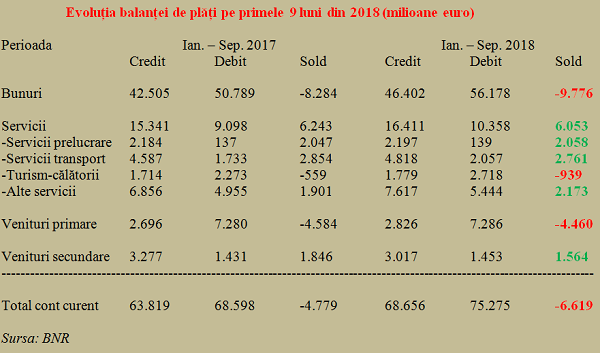

The current account of the balance of payments recorded in the first nine months of this year a deficit of EUR 6.62 billion, about 39% higher than the same period of the previous year.

The current account of the balance of payments recorded in the first nine months of this year a deficit of EUR 6.62 billion, about 39% higher than the same period of the previous year.

To be noted, the amount is already 3.24% of the GDP recently estimated officially in the autumn forecast at EUR 204.21 billion (RON 949.6 billion at an average exchange rate of 4.65 lei/euro).

Or, the current account deficit was adjusted by CNSP from 3.1% of GDP, which could no longer be maintained, to just 3.5% of GDP. But it is unlikely that we will have a deficit of only 0.26% of GDP in the last quarter.

Rather, in the context of imports made at the end of the year, we should be careful not to exceed the recommended threshold of maximum 4% of GDP (the figure indicated in the scoreboard for tracking macroeconomic imbalances of EU countries as an average of the last three years).

The weakest evolution was recorded in the mixed goods and services segment, where the increase in the negative balance was 82% (from just over EUR 2 billion to over EUR 3.7 billion). While the foreign trade of goods had a weaker result by one billion and a half (simply put, from –EUR 8.28 billion to –EUR 9.78 billion), the traditionally positive balance of services declined by more than three percentage points, from +EUR 6.24 billion to +EUR 6.05 billion.

The growth rate of payments in the account of imported goods (+ 10.6%) was higher than the amounts entered in the accounts for the deliveries carried out (+ 9.2%). At the same time, the capacity to cover a significant part of the negative result in the goods trade exchange based on the positive balance of services decreased from about 75% to just 62%.

Although the result was slightly better in the segment of the processing of goods owned by third-parties (EUR 2,197 million versus EUR 2,184 million), the positive balance of the transport activity declined by more than three percentage points from +EUR 2,854 million to +EUR 2,761 million). Other services had a slightly better evolution and came with an additional contribution of nearly EUR 2.2 billion.

*

- Evolution of the balance of payments in the first nine months of 2018 (million euro)

- Period Jan – Sept 2017 Jan – Sept 2018

- Credit debit balance credit debit balance

- Goods

- Services

- – processing services

- – transport services

- – Tourism – travel

- – other services

- Primary revenues

- Secondary revenues

- Total current account

*

At the same time, the balance of tourism-travel segment continued to deteriorate, where receipts increased modestly (by almost four percentage points), but expenditure, fuelled by the significant increase of population’s incomes, advanced by nearly 20 percentage points. There was a considerable worsening in the sector balance (+ 68%, from –EUR 559 million to –EUR 939 million).

The primary revenue gap at the beginning of the year (from labour, direct, portfolio and other investment, and other primary revenue such as taxes or subsidies) decreased by EUR 124 million (about 3% over the same period in 2017), but was less than half the level of the previous month, which contributed to slowing down the increase in the negative balance of the current account.

Unfortunately, in the secondary revenue segment, where we find the amounts transferred by those working abroad, the positive balance dropped by a significantly higher amount (-EUR 282 million). While the amounts sent to the country declined (from EUR 3,277 million to EUR 3,017 million), the outflows slightly increased (from EUR 1,431 million to EUR 1,453 million).

Foreign investments

The balance of long-term deposits held by non-residents was slightly above the level registered at the end of last year (EUR 2,485 million at 31/09/2018 compared to EUR 2,468 million at 31.12.2017). The foreign debt service related to them was about EUR 1.2 billion.

Direct investments of non-residents were, between January and September this year, by about six percentage points lower than in the same period in 2017 (EUR 3,517 million versus EUR 3,731 million). Equity investments (including the net estimated reinvested profit) amounted to EUR 3,152 million and intra-group loans amounted to EUR 365 million.

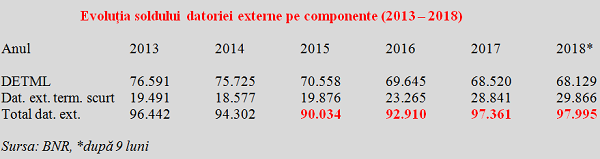

Total foreign debt increased after the first nine months of 2018 by only EUR 634 million (or + 0.65%) compared to the level recorded at the end of 2017 and reached about EUR 98 billion.

It is noteworthy, though, that while medium- and long-term debt decreased by 0.6%, short-term debt increased by 3.6%. External debt service payments amounted to more than EUR 44 billion.

*

- Evolution of foreign debt balance by components (2013-2018)

- Year 2013 2014 2015 2016 2017 2018*

- DETML

- Short-term foreign debt

- Foreign debt total

*

The medium- and long-term external debt service rate was 20.8%, down from the previous month and below the level of 25% registered in 2017 (a value, at its turn, lower than the level 30% registered at the end of 2016). Goods and services import coverage ratio remained at 4.7 months, below the level of 2017 (5.4 months) and below the 6-month theoretical recommendation.

*

- Evolution of short-term foreign debt coverage ratio calculated at the residual value

- Month

- Coverage ratio

*

The short-term foreign debt coverage ratio by BNR’s foreign exchange reserves, calculated at the residual value (including the capital instalments due in the next 12 months for the long-term external debt), increased compared to the previous month and went back above the 70 % threshold but remained well below the levels recorded in previous years.