In this second article of the series dedicated to the analysis of the quantitative easing performed by the European Central Bank (ECB), we will focus on the second argument brought in favor of such a policy.

In this second article of the series dedicated to the analysis of the quantitative easing performed by the European Central Bank (ECB), we will focus on the second argument brought in favor of such a policy.

An unsatisfactory rhythm of economic growth

Stimulating economic growth does not constitute a statutory attribute of the ECB, in opposition to the American Fed, which has a dual objective (price stability and full employment, a proxy for economic growth). Thus, in legal terms, the ECB should not concern itself with stimulating economic growth, this being the remit of national governments, through structural and fiscal policies.

Nevertheless, in the last years the ECB has been very active in this field, coming to be perceived as the only actor (“the only game in town”). In what follows, we will show how unjustified this activism was.

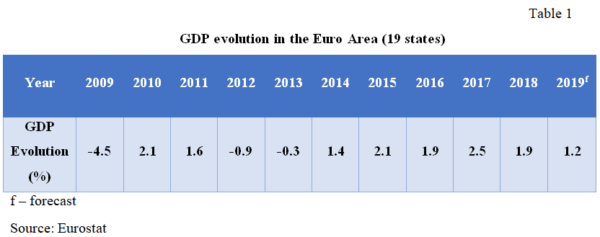

Table 1 presents the evolution of GDP in the Euro Area in the years following the crisis (2009 – 2019).

In order to see what can be deemed satisfactory in terms of economic growth, we have to refer to potential GDP, i.e. the sustainable growth rhythm that takes into consideration the three factors that contribute to it: capital, labor force, and (total factor) productivity.

According to a paper published in 2018 by Malin Anderson, Bela Szörfi, Máté Tóth și Nico Zorell („Potential output in the post-crisis period”), potential growth in the Euro Area has declined from around 2.3% per annum in 1999 to roughly 1.7% p.a. in 2007 and, again, towards 1.5% p.a. in the post-crisis period. This rhythm compares unfavorably with that of the US, which is of circa 2% p.a., due to the lower productivity in Europe, and also to the lower number of working hours. However, it compares favorably with Japan (1% p.a.), which suffers from workforce ageing.

If this is true, i.e. if Europe can grow sustainably at 1.5% per annum, then from Table 1 we see that between 2015 and 2018 it has grown, in each year, above potential (by 1.9 to 2.5 percent) and that only in 2019 there is foreseen a growth below potential, at 1.2 percent.

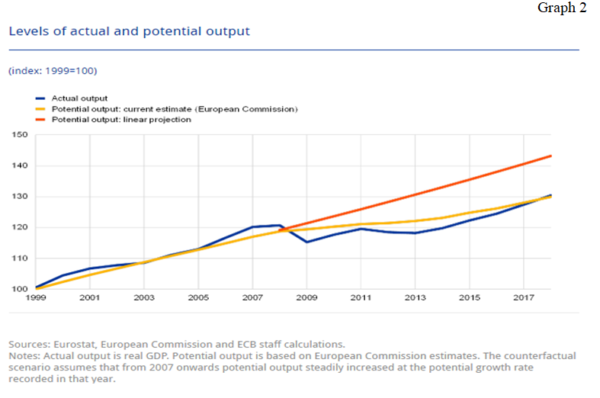

In order to explain that this slowdown is something normal, we need to refer to the concept of output gap (excess/deficit demand). Mankind being greedy, it does not accept to consider previous losses as historical costs (“bygones are bygones”), but it wants by all means to recuperate them in the growth periods, through evolutions of the GDP above potential, until it surpasses the trend of growth prevailing before the crisis. Until this happens, growth above potential is accepted and the situation is presented as a demand deficit (negative output gap). Once effective GDP growth surpasses the trend, the situation is termed demand excess (positive output gap). Graph 2 shoes how the trend (the yellow line) is being surpassed by actual GDP growth (the blue line) starting 2017, so that eventually we have also in the Euro Area an excess demand. It follows that the slight deceleration of 2019 is normal, and even desirable.

ECB’s efforts not to allow below-potential growth even when it’s needed have to do with a major paradigm shift in economic thinking, namely the effort to dismantle the economic cycle. For millennia it has been accepted that the economy has cyclical evolution, with ups and downs. Even in the Bible there is reference to the seven good years (the 7 “fat cows” of Jacob’s dream), followed by seven bad years (the 7 “meagre cows”). But, starting with mid-twentieth century, in following Lord Keynes’s teachings, more and more central banks have started practicing what one may call “macroeconomic engineering”, by trying to level down the economic cycle (in order not to have upswings and downswings), denying the very way a market economy functions, which by definition is of alternance between exuberance and pessimism.

In fact, Keynes’ intention seemed not to be the dismantling of the economic cycle, but rather cutting its extremes, both on the positive (exuberant) and negative (pessimist) sides, through counter-cyclical policies. What he has failed to notice is that in an electoral democracy there will be few politicians willing to stop an excessive economic growth and even fewer willing to accept a recession (negative growth), despite the fact that these represent economic normality. The fact that politicians think this way is grave enough, but much more worrisome is that there are macroeconomists, many of them mushrooming in the central banks and finance ministries, who validate those illusions, due to an erroneous understanding of Keynes’ lessons. We have thus come to live in a world where excessive growth, however large, is accepted, while recessions, however necessary, are rejected. But such macroeconomic engineering, being contrary to market economy’s nature, cannot end well.

One can make a parallel to the social engineering, one of the main reasons for which the Communist experiment ended in failure. It also disregarded man’s true nature, until reality contradicted it. As the Romanian poet Mircea Dinescu put it:

“Draw the curtain, Ezekiel. The end.

Lost war. Angel’s disarming.

The experiment has failed.

Man is a dog. Though it’s not barking.”

(“Letter to Mikhail Bulgakov”)

In conclusion, ECB’s intervention in modelling the economic cycle, besides being non-statutory (it does not belong to the legal objectives of this central bank), is also harmful, since it seems to ignore the way a market economy is supposed to operate.

(to be continued)