Romania’s current account deficit will be by far the largest of the European Union’s emerging economies in 2017 and will exceed 3%, according to the estimates of the banking system.

Romania’s current account deficit will be by far the largest of the European Union’s emerging economies in 2017 and will exceed 3%, according to the estimates of the banking system.

The main causes are:

- a massive increase in imports

- consequently, the deterioration of the trade balance and

- government policy of wage increases and tax relief, banking analysts say.

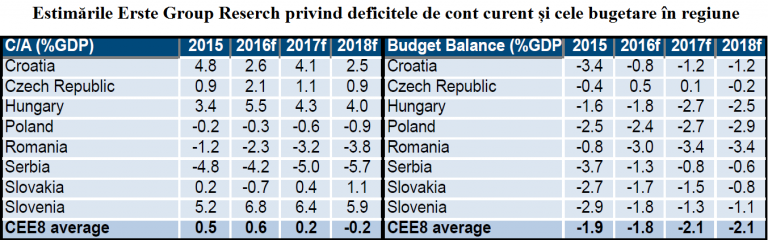

Romania’s current account deficit for 2017 will be 3.2% of GDP, according to Erste Group Research (EGR), respectively 3.4% according to Banca Transilvania’s (BT) macroeconomic scenario, exceeding the 3% threshold in 2012.

And it will increase in the coming years, reaching 3.8% in 2018 according to EGR estimates, or 3.5 and even 4% of GDP in 2019 according to BT.

On the other hand, of all the other EU member countries in the region, they estimate a deficit in 2017 only for Poland and Bulgaria and it is much lower, of 0.6% of GDP and 0.2% respectively.

For the other countries, they see surpluses between 1.1% (the Czech Republic) and 6.4% (Slovenia), according to the EGR estimates.

Erste Group Research estimates on the current account and budget deficits in the region

Erste Group Research estimates on the current account and budget deficits in the region

Romania’s economic policy appears stuck in several myths about using the current account deficit as a development tool. Reality has removed myths.

In Romania, though, the growth rate of imports is constant (12.4% in Q2 / 2017 compared to the previous quarter), but not the rate of investments, while the export rate has decreased (from 11.5% down to 9.6%).

The other countries in the region also record an increase in consumption and import but the size of their exports is keeping them out of the troubles facing Romania.

What others do

Erste Group Research (EGR) expects that Slovenia, the country with the largest current account surplus, will not fall below 5% of GDP before 2020, although the „domestic demand has a robust dynamic and could put pressure on trade balance”.

Even in Hungary, the increase in imports following the consumption growth will not but only reduce the current account surplus to EUR 4.8 billion in 2017 (3.8% of GDP). The increase of imports will weaken the pressure of forint appreciation, says the EGR report.

Poland faces similar problems to Romania but on a much smaller scale. In fact, Poland changed to deficit only this year. The current account deficit in Poland comes from the increase in the trade deficit on goods, the decrease in revenues.

Poland also recorded a substantial increase in imports (+ 11% in the first half of the year), which will increase the trade deficit and the current account deficit.

The current account of Romania’s balance of payments recorded a deficit of EUR 2.7 billion between January-June 2017, a 40.2 % year on year increase, according to BT calculations.

Causes

„This development was mainly due to the deterioration of the balance of trade with goods and services (deficit of EUR 1.5 billion, compared to EUR 372 million in the first half of 2016), against a favourable background for consumption the loss in international competitiveness of the domestic economy,” says Andrei Radulescu, Senior Economist at Banca Transilvania.

Consumption is the main cause of the deficit, as Erste Group Research (EGR) also explains, but it is likely to improve as a result of higher excise duties and electricity prices.

The improvement in the current account deficit, expected for the rest of the year, could come from the net earnings from services and the balance of secondary incomes that „will remain a relief valve for the pressure on the current account,” says a recent EGR report. Also, „the primary incomes gap, largely driven by the repatriation of profits (abroad), seems to moderate its expansion, while the farm subsidies in the EU will start to be paid in October,” according to the same source.

„However, we do not rule out the weakening pressures on leu because the FDI coverage rate (FDI) will probably fall to around 79% this year (from 104.2% at the end of 2016), while the capital account, which includes the EU structural funds, covered only 42% of the current account deficit in June – compared to 106% in December 2016„, notes the EGR report.

Deficits grow, external debt also grows

Romania’s trade balance for goods registered a deficit of EUR 5.2 billion, „which means an increase by 25.2% year on year, while the surplus of the trade balance for services has adjusted by 1.3% year on year, at EUR 3.7 billion.

A contribution to the deterioration of the current account also came from:

- the decrease in the surplus of the secondary incomes balance by 21.6% y-o- y, to EUR 894 million,

- adjustment of the deficit of the primary incomes balance by 20.6% y-o- y to EUR 2.2 billion,

- the decrease in foreign direct investment by 13.3% y-o- y to EUR 1.8 billion in the first half of 2017 (EUR 2.2 billion in equity participation but EUR -338 million in intragroup loans), according to a recent report of Banca Transilvania (BT).

The BNR data indicate an increase in total external debt of 2% this year, to EUR 94.3 billion in June, mainly because the Government has opted for short-term loans to cover its obligations assumed mainly on the wage policy side.

„This development was mainly driven by an increase in short-term external debt by 6,3% so far, in the first half of 2017, to EUR 24,9 billion. Total long-term external debt increased by 0.6%, to EUR 69.4 billion and the increase of the direct public share (by 5% so far in 2017, to EUR 33.3 billion) was partly counterbalanced by the decline in the private component (by 2.9%, to EUR 34.4 billion)”.

Within the private external debt, we notice the decline in the non-residents’ deposits by 15.6%, to EUR 3.2 billion, a minimal historical level, a trend influenced by political tensions,” remarks the BT report.

Romanian myths

The Chief Economist of the National Bank of Romania, Valentin Lazea, described them in cursdeguvernare.ro as follow:

- Myth # 1: „Countries having a similar level of development to Romania need current account deficits to develop.”

Reality: Bulgaria and Croatia, placed at a similar level to Romania, had a current account surplus (Croatia still has it)

- Myth # 2: „In the Eurozone, only northern states such as Germany, the Netherlands or Austria are capable of a current account surplus, while the Latin states – which we like – have chronic external deficits.”

Reality: Italy, Spain and Portugal had a surplus last year and France forecasts it for 2022.

- Myth # 3: „The current level of the current account deficit – about EUR 4 billion, or 2.4% of GDP – is not high, so we do not have to worry.”

Reality: At the level of the European Union, only two states have higher external deficits, in absolute terms: the United Kingdom (EUR -104 billion) and France (EUR -20.4 billion).

- Myth # 4: „In Romania, we need a current account deficit to finance investments, as domestic savings are not enough.”

Reality: „At the level of the EU states, the analysis reveals that there is no correlation between the current account deficit and the level of investment.”

In addition, „during 2009-2016, the investment rate remained high in Romania, at around 25-27% of GDP, even in the context of a drastic reduction in the current account deficit, as a result of the saving increase,” Valentin Lazea writes.