The general consolidated budget ended the first five months of 2018 with a deficit of -0.88% of GDP estimated for the current year, more than three times higher compared to the same period of the previous year (-0.27% of GDP at end of May 2017).

In nominal terms, it is about slightly more than eight billion lei at a GDP of about RON 930 billion.

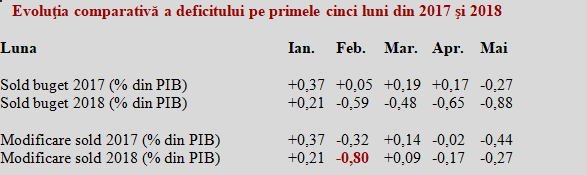

- Comparative deficit evolution in the first five months of 2017 and 2018

- Month

- 2017 budget balance (% of GDP)

- 2018 budget balance (% of GDP)

- 2017 balance change (% of GDP)

- 2018 balance change (% of GDP)

*

In fact, if we look at the comparative evolution of the deficit in the first five months of 2017 and 2018, one single major syncope may be noticed in February 2018. Otherwise, there are no significant differences in the budget implementation and even the month of May 2018 showed better than May 2017 (-0.27% of GDP versus -0.44% of GDP).

The problem is that the gap, which was clearly placed in the second month of the year, has not been recovered, and chances are worryingly decreasing, especially that as of July 1 we shall move to a 10% increase in the pension point. Why should not we have a gap? Well, to fall within the threshold of 3% of GDP, even near to the cut-off line, and not go through the excessive budget deficit procedure, about which the EU has warned us.

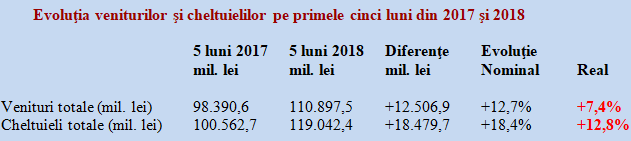

Compared to the first five months of last year, both public revenues (+ 7.4% in real terms, adjusted with average inflation of 4.92%) and public expenditures (+ 12.8% in real terms) significantly increased, above the GDP growth.

Therefore, the weaker result is not the consequence of a weaker revenue collection but of an exaggerated level of expenditure, even in relation to the robust economic performance.

*

- Evolution of revenues and expenditures in the first five months of 2017 and 2018

- five months of 2017 (mln lei) five months of 2018 (mln lei) Difference (mln lei) Evolution – Nominal Real

- Total revenues (mln lei)

- Total expenditures (mln lei)

*

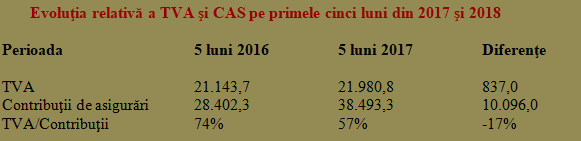

If the most important components of budget revenues are selected, we can see a decrease in the consumption tax and/or the ability to charge it (VAT collected had a totally slight increase of only 0.4%, well below the increase in the commodity and services delivered on the domestic market) and an impressive increase in labour taxes (+ 35.5%, after moving contributions to the employee).

*

- Relative evolution of VAT and CAS in the first five months of 2017 and 2018

- Period

- VAT

- CAS

- VAT/contributions

*

Basically, the insurance contributions took the lion’s share from the indirect tax revenue collection (VAT plus excises, the latter with a nominal increase of 13.7%). The report has changed from 34.4% share of taxes on goods and services in total revenues in the first 5 months of 2017 and a share of 28.9% for contributions, to 34.7% in total contributions and only 32.3% in indirect taxes.

Normally, increased domestic consumption, which has been the major engine of economic growth, would have had to bring significantly more money to the budget, and only then, after this probable evolution would have been identified at the fiscal level, but which has not happened as expected, the distribution of social benefits should have been made.

Local budgets revenues have fallen by three percentage points

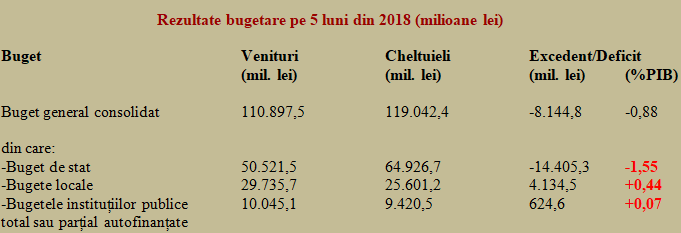

In order to identify the allocation of surpluses and deficits in the general consolidated budget, we made a selection of its main components. Traditionally, surpluses of local budgets and budgets of public institutions financed entirely or partly from public revenues covered most of the budget deficit.

But that has not happened anymore in the first five months of this year. The explanation is that tax collection to local budgets has been lower by about three percentage points in nominal terms (and eight percentage points in real terms), while expenditures have been maintained quasi-constant (+ 0.3%, of course, in nominal terms too, as they actually bought fewer products and services, in real terms, so they could not be reduced).

- *

- Budget results in first five months of 2017 and 2018 (million lei)

- Budget Revenues (mln lei) Expenditures (mln lei) Surplus/Deficit (mln lei) (%of GDP)

- General consolidated budget

- Of which:

- – state budget

- – local budgets

- – budgets of public institutions entirely or partially self- financed

*

From a surplus of almost one and a half billion lei recorded in the same period of last year, self-financing public institutions also posted only a marginal margin, slightly higher than RON 0.6 billion, after a 23% increase in expenditures, most likely generated by the salary increases in the respective administration.

Salaries and social protection, granted beyond the possibilities

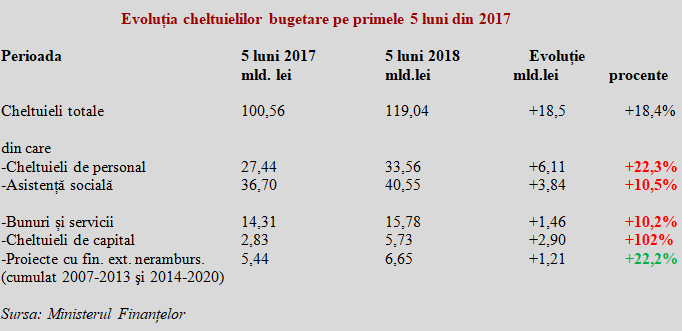

A selection of expenditures in the first five months of the year shows an excessive increase in the wage bill, more than five times higher than the GDP growth in the first quarter of this year. And double the increase in the amounts allocated for social assistance (anyway, of two digits and over the possibilities generated by the economy).

*

- Evolution of budget expenditure in first five months of 2017

- Period Five months of 2017 (billion lei) Five months of 2018 (billion lei) Change (billion lei) Percentage points

- Total expenditures

- Of which

- – personnel costs

- – social assistance

- – goods and services

- – capital expenditure

- – projects financed with non-reimbursable funds (total 2007-2103 and 2014-2020)

*

However, we welcome the increases in the sections of goods and services expenditures, as well as the capital expenditures, which doubled compared to the same period of the previous year.

Also, the 22% increase in the amounts taken mostly from the EU for projects with non-reimbursable external financing.