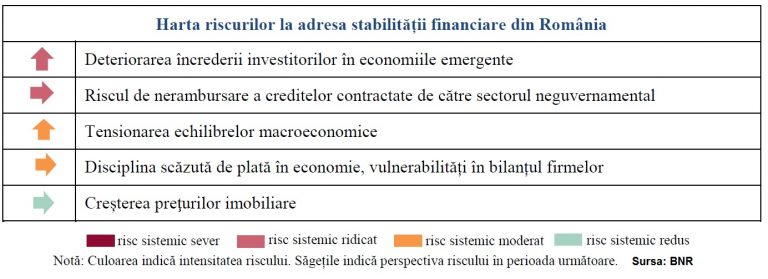

The deterioration of investors’ confidence in emerging economies and the default risk of loans to companies and population are the biggest risks to financial stability in Romania, according to a report published on Thursday by the National Bank of Romania (BNR).

The deterioration of investors’ confidence in emerging economies and the default risk of loans to companies and population are the biggest risks to financial stability in Romania, according to a report published on Thursday by the National Bank of Romania (BNR).

The default risk of non-governmental loans is a new entry on the risk map (in this form) and directly positioned at the high systemic risk level, according to the first report of this year on the financial stability.

The current report also includes companies in this risk, compared to the previous report, which had only identified the risk of „the increasing population’s indebtedness.”

The credit default risk trend is stagnant, while the risk of investor confidence’s deterioration is on the rise, unlike the report in December 2017, when the outlook for this latter risk was stagnant.

*

- The map of risks to financial stability in Romania

- Deterioration of investors’ confidence in emerging economies

- Default risk of non-governmental loans

- Increasing tension in the macroeconomic balance

- Low payment discipline in the economy, vulnerabilities in companies’ balance sheet

- Increase in the real estate prices

- Severe systemic risk High systemic risk Moderate systemic risk Low systemic risk

*

Of the other three risks, „Low payment discipline in the economy, vulnerabilities in companies’ balance sheet” (moderate) has entered a growing trend compared to the previous report, and the increasing tension in macroeconomic balances maintains its increase prospect.

The outlook for real estate prices is steady.

Confidence deterioration

„A rapid deterioration of investors’ confidence in emerging markets is the most important risk for the next period,” says the BNR report.

The main factors influencing this risk are:

- The normalization of monetary policies of the main central banks at a faster pace than anticipated by investors, amid increased inflationary pressures or worries about the rate of economic growth;

- trends in the global trade, in the context of the adoption of some protectionist measures;

- Uncertainties about Brexit and new trade agreements;

- adverse and sudden market reactions that have the potential to generate significant contagion effects and feed other vulnerabilities existing in the financial system.

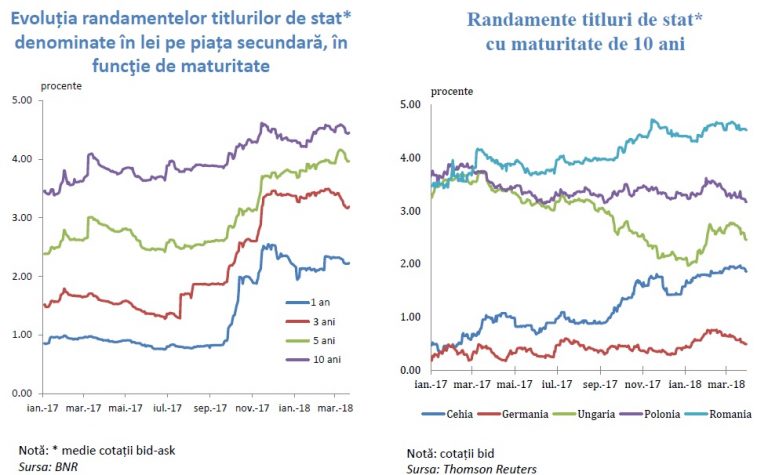

„These developments have also been reflected in the temporary increase in costs of financing the states, both in emerging countries (such as Romania) and in developed ones (such as Germany, whose bonds are a benchmark including for our country), ” says the report.

Evolution of the return of state bonds denominated in RON on the secondary market, depending on maturity Return of state bonds with a 10-year maturity

The BNR Governor has stated that there is no unanimously accepted definition of the normalization process of monetary policies and interest rates are still low in Romania.

