Credit institutions have tightened credit standards for the population in the first quarter of 2017 for both consumer credit and home and land loans (mortgage loans), according to the lending survey conducted by the National Bank of Romania (BNR).

Credit institutions have tightened credit standards for the population in the first quarter of 2017 for both consumer credit and home and land loans (mortgage loans), according to the lending survey conducted by the National Bank of Romania (BNR).

For companies, credit conditions have been maintained at a constant level, except for the short-term loans to small and medium-sized companies.

Credits for population

„Credit standards moderately tightened in Q1/2017 for both mortgages and consumer loans, this evolution being based on the monetary or prudential policy decisions made by the National Bank of Romania,” the BNR report said.

For Q2/2017, credit institutions participating in the survey „forecast a marginal tightening of standards for home and land purchase loans and a significant tightening of the consumer credit,” according to the source mentioned.

On the other hand, according to the reports of the Eurozone banks, credit standards related to both mortgages and consumer credit have lessened in Q1/2017. „The forecast for the next quarter shows that credit standards for all types of loans to the population will maintain constant,” BNR added in the report.

*

- Evolution of the credit standards for population

*

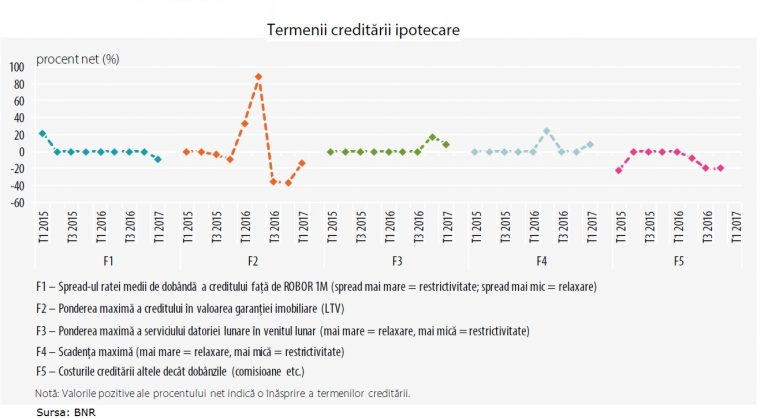

BNR noted in Q1/2017 „a mixed evolution of the terms of credit agreements for home and land purchases”.

„The debt and maximum maturity requirements have marginally tightened, while the conditions for the maximum loan weight in the value of the mortgage collateral (LTV) and the spread of the average interest rate of the credit against ROBOR at 1 month have moderately, respectively marginally relaxed„.

*

- Terms of mortgage lending

*

Residential real estate prices rose in Q1/2017, according to the reports from credit institutions participating in the survey. Banks estimate that this trend will continue in the second quarter.

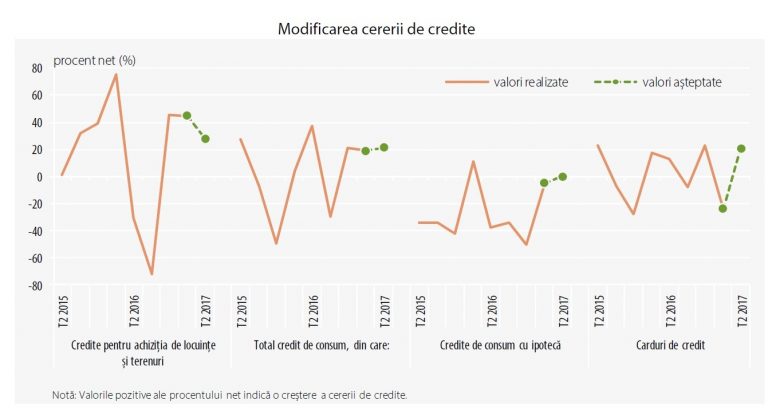

„Demand for housing and land purchase loans increased significantly in Q1/2017, and credit institutions forecast that it will have a significant advance over the next three months as well. In Q1/2017, the ratio of loan requests rejected by banks remained relatively unchanged in the mortgage category,” the report said.

The report also shows that in the first quarter of 2017, the demand for credit significantly increased both for consumer loans and housing and land purchase loans.

*

- Evolution of credit demand

*

The main factor contributing to this evolution was the BNR’s monetary or prudential policy decisions, „particularly the requirements for assessing the creditworthiness of borrowers„.

Credit institutions anticipate a significant tightening of credit standards for consumer loans and a marginal tightening for mortgage loans in the next three months. As far as the non-financial companies are concerned, it is expected that „credit standards to remain in Q2/2017 at a similar level to the current one,” the report said.

Corporate loans

For the non-financial companies, „credit conditions have maintained at a steady level compared to the previous period, except for the short-term loans to small and medium-sized businesses, for which conditions have moderately tightened.

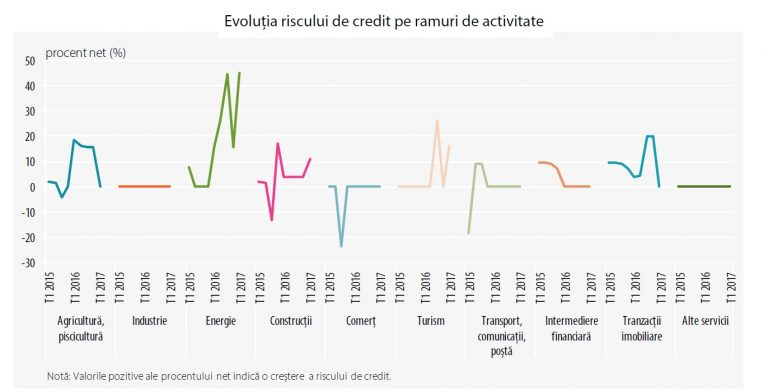

The credit risk associated with most business sectors remained relatively constant in Q1/2017, except for the energy sector where it recorded a significant advance, as well as the construction and tourism sectors, where it increased with a moderate amplitude.

*

- Evolution of credit risk by sectors of activity

*

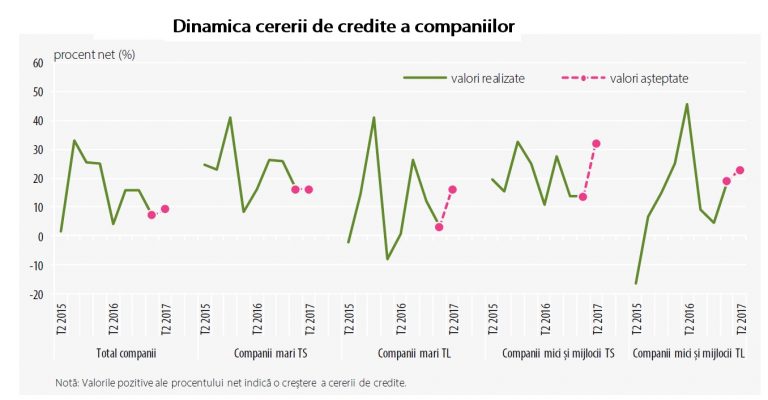

Demand for loans to non-financial companies posted a marginal advance.

„In the structure, short-term financing needs have moderately increased among both large and small and medium-sized companies. In the case of long-term loans to large companies, there were no notable changes,” the report says.

*

- Dynamic of corporate loan demand

*

BNR notes that the survey is conducted quarterly by the institution in January, April, July and October. It is based on a questionnaire (published in the May 2008 analysis) sent to the top 10 banks by market share in terms of credit to companies and population. These institutions hold about 80% of the lending to these sectors.