Profit or Loss Keys Showing Returns for Internet Businesses

Profit or Loss Keys Showing Returns for Internet Businesses

Banks in Romania achieved net profits of about ROL 2.7 billion lei in the first half of 2017, according to the companies’ tax statements and reports of the National Bank of Romania.

In other words, the banks’ profits equal 72% of the earnings amounted to 3.7 billion lei of the most important Romanian companies, which go into debt by borrowing from banks and are listed on the Bucharest Stock Exchange (BSE).

If the profit reported by Hidroelectrica on first five months (ROL 774 million) is included, the share of the banks’ profits is 60% of the profits of the large companies in Romania.

Banks’ earnings were mainly attributable to the expenditure cuts (including the provisions for bad loans) and in the context of increasing the lending activity and increasing the revenue from interests.

„The average interest rate on new loans was relatively higher between April and May than in the first quarter,” says the National Bank’s report on inflation, published in August 2017.

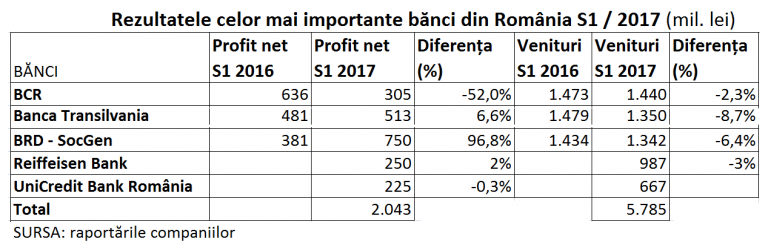

The largest five banks in Romania by value of assets (BCR, Banca Transilvania, BRD, Raiffeisen Bank and UniCredit Romania) registered net profits of ROL 2.04 billion in the first six months of the year, that is almost 55% of the profits of the most important companies on the stock exchange (excluding BRD and Banca Transilvania).

*

- Results of the most important banks in Romania – H1/2017 (million lei)

- Banks Net profit H1 2016 Net profit H1 2017 Change (%) Revenues H1 2016 Revenues H1 2017 Change (%)

*

Revenues from fees declined in the first semester for some of the largest banks. However, last year, the largest three banks in the system obtained cumulative revenues from interest 6.5% lower compared to 2015 (up to ROL 4.98 billion) and the revenues from fees had increased by almost 3% to ROL 1.95 billion.

Out of the large banks, BRD is noted by far, which almost doubled its profit to ROL 750 million, and Banca Transilvania (TLV) that managed to obtain an increased profit by 6.6% in the first half of the year, even in the context of the costs with the absorption of Volksbank Romania.

The 13 companies included in the BSE benchmark index, BET, recorded net cumulative profits of more than ROL 4.9 billion at June 30, 2017, results of Banca Transilvania (TLV) and BRD included.

All large companies listed on the stock exchange recorded a profit growth in the first half of 2017 compared to the same period of the last year, with two exceptions: Electrica (EL) and Transelectrica (TEL), which suffered from the market imbalance caused by the withdrawal of some energy distributors.

*

- Results of the most important companies in Romania – H1/2017 (BET index, million lei)

- Company Symbol Net profit H1 2017 Change (%) Revenues H1 2016 Revenues H1 2017 Change (%)

*

On the other hand, the companies’ potential profit is limited by the fact that the rate of capacity utilisation in Romania „exceeds the long-term average in most industrial groupings„, according to the BNR report mentioned.

The highest capacity utilisation is provided by companies manufacturing durable goods, more than four times the long-term average (Q1/2005 – Q1/2017), followed by the companies in the sector of intermediate goods and capital goods but declining since the second half of last year.