This text is intended primarily for youths, namely those who look to a future in which they are to build their lives and careers. However, the clouds of paradigm change loom on the horizon: a combination of 5 factors will bring significant changes to the functioning of economies, as well as of societies. Consumerism – the foundation of Western economy of recent decades – is under attack by many types of crises from all directions and it is difficult to assume it will hold out.

Considering this, the text is also addressed to those at the peak of their personal and professional life: society itself will have to adapt to the consumerism crisis.

Consumerism – defined as the social and economic order in which the aspirations of most individuals include the purchase of goods and services beyond necessity, often as an emphasis on acquired status – emerged in Western societies in the 20th century, but gained momentum especially after 1971, the year when central banks started issuing fiat money, uncorrelated to gold or any other asset.

Since then, Western governments found it increasingly difficult to withstand demands from popular masses to stimulate consumption by any means – even at the cost of increasing inflation, budget deficits and public debt – demands facilitated by:

- the advent of the credit card in 1958, in the USA, which took debt consumption to new heights;

- the sophistication of advertising, marketing and banking services, that exploited the weaknesses of the human psyche, leading to the desire of numerous unnecessary goods and services;

- the expediency of goods producers who deliberately reduced the lifespan of goods (cars, refrigerators, TVs, computers, etc.), in order to increase sales.

In particular, consumerism experienced its peak period during the Second Globalization (1990-2022), taking advantage of a favorable conjunction of factors:

- the peace dividend: once the Cold War ended, a number of resources intended for the defense industry were reallocated to the consumer goods industry;

- the demographic dividend: the generation of baby-boomers (those born between 1946 and 1964) in the West and the generation of “decree children” (those born between 1967 and 1989) in Romania entered the workforce;

- the globalization dividend: the entry into production chains of countries such as China, India and other states from South-East Asia, with cheap labor, enabling the production of goods and services at very low prices;

- the digitalization dividend: also allowing lower prices for products;

- the low interests dividend: while factors mentioned above kept global inflation at a low level, central banks allowed themselves to practice low interest rates (sometimes, negative real, that is, below the level of inflation), that furthermore stimulated debt living.

Romania joined this fever of consumerism relatively late, after the year 2000, but it did so with considerable zeal, as if meaning to catch up to lost decades.

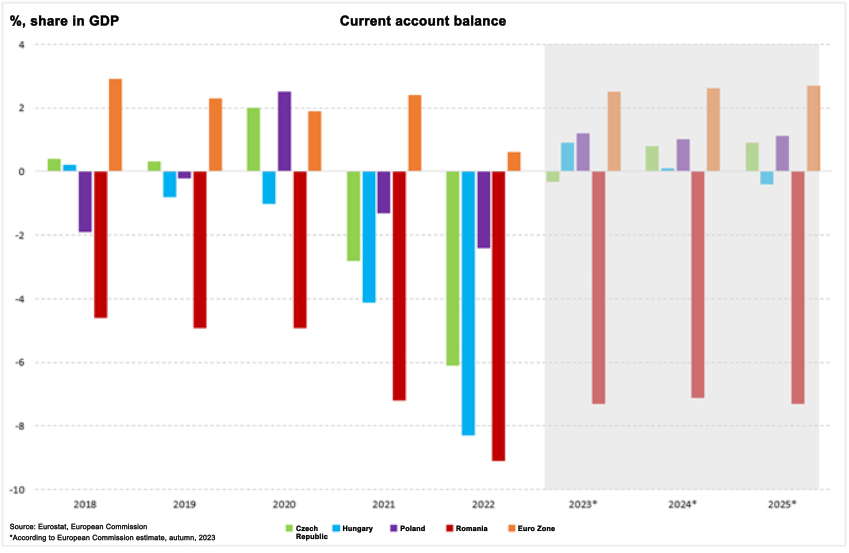

Consequently, the growth model chosen by the public (producers and consumers) and validated by politicians was based on consumption in Romania, unlike the Czech Republic, Poland and Hungary, which based their economic growth on export, following the German model. Consumption leads to increased imports and is financed by increasing foreign debt.

Chart 1 from Eurostat shows that Romania’s current account deficit registers higher and higher values year on year, while countries in Central and Eastern Europe, as a rule, have current account surpluses (except in the two post-pandemic years), similar to the euro zone as a whole.

Chart 1:

However, with the outbreak of Russian aggression in Ukraine in 2022, a series of trends were set in motion that portend the decline of the consumerist lifestyle.

