Romania will see in 2019 the highest increase in the Central and Eastern Europe (CEE) in 10-year government bond yields due to the adverse effects of the „Teodorovici Ordinance”.

The prospect is exacerbated by the fact that the big local buyers of Romanian government bonds will not be willing to increase their holdings, either because of the tax on asset (banks) or because of other severe constraints (private pension funds), according to a report by Erste Group Research (EGR).

All governments in the region are going to face the price rise in money they want to borrow through government bonds.

Unlike the rest of the region, though, in Romania, „the Government is struggling to repair the negative fiscal evolution, and recent measures could have adverse effects on the demand for long-term government bonds,” EGR analysts write.

Yield signal

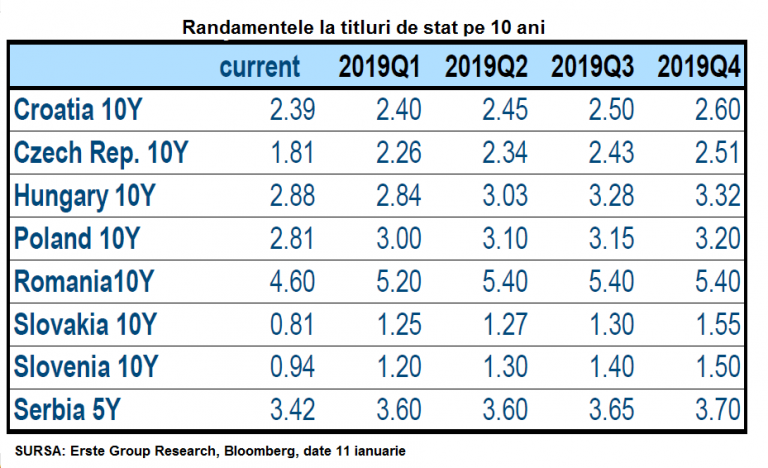

As a result, Romania could record the largest increase in the yield on 10-year bonds among CEE countries: 80 basis points (pp., hundredths of per cent), while the average increase in the region could be of 50 pp.

Romania is already borrowing with the highest costs in the region: at yields of 4.60% for 10-year bonds, compared to 3.42% – Serbia, or 1.81% – the Czech Republic.

Yield on 10-year bonds

The increase in yield on bonds (the ratio between interest and price) is the effect of an amplifying distrust of the market in the issuer of the securities, manifested by their sale, respectively by lowering their price.

Romania – negative exception

„With the exception of Romania, all CEE countries would maintain the budget deficit safely below the 3% of GDP threshold in 2019,” the report quotes.

At the same time, Romania does not enter the syllogism valid for the rest of the region, where the cost estimates of loans are not aggravated by the signals triggered by the economic growth, inflation and, again, fiscal performance.

„For Romania, the situation is more complex. We have changed BNR’s monetary policy outlook and we expect the reference rate to remain unchanged throughout the year 2019 for two reasons:

- the economy will pay the cost of the Government’s pro-cyclical fiscal policy (tax cuts from the last two years, editor’s note). A long delayed fiscal consolidation will be much more painful and perhaps less effective.

- the transmission of the monetary policy will be paralyzed or at least more inefficient, under the new unconventional measures for punishing the banks by a tax linked to ROBOR 2% threshold,” says the report mentioned.

Adverse mechanics

In other words, the new taxes will burden the economy and the National Bank’s instruments will no longer work, because a tax already requires an interest rate capping below the BNR monetary policy rate

Although the reference interest rate will remain unchanged, „the decrease in the demand from financial institutions (banks and pension funds) for government securities could result in a faster increase in yields,” the EGR report said.

In other words, the issuer – the Ministry of Finance will have to promise or accept higher interest rates in order to sell its bonds.

Otherwise, the picture of gross financing needs shows a relative safety in most countries of the region. Hungary, for example, would no longer have to cope with a need of pre-financing the projects implemented with European funds as high as last year.

Waiting for budget

The above-mentioned increases in yields do not incorporate the effects of Ordinance 114, which is likely to reduce Romanian financial institutions’ appetite for government bonds.

„We look forward to seeing the state budget approved in the Parliament (not even the draft is known yet, editor’s note). We believe, though, that long-term yields will steeply increase if the measures are not adjusted,” writes Eugen Sinca, BCR senior analyst, in the report of Erste Group Research (EGR).

Declining demand for Romanian government bonds

Moreover, „it is certain that if fiscal measures are implemented in an unfriendly manner, the demand for local government bonds will be affected,” even though technical details of the controversial measures from the ordinance are not known.

Banks’ demand for government bonds accounted for 23% of the increase in the volume of government securities in the market over the last 12 months, until September 2018.

Pension funds, whose activity is also severely affected by the ordinance, are responsible for 50% of the same volume increase.

Few solutions

The mechanism explained by the EGR report does not show favourable perspectives, nor does it offer many solutions.

If local demand for securities weakens, the government will become increasingly dependent on foreign investors.

If market conditions become hostile, the BNR could provide liquidity and the Finance Ministry could focus on short-term securities issues.

However, „it remains to be seen where the demand will meet the offer of short-term government bonds. Foreign investors do not have a big appetite for these bonds’ returns.”

And „local banks will think twice before raising their balance sheets if they are forced to pay large taxes on their assets,” concludes the quoted analyst.