In Romania, the ratio between the revenues that must be collected from taxes (including social contributions – tax/GDP ratio) and GDP was 26% in 2016, higher only than the level in Ireland and below the collection level in Bulgaria (29%), Lithuania (30.2%), Latvia (31.6%) and Slovakia (32.4%) and the European average of 40%, says a Eurostat report released on Thursday.

In Romania, the ratio between the revenues that must be collected from taxes (including social contributions – tax/GDP ratio) and GDP was 26% in 2016, higher only than the level in Ireland and below the collection level in Bulgaria (29%), Lithuania (30.2%), Latvia (31.6%) and Slovakia (32.4%) and the European average of 40%, says a Eurostat report released on Thursday.

The highest “tax/GDP” ratio is in France (47.6%), followed by Denmark (47.3%), Belgium (46.8%), Sweden (44.6%), Finland (44.3%), Austria and Italy (42.9%) and Greece (42.1%).

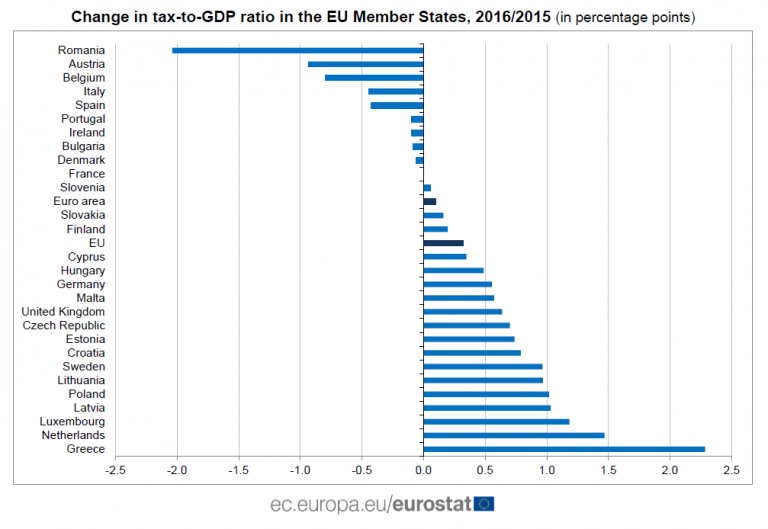

The tax/GDP ratio decreased the most in Romania in 2016, from 28% in 2015 to 26%, in Austria (from 43.8% to 42.9%) and Belgium (from 47.6% to 46.8%) and increased the most in Greece, the Netherlands and Luxembourg.

The tax/GDP ratio decreased the most in Romania in 2016, from 28% in 2015 to 26%, in Austria (from 43.8% to 42.9%) and Belgium (from 47.6% to 46.8%) and increased the most in Greece, the Netherlands and Luxembourg.

The ratio is defined as the total amount of taxes and social contributions due to the national and EU public administrations and „represents a measure of the fiscal burden„, according to the Eurostat methodology.

The analysis of the main tax categories shows that there is a significant diversity among the EU member states. Taxes on production and imports are the highest in Sweden (22.6%) and the lowest in Germany (10.9%).

Taxes on income and wealth are particularly high in Denmark (30%), followed by Sweden (18.8%), compared to 5.4% in Bulgaria. Finally, France is the country with the highest social contributions (18.8%), followed by Germany (16.7%), compared to 1% in Denmark, where social benefits are financed from taxes.