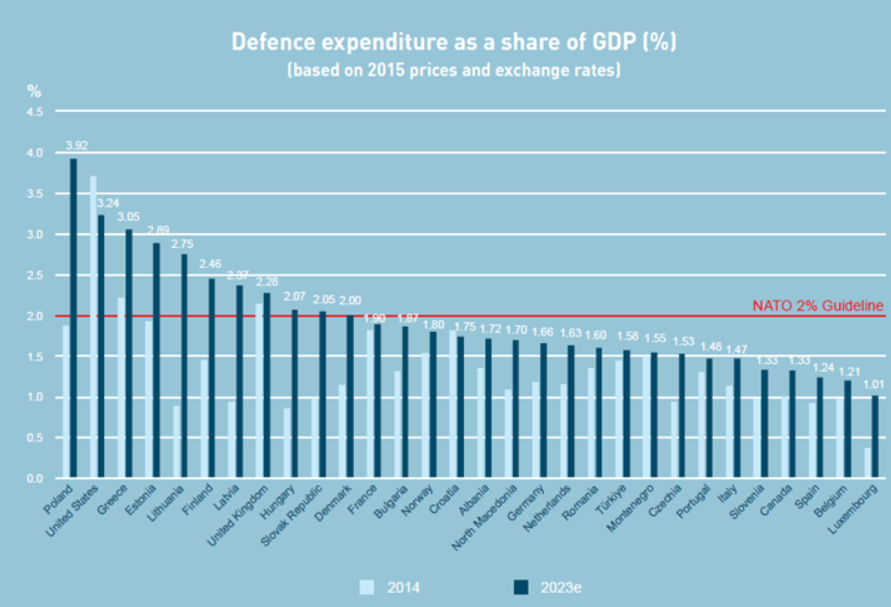

1. The peace dividend is gone. Democratic states will have to rearm, at least to the minimum limit of 2% of the GDP, if not more. Chart 2, taken from the 2023 NATO Report, shows that Romania has a lot to make up for in this regard, having spent in 2023 only 1.6% of GDP for defense.

In the “guns versus butter” dispute, relocating resources towards armament will automatically mean a reduction of resources allocated to consumption.

Chart 2:

Source: NATO; Annual report 2023.

2. The globalization dividend is about to disappear. Given the new geopolitical reality, marked by rival economic-military blocs, it is natural for Western states to try to bring the manufacture of goods closer to home, through nearshoring and friendshoring. However, this will result in more expensive products, without the benefit of cheap workforce from countries with authoritarian regimes. As such, consumption will also suffer.

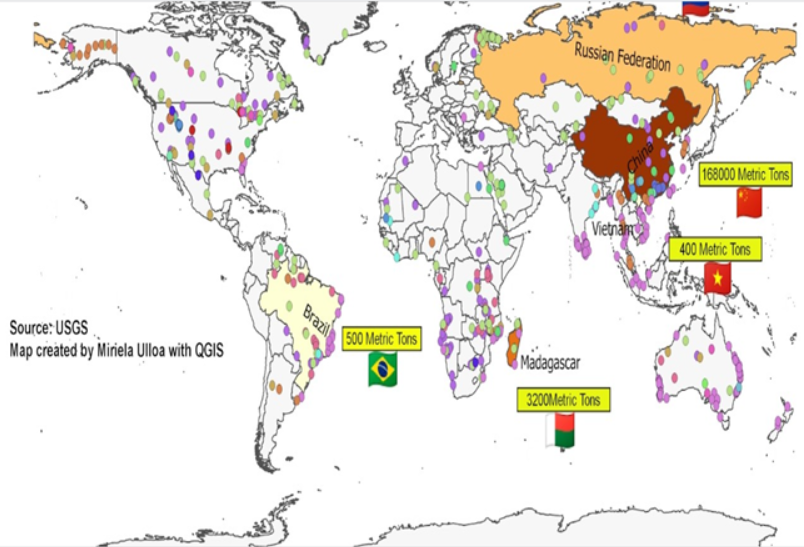

3. The vast majority of rare earths, essential for the economy of the future, are concentrated in China (Chart 3). This means that a number of essential components for electric vehicles, solar panels, smartphones, etc. will be hard to find or will come at prohibitive costs.

It follows that manufacturers of such goods will have to redesign them with as long as possible lifespans (muting advertising and marketing activities), much like it was done in the ‘50s and ‘60s of last century.

And if Western manufacturers will refuse to adapt, they will probably be forced to by governments faced with a shortage of strategic raw materials. At the same time, the reuse and return of goods by consumers will again be rewarded with much higher amounts than in the recent past.

