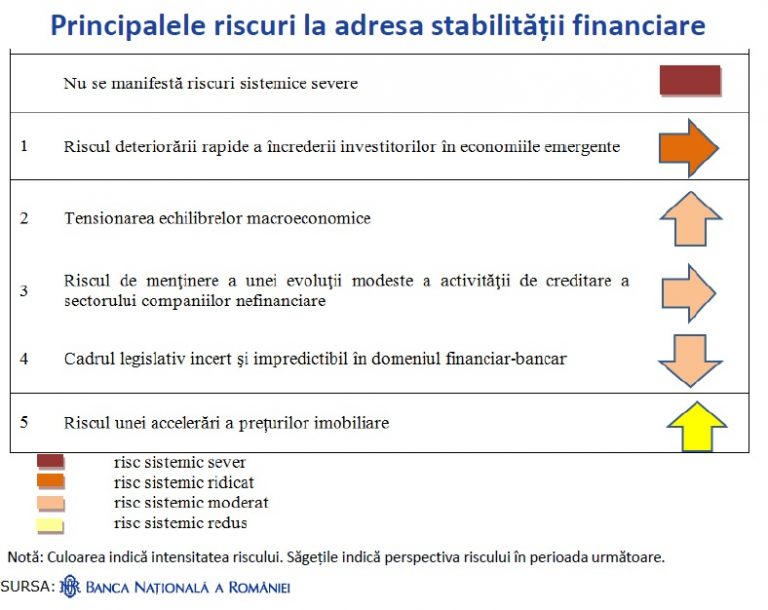

The old systemic risks to Romania’s financial stability have diminished, some remain „moderate”, others have disappeared, but a new one has emerged: the risk of accelerating real estate prices, still low, according to the report of the National Bank of Romania (BNR) published on Thursday.

The old systemic risks to Romania’s financial stability have diminished, some remain „moderate”, others have disappeared, but a new one has emerged: the risk of accelerating real estate prices, still low, according to the report of the National Bank of Romania (BNR) published on Thursday.

„The risk of the uncertain and unpredictable legislative framework” has decreased by two steps, it is „moderate” – not „severe”, as it was a year ago, but it is diffused, with no specific cause offered by any draft law.

„As the saying goes, whoever gets burnt by soup blows the yogurt as well. The risk of the legislative framework has improved from the severe level after the Parliament made amendments to the draft law on debt to equity swap and the Constitutional Court has also brought clarifications on the conversion of loans. However, the uncertainty maintains, we need some time to pass, to see whether other draft legislation/sources of risk will occur„, said Liviu Voinea, Deputy Governor of the BNR.

On the other hand, although on a decreasing trend, the legislation risk (severe one year ago) has produced effects, the average advance of the loans exceeding 20,000 lei has increased from 20% in 2015 to 25% in 2016, according to the data of the Payment Incidents Register, quoted by Deputy Governor Liviu Voinea (foto).

On the other hand, although on a decreasing trend, the legislation risk (severe one year ago) has produced effects, the average advance of the loans exceeding 20,000 lei has increased from 20% in 2015 to 25% in 2016, according to the data of the Payment Incidents Register, quoted by Deputy Governor Liviu Voinea (foto).

Thus, the time needed to save the advance for a mortgage loan has increased from 4.5 years in 2015 to 5.6 years in 2016.

Among the other four risks to Romania’s financial stability, two have increase perspectives and refer to:

- The tension of the macroeconomic balances: deficits are increasing, and among them, the structural deficit that Romania has committed to maintain below 1% of GDP, reached 2.6% in 2016.

- Accelerating real estate prices: this risk is low, but the increase in the price of the residential real estate in Romania is right below the European one.

Two other risks to financial stability are stagnant:

- The risk of a rapid deterioration of the investor confidence in the emerging economies is one of a foreign origin, but it is high, the only one categorised as such. The increase in the interest rates can cause unfavourable effects.

- The risk of maintaining a modest growth in the corporate lending is moderate.

*

- The main risks to the financial stability

- There are no severe systemic risks

- The risk of a rapid deterioration of the investor confidence in the emerging economies

- The tension of the macroeconomic balances

- The risk of maintaining a modest growth in the lending activity for the non-financial corporate segment

- Uncertain and unpredictable legislative framework in the financial and banking sector

- Risk of accelerating real estate prices

- Severe systemic risk

- Increased systemic risk

- Moderate systemic risk

- Low systemic risk

- Note: The colour indicates the risk intensity. The arrows indicate the perspective of the risk for the next period

*

Investor confidence

The highest risk to Romania’s financial stability is the rapid deterioration of the investors’ confidence in the emerging economies. In the BNR classification, this is a „high” risk.

However, the current account deficit was fully financed by foreign direct investment, although it doubled in Q1/2017 compared to Q1/2016 because of the import pressure triggered by the increase in consumption.

It means that foreign investors are confident in Romania’s financial stability, which BNR considers „robust”. Especially that „systemic risks have diminished in number and intensity compared to the same period of the last year,” according to the report.

On the other hand, the potential risk is that the global developments will cause investors to withdraw or not increase their exposure to the emerging countries.

„The risk is also fuelled by the uncertainty regarding the future of the European Union, although the debates have just started,” BNR Deputy Governor Liviu Voinea said on the occasion of the presentation of the Report on the Financial Stability of Romania.

Macroeconomic tensions

„There are tensions accumulated in terms of the economic growth beyond the potential and the twin deficits,” although the „domestic macroeconomic context is favourable”, according to the BNR report.

