*

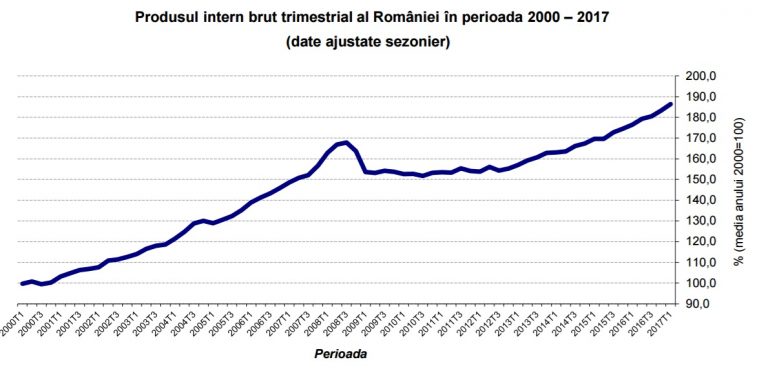

- Romania’s quarterly gross GDP between 2000-2017

- (seasonally adjusted data)

- Source: INS

*

The unexpectedly high GDP growth in the first quarter, at 5.7% y-o-y, induces analysts’ worries about its unsustainability, which has already caused a deterioration of Romania’s balance of payments and trade balance. Negative effects on the national currency and the budget deficit are to be anticipated.

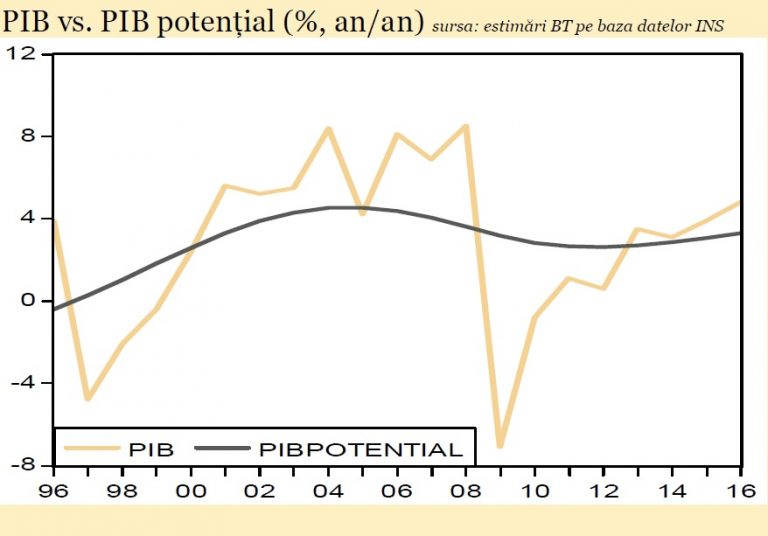

„The problem is the disagreement, the disharmony of the real GDP versus the potential GDP,” Adrian Vasilescu, Adviser to the BNR Governor, told cursdeguvernare.ro.

Adrian Vasilescu (foto), Adviser to the BNR Governor

Adrian Vasilescu (foto), Adviser to the BNR Governor

We have „a quantitative economic growth, not necessarily qualitative too, because we have not yet managed to have a technology surplus in Romania to change the quality of the products, and that ultimately impacts the quality of life,” added the Adviser to the BNR Governor.

The balance of payments „expresses the excess of the domestic demand. Is it good to have an increase in the demand, which leads to the production increase, yet whose production would be? If domestic production does not cover the critical mass of demand, that is no good anymore and affects the trade balance with the countries we import from,” Adrian Vasilescu also said.

The increase of consumption is the main cause of the fact that „the process of accelerating the domestic economy in the post-crisis economic cycle continues to be accompanied by the intensification of the twin deficits and the accumulation of risk factors for the macro-financial stability in the medium term,” says a report issued by Banca Transilvania.

Deficits

The trade deficit in the first quarter of 2017 was EUR 2.32 billion, 18% higher than in the same period of the previous year, according to the INS data.

On the eve of the INS announcement regarding this growth on Q1/2017, the National Bank of Romania drew the attention that over the same period, the current account deficit of the balance of payments was more than double compared to Q1/2016 (EUR 690 million, versus EUR 314 million).

„In terms of structure, the balance of goods had a deficit higher by EUR 281 million, the balance of the secondary revenues and the balance of services ended with surpluses lower by EUR 317 million, respectively EUR 19 million, and the balance of primary revenues had a deficit lower by EUR 241 million,” a press release issued by BNR mentioned on 15 May.

