The International Monetary Fund (IMF) recommends Romania a „comprehensive revision of the tax system,” according to the institution’s 2018 annual report.

The International Monetary Fund (IMF) recommends Romania a „comprehensive revision of the tax system,” according to the institution’s 2018 annual report.

The recommendation has been issued in the context of the need to focus the tax policy on improving its effectiveness „to support the consolidation and (respectively) improve the structure of the budget” by:

- The efficiency of revenue collection by „rationalizing tax exemptions and reforming tax administration, especially on the VAT side”.

The IMF has inevitably insisted on the priority of restoring the IT infrastructure of the „aging and fragile” tax system, given that the financing approved for this purpose by the World Bank, even since 2013, has NOT led to the necessary reforms.

- The efficiency of spending, especially of large investment projects, which „should be strengthened and reflected in annual budgets”;

- An increased efficiency in the absorption of the European funds, „especially for major infrastructure projects„.

Moreover, „the organizational structure of ANAF needs to be improved in order to produce reforms, by simplifying the legislation and procedures,” the IMF report said.

At the same time, the IMF recommends the compliance with the Fiscal responsibility law, which has not happened so far. The Fiscal Council’s opinion, which identified some major gaps on this matter, „should be better integrated into the process of drafting the budget” (state budget).

The IMF estimates a budget deficit of 3.6% of GDP for 2018 and points out that balancing measures are needed (for increasing the revenues or cutting the expenditure), equivalent to 0.6% of GDP.

Therefore targeting now a budget deficit at the maximum level of 3% is „not sufficiently supported by fiscal measures”, which makes a 2% budget deficit target more appropriate, in line with the position where the economy is on the growth cycle, according to the report.

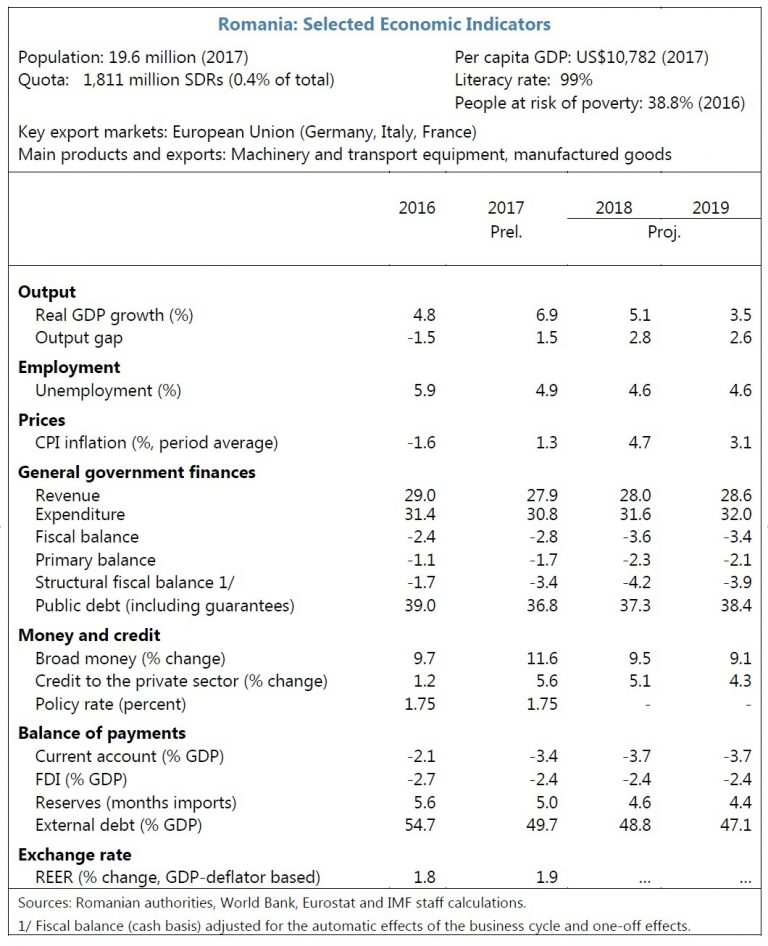

The table of the Romanian macroeconomic indicators shows:

The IMF also proposes, among other things, the following possible fiscal consolidation measures:

The IMF also proposes, among other things, the following possible fiscal consolidation measures:

- postponing or a gradual implementation of the increase in the pension point – with an impact of 0.3% of GDP (cash)

- re-prioritizing the current expenditure (for instance, the centralized procurement system announced in the meanwhile by the Ministry of Finance) – an impact of 0.2% of GDP

- increasing efficiency in the state revenue collection and expanding the tax base -an impact of 0.1% of GDP

- rationalizing the reserve of 10% of the expenditure, set for each ministry – an impact of 0.5% of GDP

- other measures (for instance, increase rhythm in attracting EU funds) – an impact of 0.5% of GDP

The IMF also recommends „the clarification of potential adjustments of Pillar 2 of the (privately-managed) pension system, to eliminate uncertainty.”

Risk of „overheating”

The IMF’s recommendation for the Government to target a 2% budget deficit this year and 1.5% in 2019 comes in the context of the risk for the economy to overheat.

The rapid increase in inflation, as well as the rise in the budget deficit and the current account deficit, the fact that investment remained behind the consumption, and the absorption of the European funds is weak are also „signs of overheating the economy„, on which the IMF management team expressed their „concern”.

Under these circumstances, the economy would face higher difficulties in the event of potential „adverse shocks” from outside.

In addition, „there is a risk that the current policy path will increase the macroeconomic volatility, undermine the capacity to resist potential adverse shocks and eventually slow down the convergence toward the advanced EU countries.”