*

- Deficit of the consolidated general budget (share of GDP)

- Balance of the consolidated general budget, cash* (national methodology)

- Balance of the consolidated general budget (SEC2010 methodology)

- Balance of the consolidated general budget, primary **

- Balance of the consolidated general budget, structural ***

- * According to the date from the Fiscal-budgetary strategy for 2017-2019

- ** Primary deficit is the SEC2010 deficit, excluding the interest costs

- *** Structural deficit is the budget deficit adjusted with the cyclical component (estimated based on the potential GDP)

- Source: MFP, Eurostat, European Commission, BNR

*

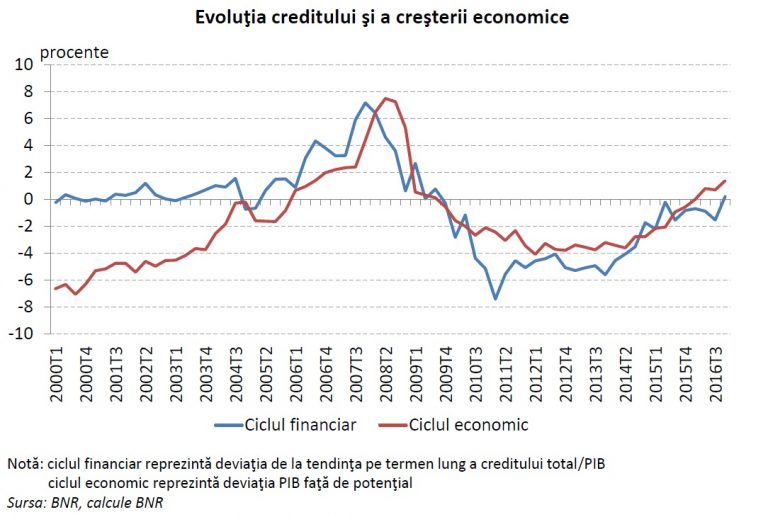

There was „a slight decoupling between the financial cycle and the economic cycle,” explained Liviu Voinea. The financial cycle is the deviation from the long-term trend of the aggregate credit related to GDP, and the economic cycle is the GDP deviation from the potential.

*

- Development of the lending and the economic growth

*

In other words, the dynamics of lending to the economy is behind its growth, a fact that leads to the risk of stagnation at „modest levels of corporate lending„.

Margin or volume?

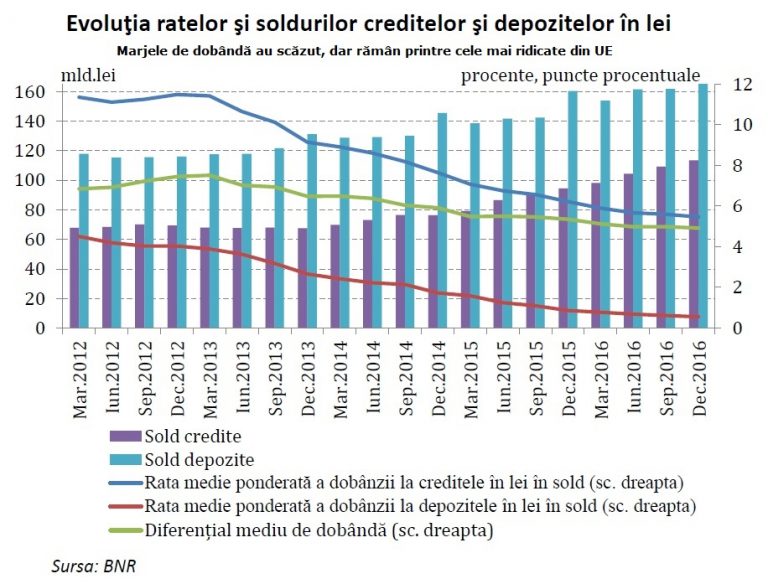

Bank lending to the population is relatively equivalent to the one to companies and accounts for about 14-15% of GDP. But both companies and the population also sought after funding outside the banks in 2016.

Bank lending accounted for as much as 29% of GDP, but the debt of the population and companies equals 41% of GDP.

On the one hand, the hesitation that banks have in lending to companies is part of the general trend showing a high appetite for liquidity, which is also seen in other countries than Romania. This adds to the fact that almost half of the Romanian companies (268,000) have negative equity, so they are non-bankable.

On the other hand, another phenomenon is indicated by the fact that interest margins in Romania are among the highest in Europe, although they have decreased. Banks prefer to gain from the big differences between the interest rate on loans and interest rate on deposits.

*

- Development of the rates and balances of loans and deposits in lei

- Interest margins have decreased but maintain among the highest in the EU

- Loan balance

- Deposit balance

- Weighted average interest rate on outstanding loans in lei

- Weighted average interest rate on outstanding deposits in lei

- Interest rate average differential

- Source: BNR

*

BNR Deputy Governor Liviu Voinea called the banks to also try applying the solution of increasing the revenues from higher lending volumes rather than from high interest margins. „There is room for increasing the corporate lending,” said Liviu Voinea.

Appetite for real estate

The new risk emerged of the accelerating prices in the real estate sector is considered to be still low, but „the increases in the prices of the real estate assets in Romania (around 7% in the last year), although it may not seem high, is above the European Commission’s signal value of 6%„, according to the BNR Deputy Governor.

Liviu Voinea also explains the increase in the real estate prices by the higher household incomes as well as the low interest rates.

The income growth has pushed the index of accessibility to a mortgage loan to the highest level, even though the advance set for the standard loans has increased.

Finally, it is worth mentioning the idea that „when BNR identifies and communicates a risk to financial stability, it is not necessary that this risk would materialize. We inform so that the risk can be managed and possibly eliminated,” BNR Governor Mugur Isarescu said.