At the same time, short-term foreign debt increased by 3.5% compared to 31 December 2016, to more than EUR 24.2 billion, or 26% of the total foreign debt.

Andrei Radulescu (foto), Senior Economist, Banca Transilvania

Andrei Radulescu (foto), Senior Economist, Banca Transilvania

In this context, it is foreseeable „the increase in the cost of financing for the economy in the next quarters, with an impact on future investment and consumption decisions. This scenario is also justified by the increase of the financing costs in the world economy but also by the proximity of the monetary cycle”, writes Andrei Radulescu, Senior Economist, in the report of Banca Transilvania.

Lastly, budget deficit pressures are amplifying. The most recent estimate of the European Commission indicates a budget deficit of 3.5% of GDP.

Unsustainability

„Therefore, the likelihood that the economy will decelerate in the second half of this year is on the rise,” Banca Transilvania’s analyst adds in the report mentioned.

Adrian Codirlasu (foto), President of CFA Romania

Adrian Codirlasu (foto), President of CFA Romania

In fact, most analysts from the banking system expected a slowdown in the growth and „the INS announcement was surprising given that analysts were already expecting a slowdown in the economic growth. Until the statistical details become available, we can say that the main explanation is the increase in consumption, as a result of the expansionary fiscal policy, with unfavourable effects for the trade deficit,” said Adrian Codirlasu, President of the CFA Romania Association.

BNR administrators had also found that „the available statistical data predict a slight deceleration of the GDP growth in the first quarter of 2017, implying a relatively broader opening of the aggregate demand surplus, given that the growth was above the previously forecasted values. At the same time, they indicate the private consumption as being the main factor of the economic growth and it is relevant from this perspective the high dynamics maintained in the turnover volume of the retail trade, auto-moto trade and services, between January – February”, records the minutes of the monetary policy meeting of the National Bank of Romania’s board, on 5 May.

„Public consumption continued to make a strong contribution to the dynamics of the economy in the first three months of the year (data published by the Ministry of Finance shows a 10.4% growth in public spending, year on year, to 58 billion lei, in Q1 2017), against the backdrop of the increase of the subsidies, transfers and personnel expenses,” writes Andrei Radulescu in the report of Banca Transilvania.

„Public consumption continued to make a strong contribution to the dynamics of the economy in the first three months of the year (data published by the Ministry of Finance shows a 10.4% growth in public spending, year on year, to 58 billion lei, in Q1 2017), against the backdrop of the increase of the subsidies, transfers and personnel expenses,” writes Andrei Radulescu in the report of Banca Transilvania.

Different macroeconomic speeds

The Advisor of the BNR Governor avoided to make the connection between the need to increase the competitiveness of Romanian exports and the national currency, but he agreed that the speed of improving the competitiveness of Romanian products is lower than the rate of the domestic demand increase.

„Stocks had a contribution that deteriorated the annual evolution of the GDP growth in Q1/2017 after they reached a record high in Q4 2016,” notes the report of Banca Transilvania.

The increase of competitiveness depends on the investment made in technology, and if investments from domestic resources are not enough, we need a higher level of attractiveness for the external financial flows.

Recently, BNR has decided to maintain the monetary policy rate and released part of the minimum reserves of foreign currency as a sign of the importance the institution attaches to financing and foreign investment.

At the same time, the national currency depreciated against the euro in the first quarter by 0.74% to 4.5511 lei/euro, a behaviour considered by the BNR Governor to be „excessively good”. Mugur Isarescu recently said that it would be exaggerated to consider „a 1-2% change” as a depreciation.

Being used to take any statement by the Governor of the central bank as a signal, the forex market operators may easily understand that if there is no longer „room for appreciation” for the national currency, there will be enough room left for depreciation.

BNR officials also noted that “the contribution of the gross fixed capital formation could remain negative, although in decline, given the persistent decline of the engineering construction and the considerable increase in the dynamics of the residential construction, possibly stimulated by the accelerating trend of increase in the housing price. The contribution of net exports to the GDP dynamics could also return to the negative range in the first quarter of 2017 „, according to the minutes mentioned.

On the other hand, the acceleration of the manufacturing industry to 7.3% y-o-y in Q1/2017 „shows the resumption of the private investment flows in the economy, after the unfavourable developments in late 2016. It can be said that private companies have postponed some of the plans until the second-round measures of the new Tax Code entered into force (the elimination of the special tax on construction, the extra excise duty on fuel and the reduction of the standard VAT rate from 20% to 19%, as of 1 January, this year). The resumption of the investment plans is also confirmed by the increase of the foreign direct investment by 26.1% y-o-y, to about EUR 1.1 billion in Q1 2017, according to the BNR data.”