The balance of negotiation powers in the Romanian M&A market has reversed over the past 10 years, as it became a buyer’s market, according to Deloitte experts.

The balance of negotiation powers in the Romanian M&A market has reversed over the past 10 years, as it became a buyer’s market, according to Deloitte experts.

Company sellers in Romania no longer have the strong negotiation positions from 10 years ago, when investors’ expectations regarding the EU accession were at their peak. The opportunities from that moment are unrepeatable.

„I do not think we are ever going again toward such a polarized market that advantages the sellers as it was in 2008,” said Ioana Filipescu, M&A Partner of Deloitte Romania, at a conference on M&A market organised on Monday.

Romania’s attractiveness no longer benefits from the strengths of 2008, when the country had just joined the European Union and many investors wanted to be present here. „What happened then cannot happen again,” the expert believes.

„There are larger markets, and for every asset in Romania, there is certainly a double or even larger asset in another country, like Poland,” for example. „The exception is represented by the assets that are extraordinarily appealing,” Ioana Filipescu said.

The M&A market in Romania reached a value of transactions of about EUR 4.6 billion in 2017, after a 15% increase over the previous year and after the recovery in 2014. In 2008, the level was over EUR 6 billion, according to Deloitte data.

Prices

What has not changed, though, is the gap between the price claims from the Romanian sellers and how much the buyers are willing to commit.

The gap remained, proportionally, relatively the same, even though the levels of the multipliers dropped (how many times EBIDTA goes within the price, for example), Ioana Filipescu estimated.

The earnings of consulting firms that assist M&A transactions vary between 1% and 3% and are inversely proportional to their size. At a transaction of about EUR 100 million, the earning is up to 1% and mainly consists of a successful component.

Deloitte Romania participated in the past three months in the conclusion of transactions amounting to more than EUR 500 million, according to the audit and consultancy company’s data. The company has decided to establish a team dedicated to M&A transactions in the tax services department, which will be led by Alin Chitu.

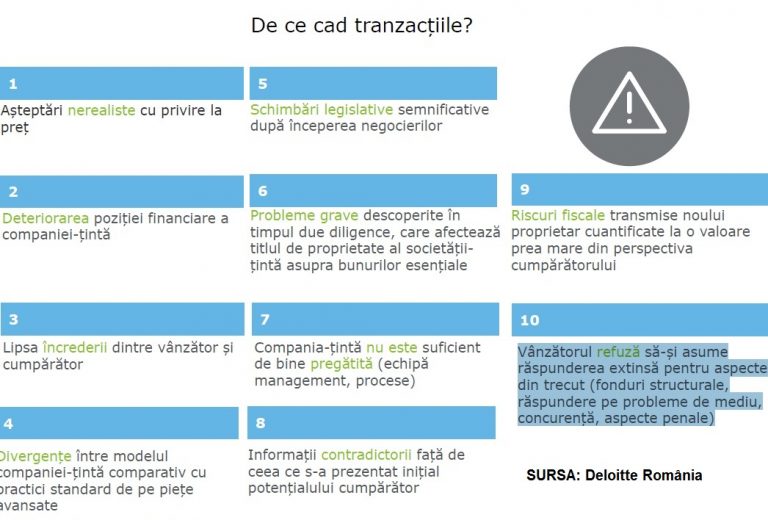

„Why transactions fail”

Adverse business environment factors, such as the legislative unpredictability, may end up blocking a deal.

„Significant legislative changes” occurred after the start of negotiations are among the 10 causes that can lead to the failure of a transaction.

The process of preparation and negotiation of a transaction may take between several months and two years, depending on the method chosen by the seller.

„Legislative unpredictability” is given either by new regulations issued or their interpretations in the tax authorities’ view, according to Radu Dumitrescu, a support partner in transactions with Deloitte Romania.

Difficulties come from the risk assessment, which „you need to know, be manageable and worth being taken,” says Andrei Burz-Pinzaru, Managing Partner of Reff and Associates – Deloitte Legal.

On the other hand, things get complicated when the seller refuses to assume the extended responsibility for certain risks from the past that could materialize after the transaction is completed (related to structural funds, environment or competition), says Georgiana Singurel, partner of Reff & Associates – Deloitte Legal.

- Unrealistic price expectations

- Financial deterioration of target company

- Lack of confidence between the seller and buyer

- A divergence between the model of the target company and standard practices in the advanced markets

- Significant legislative changes occurred after negotiations started

- Critical problem identified during the due diligence process, which affects the legal title of target company on main assets

- Target company is not well enough prepared (management team, internal processes)

- Tax risks transferred to the new owner, amounting to a value too high from the buyer’s perspective

- The seller refuses to assume the extended responsibility for certain aspects from the past (related to structural funds, environment issues, competition or criminal aspects)

Among the other eight causes that can lead to the failure, the following can be noticed:

- tax risks transferred to the new owner are estimated to be too high from the buyer’s perspective;

- „unrealistic” price expectations,

- deterioration of the financial position of the target company and the significant mismatch between the short-term business plan and achievements;

- lack of adequate training of the management team;

- contradiction existing in the information initially presented to the potential buyer;

Ingredients of success

What are the ingredients for a successful transaction?

What are the ingredients for a successful transaction?

- Strategic decision to follow a market competitor

- Understanding the risk of missing an opportunity to a competitor

- Opportunity to consolidate own business at the local and regional level by successive transactions

- Good organisation of the M&A process and transparency

- Quality of the target company’s management team

- Accuracy of the financial statements and compliance with the accounting standards followed in preparing them

- Existence of an operational accounting system

- Seller’s preference for a simple transaction, even at a smaller price

- A comparable offer obtained, which allows shareholders to agree on the price

- Value of synergies

Before approaching an M&A project, the seller should turn the risks of failure above into the assets.

In fact, Deloitte experts presented a summary of a virtual handbook for completing an M&A transaction that is useful for entrepreneurs who think about preparing for a transaction.