Credit default risk

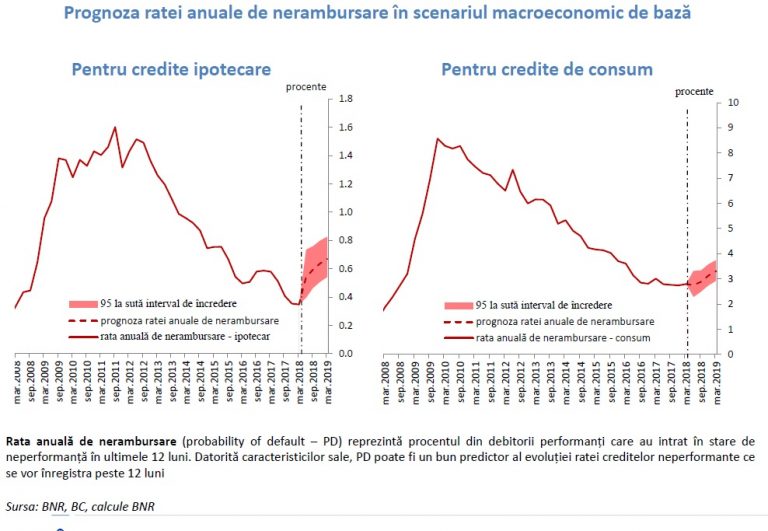

„Although the risk of default has not materialized, it is a vulnerability that can be manifested in the context of the global trend of interest rate levels returning to historical trends,” the NBR report said.

*

- Annual probability of default in the basic macroeconomic scenario

- Mortgage loan Consumer loans

*

The risk of default is the result of factors related to:

- payment discipline in the economy;

- the suitability of bank lending standards to the moment of granting the loans;

- draft legislation that has encouraged moral hazard;

- the volume of bad loans granted to this segment in the national currency resumed an upward trend and increased by 13% (March 2018 versus March 2017);

- the probability of default on a one-year horizon (March 2018 – March 2019) resumed an upward trend;

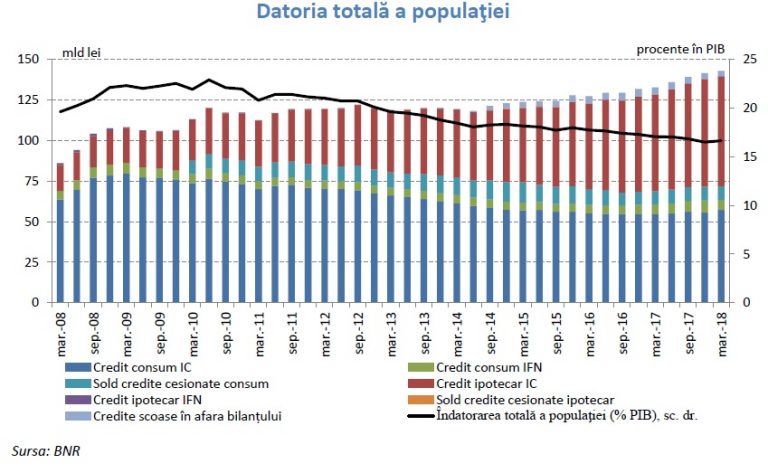

- the total debt of the population continued to increase in nominal terms in 2017, mainly due to the significant rise in the mortgage credit (+ 13%, in median value, March 2018/April 2017) and the consumer credit (+ 17%);

*

- Total debt of population

- Billion RON % of GDP

- Consumer credit CI IFN consumer credit

- Balance of assigned consumer credit Mortgage credit CI

- IFN Mortgage credit Balance of assigned mortgage credit

- Credits removed from the balance sheet Total debts of population (% of GDP)

*

- the debt/income ratio (DSTI) of debtors earning between the regulated minimum national wage and the average national wage is significantly higher than the ratio for people with higher incomes;

- a possible increase of 10 percentage points of DSTI would lead to a 6% increase in the probability of default for the mortgage credit and by 3% for the consumer credit.

- the bad loan ratio for the loan portfolio with DSTI over 60% is 10%, twice the value of the entire portfolio of exposures to the population.

„In this context, the asymmetry of the indebtedness by income remains an important concern, as the DSTI for debtors earning between the regulated minimum national wage and the average national wage is significantly higher than for people with higher incomes,” the BNR report said.

