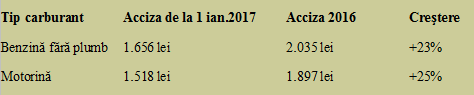

At the beginning of the current year, the over-excise of 7 euro cents per litre included in the total excise duty has been eliminated. At the same time, VAT has fallen by one percentage point, from 20% to 19%, which led to a cheaper litre of fuel by about 50 bani.

At the beginning of the current year, the over-excise of 7 euro cents per litre included in the total excise duty has been eliminated. At the same time, VAT has fallen by one percentage point, from 20% to 19%, which led to a cheaper litre of fuel by about 50 bani.

The return to the 2016 excise level would result in about 45 per cent increase in the price of a litre of fuel.

It should be noted that Romania was, before the elimination of the 7- euro cent over-excise and the VAT reduction at about 1.10 – 1.12 euros per litre for both gasoline and diesel fuel, which placed us (with fluctuations from month to month) somewhere between the 8th and 11th positions among the EU countries, namely below the EU average.

It should be noted that Romania was, before the elimination of the 7- euro cent over-excise and the VAT reduction at about 1.10 – 1.12 euros per litre for both gasoline and diesel fuel, which placed us (with fluctuations from month to month) somewhere between the 8th and 11th positions among the EU countries, namely below the EU average.

The up-to-date situation

At present, according to official data published by the European Commission on July 31, 2017, we rank second in the list of countries with the cheapest gasoline, with 1.00451 euro/ litre (after Bulgaria) and fifth on diesel, with 0.99351 euro/litre (after Luxembourg, Latvia, Bulgaria and Lithuania).

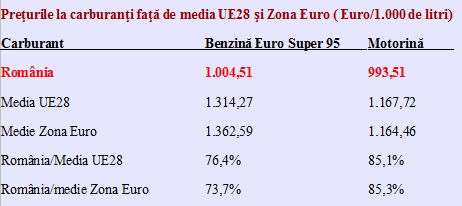

It is noteworthy that by these values we are significantly below the fuel price averages recorded in EU28 and the Eurozone. Respectively, we were at about 75% at gasoline and somewhere around 85% at diesel (see table). In conclusion, government decision-makers have estimated that there would be room for increasing the prices back to the 2016 levels.

*

- Fuel prices compared to the average in EU28 and the Eurozone (euro/1,000 litre)

- Fuel Euro Super 95 Gasoline Diesel

- Romania

- EU28 average

- Eurozone average

- Romania/EU28 average

- Romania/ Eurozone average

*

High risks of price increase versus uncertain results

The easy idea to increase the tax on products known to be rigid at price fluctuations (where consumption does not increase or decline in a significant proportion to price changes) has though, beyond the fact that it pushes inflation (because of the high proportion of fuel in the consumer basket and the indirect effect on the price of all goods and services) some adverse effects. Especially because we are not alone in the region.

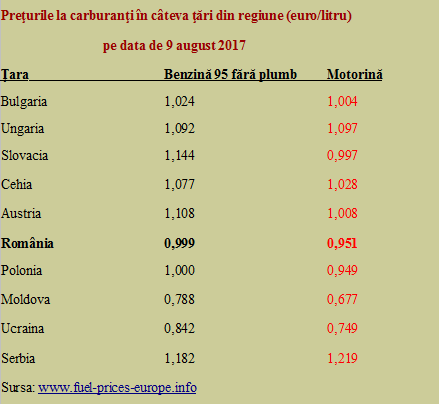

If we refer to the operative situation, according to the current prices, it can be noticed that Romania would leave the de facto overlapping area with the situation in Poland, a balance point, also by the similar quotation in relation to the European single currency. Reintroducing the 7-euro cents over-excise would translate into the increase in the diesel prices over the levels in Bulgaria, Hungary, the Czech Republic and Slovakia, and we would equal Austria.

*

- Fuel prices in some countries from the region (euro/litre) on August 9, 2017

- Country Euro-95 Gasoline Diesel

- Bulgaria

- Hungary

- Slovakia

- Czech Republic

- Austria

- Romania

- Poland

- The Republic of Moldova

- Ukraine

- Serbia

*

Incidentally, perhaps, a slightly higher level of gasoline price would have been acceptable, as it is mainly about the individual transportation and we would have followed the European trend in that matter. But the increase in the diesel fuel is one that is highly likely to prove counterproductive as it will translate into higher freight and passenger transportation costs.

It should also be noted that the data in the press release of the Ministry of Finance have been slightly glossed over compared to those published at the end of July by the European Commission: „Romania reached in July 2017 the lowest price of the Euro-95 gasoline in the European Union (0.997 euro per litre with taxes) and the third lowest price for diesel (0.977 euro per litre with taxes)”,

All in all, though if we look at the price levels in the neighbouring non-EU countries, we risk losing more of the lower volume of fills (which had barely increased following the measure on January 1, 2017) than gaining from the increase of the excise duties.

The Finance Ministry probably expects lower decreases of the fuel sales than the 23% -25% increase in the foreseen excise revenues. As well as the fact that, anyway, we already have a slightly lower price than Bulgaria and it hopes for us to stay below Hungary (if we look at the differences, we see exactly teuro centsocents pursued by the Finance Ministry).

It is, though, a risky bet, with uncertain positive results in terms of budget revenues, but with results as clear as possible in the increase of the inflation, which had already been updated as a BNR forecast in the recent publicly presented Report, to 1.9% for the end of the year.

Introducing a major disturbance through the price of a new key energy product, after the electricity has also started to give the chills with the market quotes, would risk sending the price increase beyond the theoretically ideal level of 2%, and, worse, could take us at the beginning of 2019 out of the target corridor of 2.5% plus/minus one percentage point. Of course, above its upper limit (3.6% instead of 3.5% if we maintain taxes constant, according to the BNR forecast).

Beyond the dangers mentioned for the macroeconomic stability, translated into a fall in the purchasing power of the recently (and hazardously) increased wages and pensions, there might be one more compromise solution. That is the increase in the rate of the excise reduction for the fuel used for the freight and passenger road transportation, from 189.52 lei/1,000 litres to about double. To cover this way as much as possible from the reestablishment of the excise duty on diesel. That is to much less affect the transporters and the consumer price index.