The execution of the general consolidated budget in the first eight months of 2020 registered a deficit of RON 54.77 billion (5.18% of GDP, an increase by half a percentage point of GDP compared to July), of which more than half it is the result of measures to fight the crisis caused by COVID-19 epidemic, the Ministry of Public Finance (MFP) reports.

The execution of the general consolidated budget in the first eight months of 2020 registered a deficit of RON 54.77 billion (5.18% of GDP, an increase by half a percentage point of GDP compared to July), of which more than half it is the result of measures to fight the crisis caused by COVID-19 epidemic, the Ministry of Public Finance (MFP) reports.

„Amounts of RON 31.17 billion (2.95% of GDP) were left in the economic field through fiscal facilities, investments and exceptional expenditures adopted to fight the effects of COVID-19 epidemic,” explain the representatives of the Ministry of Public Finance.

The budget deficit increase related to the first eight months of the current year, compared to that registered in the same period of 2019, is explained, on the revenue side, by:

- the unfavourable evolution of budget revenues during March-August,

- payment postponement for some fiscal obligations of economic agents during the crisis (RON 14.4 billion),

- the increase of VAT refunds by RON 2.8 billion, compared to the level for period January-August 2019,

- bonuses granted for the payment of the corporate tax at maturity and the income tax for micro-enterprises, amounting to RON 0.25 billion.

Also, on the expenditure side, besides the budget increase by the effect of the laws, there was an increase in investment expenditures by RON 5.1 billion compared to the same period of the previous year, as well as one-off payments generated by COVID-19 epidemic, of approximately RON 8.62 billion.

Revenues increased in August by 8.8% year/year

The revenues of the general consolidated budget amounted to RON 201.32 billion in the first eight months of 2020, meaning a decrease by 1.4% compared to the level registered in the same period of 2019. Expressed as a share in the estimated GDP, budget revenues registered a decrease of 0.23 percentage points (year/year), mainly caused by the contraction of net VAT revenues.

Regarding the monthly evolution, the dynamics of total revenues returned in August within the positive range (8.8% year/year), as an effect of the advance in non-fiscal revenues and those from European funds. The increased volatility of monthly receipts, as of March, is explained by tax facilities granted in the current context.

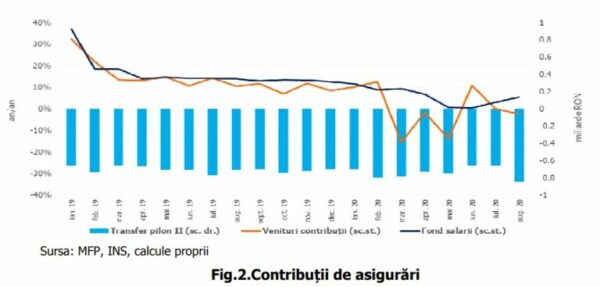

Contributions decrease although the salary fund increases

Insurance contributions totalled RON 73.71 billion in the first eight months of 2020, showing a marginal reduction compared to the level recorded in the same period of the last year (-0.3%).

In August, unlike the salary tax receipts, the dynamics of contributions decreased by 2.5% year/year, given that the national wage fund increased by 5.4%.

*

- Chart 2. Insurance contributions

- Receipts from social contributions were affected by:

- (i) the deadline extension for the payment of tax obligations declared by taxpayers,

- (ii) change in the calculation basis for CAS and CASS payable by employees with an individual part-time employment contract,

- (iii) exemption from payment of the insurance labour contribution (for technical unemployment).

*

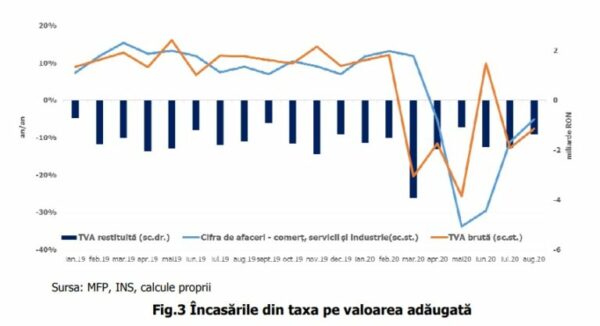

Net VAT revenues remain by 15% below 2019 level

Net VAT revenues recorded RON 35.12 billion in the first eight months of 2020, down by 14.9% compared to the same level from last year.

VAT is the second most important revenue source for the general consolidated budget, after insurance contributions. Net VAT receipts represent the difference between the VAT collected and the VAT reimbursed by the state (value-added tax is a neutral business tax, in the sense that it is paid by the final consumer). MFP charts show that VAT refunds fell after March down to levels similar to 2019.

VAT amount receipts

„Against the background of resuming the activity in some sectors, in August, the dynamics of gross revenues from VAT improved (-5.3%), in line with the relevant macroeconomic basis”, explains MFP.

*

The evolution of VAT receipts in the first eight months of the year was negatively influenced by:

- increase of VAT refunds by 22.1%, year / year (+ RON 2.78 billion);

- extension of the payment term of the declared fiscal obligations;

- unfavourable developments in economic sectors as of March (mainly in industry, services for population and trade with motor vehicles).

*

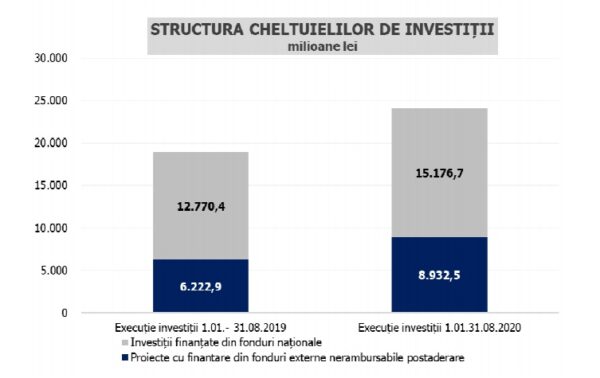

+ 27% in investments

The amounts reimbursed by the European Union in the account of payments made and donations totalled RON 13.32 billion in the first eight months of 2020, which is an increase by 35.4% compared to the same period of last year. The amounts also include RON 1.2 billion related to the settlements from non-reimbursable external funds in the account of indemnities granted during the period of temporary suspension of individual employment contract by the employer.

*

Investment expenditure structure (million RON)

Investment implementation (1.01 – 31.08 2019) Investment implementation (1.01 – 31.08 2020)

– projects financed from national funds

– projects with post-accession non-reimbursable foreign funds

*

Investment expenditures, which include capital expenditures, as well as those related to development programs financed from domestic and foreign sources, amounted to RON 24.1 billion, the largest amount invested in the economy over the last 10 years related to the first 8 months of the year, which means an increase by 26.9% compared to the same period of the previous year.

Pandemic expenditure

Expenditures of the general consolidated budget in the amount of RON 256 billion increased in nominal terms by 13.3% compared to the same period of the previous year. Expressed as a share of Gross Domestic Product, expenditures increased by 2.9 percentage points from 21.3% of GDP in 2019 to 24.2% of GDP in 2020.

Until the end of August, the main expenses incurred in the context of the pandemic were:

- RON 3.98 billion for allowances granted during the period of temporary suspension of the individual employment contract by the employer;

- RON 813.1 million for allowances granted for other professionals, as well as for persons who have concluded individual employment agreements that stop the activity following the effects of SARS-CoV-2;

- RON 639.6 million representing amounts granted to employers for the partial settlement of the gross salary of employees retained at work (41.5%);

- RON 81 million for allowances granted to parents for the supervision of children during the period of the temporary closure of schools.