Chart 3:

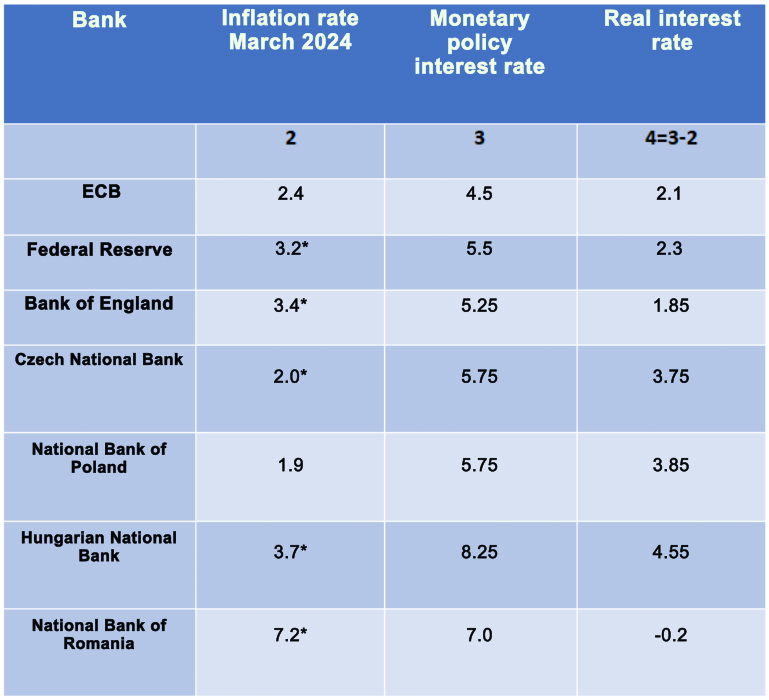

4. If inflation tends to increase, for reasons such as those presented above, central banks will no longer be able to nonchalantly practice negative real interest rates. This will put pressure on consumer lending and will direct the public towards taking out loans only for essential goods. There is already a noticeable trend of central banks to practice strongly positive real interest rates (higher than inflation). See Table 1.

Among others, positive real interest rates will also pressure Ministries of Finance to reduce deficits, as they will be harder to finance from both domestic and external sources. Subsequently, smaller budget deficits translate to smaller current account deficits and more moderate consumption in turn.

Table 1:

Source: tradingeconomics. *- February 2024

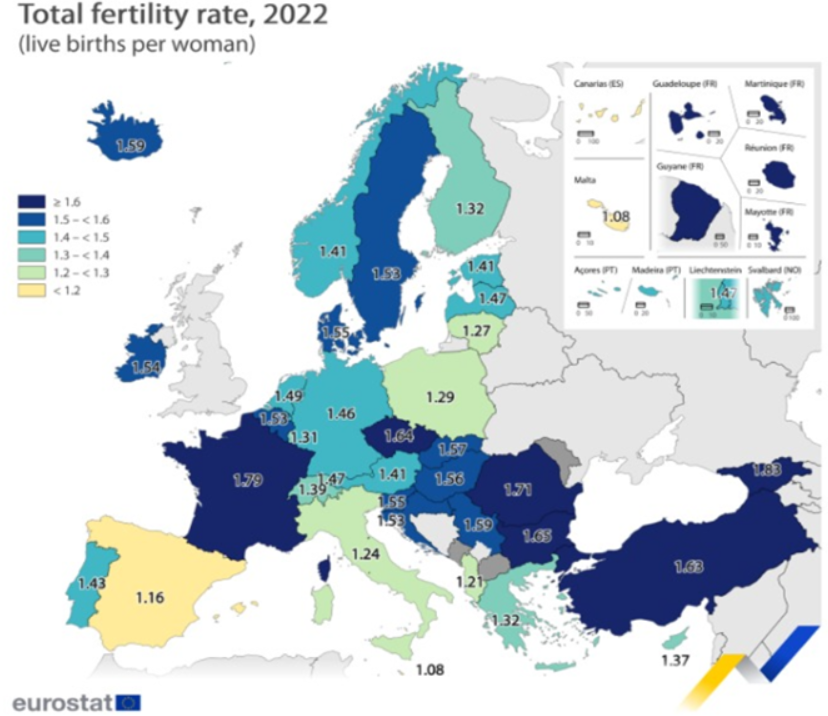

5. The demographic dividend is also running out, with the retirement of baby-boomers and of the “decree generation”. While smaller and smaller generations come to the foreground, considering that the European record in terms of total fertility rate is held by France, with 1.79 births/woman, much below the replacement rate of 2.1 births/woman. Romania holds an encouraging (but insufficient) second place in this ranking, as shown in Chart 4 from Eurostat.

People will inevitably have to work for more years before being able to retire.

The notion of fewer young workers implies fewer producers and consumers of goods and services. At the same time, fewer contributors to the Pillar 1 pensions system means that mature workers will have to save more for retirement, reducing their consumption accordingly.

Chart 4:

In conclusion, the world we entered as of 2022 is a world with higher prices, less readily available consumer goods and increased retirement ages.

If anyone thinks that Romania can escape these continental trends, they are sorely mistaken.

And it is not even mandatory for all five to come true. It is sufficient that only two or three of the trends illustrated to come about for the consumerist lifestyle to go into decline.

I can understand the frustration of Romanians who have made consumerism a way of life. But if they ignore the trends presented in this article, they do so at their own risk.

***