.

Money neither from taxes nor EU funds

If we look at the statistical series published by Eurostat since 1995, we can see that similar values of the share of tax revenues and social contributions (and the lowest ones registered during the observation period based on European criteria) are found at an interval of 20 years, between 1996-1997 and 2016 -2017.

*

- Share of tax revenues and social contributions in Romania after 20 years

- Year

- Share of GDP

*

There is, though, a major difference between the two pairs of values. The first one was on an increasing trend against the backdrop of the crisis started in 1997 that affected the economic result, while the second one reflects a percentage decline, in the context of robust GDP growth.

The question is why we have not maintained the revenue share of GDP to co-finance public investment based in European non-reimbursable funds.

If we had been to remain at 2015 level (28% of GDP, namely 2.2 percentage points in addition compared to 2017), with the same expenditure from public budgets, we would have maintained the deficit of 0.8 percentage points attained then (a big achievement from the perspective of financial stability commitments) or we would have used the extra deficit for infrastructure works.

All in all, we can neither reinvent the wheel nor the hot water.

The same as we cannot be able to change the elementary arithmetic of the budget. That is why we cannot go forward to new progress and civilization heights of the multilaterally developed capitalist society with macroeconomic parameters registered two decades ago.