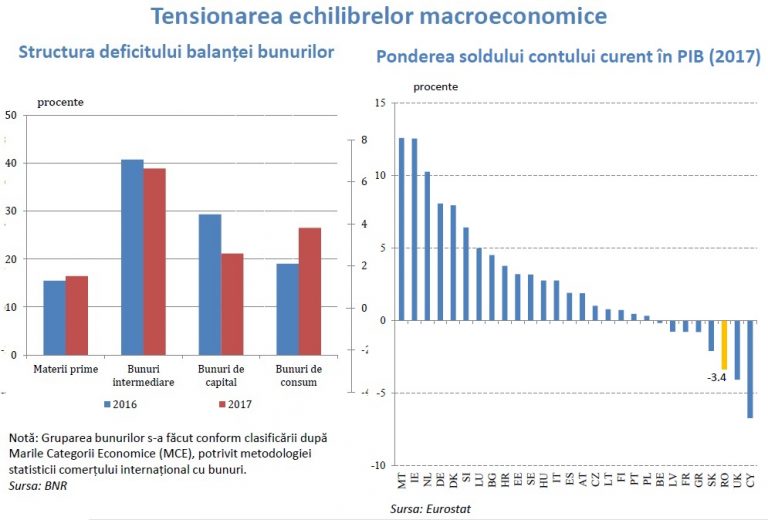

Increasing tension in macroeconomic balances

The risk continued to manifest especially related to the evolution of twin deficits.

„The intensification of the aggregate demand in the national economy led to the deepening of the current account deficit and the impulse generated on imports eroded the favourable effect of the accelerated export growth”.

The budget deficit is at the maximum threshold of 3% of GDP

The structural deficit has deteriorated to 3.3% of GDP in 2017 (from 2.1% in 2016), above the medium-term target of 1%, and is projected to reach 3.8% at the end of the year 2018.

*

- Increasing tension in macroeconomic balances

- Structure of goods balance deficit Share of the current account balance in GDP (2017)

- Note: Grouping of goods was made based on the classification by Large economic categories (MCE), according to statistic methodology of international trade of goods

*

The polarization of the economy is significant: top 100 firms accounted for about 47% of the aggregate net result for the whole economy (compared to 42% in June 2016), while top 100 companies by the level of negative results represent 28% of total losses in the whole economy”.

The BNR is „concerned” with the effect of corroborating the tension from the macroeconomic balance with a potential deterioration in investors ‘sentiment towards emerging markets, an increasing indebtedness of the population and the vulnerabilities in companies’ balance sheets.

All these factors can „generate pressures on the financial stability by amplifying the effects on debtors’ capacity to pay either through the interest rate channel or the exchange rate channel.”

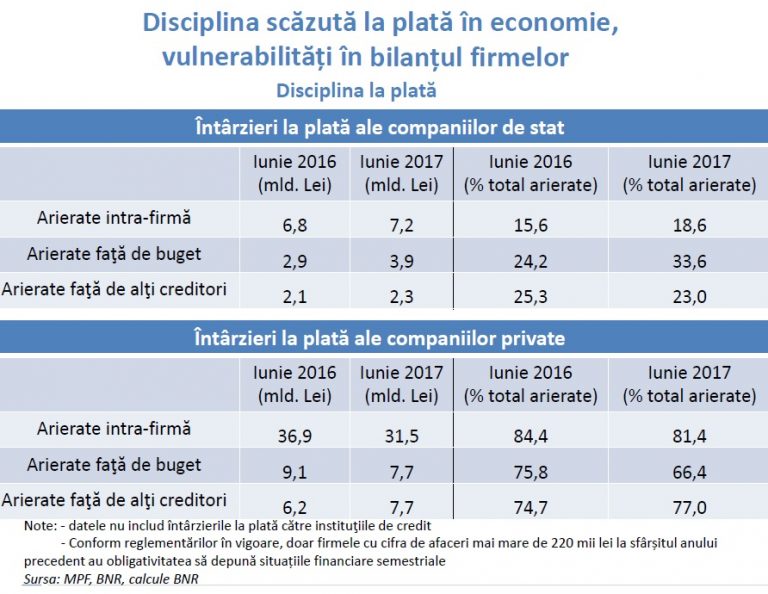

Payment discipline in the economy was mixed: the amount of arrears decreased, while the volume of major payment incidents increased.

*

- Low payment discipline in the economy, vulnerabilities in companies’ balance sheets

- Delays in payments registered by state-owned companies

- June 2016 June 2017 June 2016 June 2017

- (billion RON) (billion RON) (% of total arrears) (% of total arrears)

- Intra-company arrears

- Arrears to the budget

- Arrears to other debtors

- Delays in payments registered by private companies

- Intra-company arrears

- Arrears to the budget

- Arrears to other debtors

*

The main determinants are reduced capitalization in a large proportion of firms, the lax financial discipline or the loopholes in the corporate insolvency.

Besides, the ratio between debtors and creditors got unbalanced, and mutual trust has deteriorated.

The systemic risk generated by rising house prices has lower amplitude but it may amplify the other risks identified, especially related to the rising population indebtedness.

House prices maintain on an upward trend in 2017, similarly to the developments in the region.

„These price dynamics translates into the need to access higher mortgage loans, which in the context of longer maturities and greater sensitivity to changes in interest rates might put pressure on the debtors’ ability to honour the debt service”, says the BNR Report on Romania’s Financial Stability.