The implementation of the consolidated budget in the first five months of 2020 registered a deficit of RON 38.8 billion (3.59% of GDP), of which almost half was generated by “the amounts left in the economic environment through tax incentives and expenditures adopted to combat the effects of COVID-19 epidemic”, communicates the Ministry of Public Finance (MFP). The deficit rose by 1.1 percentage points of GDP compared to April.

The implementation of the consolidated budget in the first five months of 2020 registered a deficit of RON 38.8 billion (3.59% of GDP), of which almost half was generated by “the amounts left in the economic environment through tax incentives and expenditures adopted to combat the effects of COVID-19 epidemic”, communicates the Ministry of Public Finance (MFP). The deficit rose by 1.1 percentage points of GDP compared to April.

The increase in the budget deficit for the first five months of this year, compared to the same period last year, is explained in terms of revenues by:

- – the unfavourable evolution of budget revenues during March-May, as a result of the postponement of companies’ payments of some tax obligations during the state of emergency and alert (RON 11.7 billion);

- – the increase by RON 2.26 billion in VAT refunds, compared to the level registered in January-May 2019, to foster liquidity in the private sector;

- – the bonuses granted for the payment of the corporate tax and the tax on micro-enterprises revenues within the deadline, amounting to RON 0.25 billion.

Also, in terms of expenditure, compared to the budget increase through the laws’ effect, there was an increase in investment spending by RON 3.43 billion compared to the same period of the previous year, as well as exceptional payments generated by COVID-19 epidemic of approximately RON 3.83 billion.

Revenues of the consolidated budget amounted to RON 119.6 billion in the first five months of 2020, a 3.4% decrease compared to the level of the same period last year.

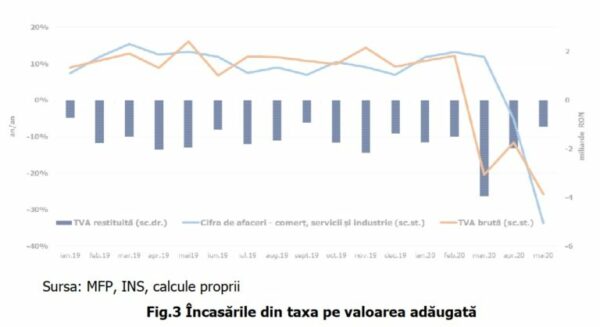

VAT revenues reached RON 20.11 billion in the first five months of 2020, an 18.9% decrease compared to the level registered in the same period last year.

The evolution of net VAT revenues in the first five months was negatively influenced by:

- – the increase of VAT refunds by 28.4% (year/year);

- – extension of the deadline for the payment of stated fiscal obligations;

- – unfavourable economic developments in economic sectors as of March: mainly market services provided to the population, the industry and trade.

*

- Refunded VAT Turnover – trade, services and industry Gross VAT

- Chart 3 – VAT revenues

*

The amounts reimbursed by the European Union on account of payments made and donations totalled RON 7.58 billion in the first five months of 2020, an increase of 24.8% compared to the same period last year.

Expenditures of the consolidated budget in the amount of RON 158.43 billion increased in nominal terms by 14.4% compared to the same period of the previous year. As a share of Gross Domestic Product, expenditures increased by 1.57 percentage points from 13.07% of GDP in 2019 to 14.64% of GDP in 2020.

Expenditures incurred in the context of Covid-19

By the end of May, the following were paid:

- – RON 2.28 billion for allowances granted during the period of temporary suspension of the individual employment contract at the initiative of the employer;

- – RON 440.1 million for allowances granted for other professionals, as well as for persons who concluded individual labour agreements and suspend the activity as a result of SARS-CoV-2 effects;

- – RON 9 million for allowances granted to parents for the supervision of children during the period of the temporary closure of educational establishments.

Personnel expenses amounted to RON 43.99 billion, up 5.2% compared to the same period of the previous year, which reflects salary increases, food allowance, both those applied as of January 1, 2019, granted under the Framework Law no. 153/2017 on the remuneration of staff paid from public funds, as well as the salary increases applied as of January 1, 2020.

Expenditures on goods and services were RON 21.1 billion, up 16.2% compared to the previous year. Under the consolidated budget, increases compared to the average are registered at the level of the local public administration (15.6%) and public institutions financed in whole or in part from own revenues (15.7%), increases mainly due to additional payments for medicines, sanitary materials, reagents and other products needed for the diagnosis and treatment of patients infected with the SARS-CoV-2 coronavirus.

An increase is also reflected in the budget of the single national Health Insurance Fund by 13.6% compared to the same period of the previous year, as a result of higher returns for the payment of medicines that are the object of resulted cost-volume contracts and for the repayment of out-patient medical services.

Investment expenditures, which include capital expenditures, as well as those related to development programs financed from internal and external sources, amounted to RON 13 billion, which led to the highest level in the last 10 years in terms of investment expenditures for first 5 months. These are by 35.8% more than the same period of the previous year.

Under the consolidated budget, the increases appear in the state and local budgets both from national funds and related to projects financed from non-reimbursable foreign funds.

Also, from the budget of the Ministry of Internal Affairs, RON 235.0 million were paid for purchasing products – emergency medical stocks, including thermal scanners to combat the spread of SARS-VOC-2 coronavirus infection.