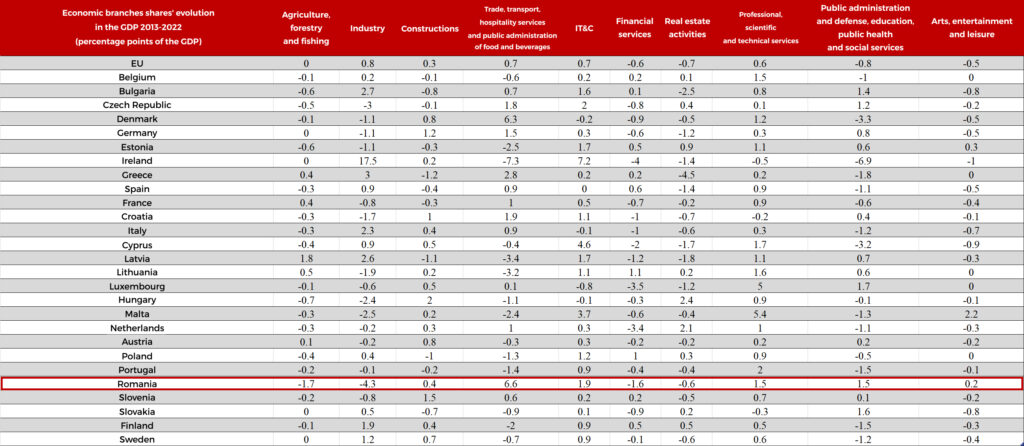

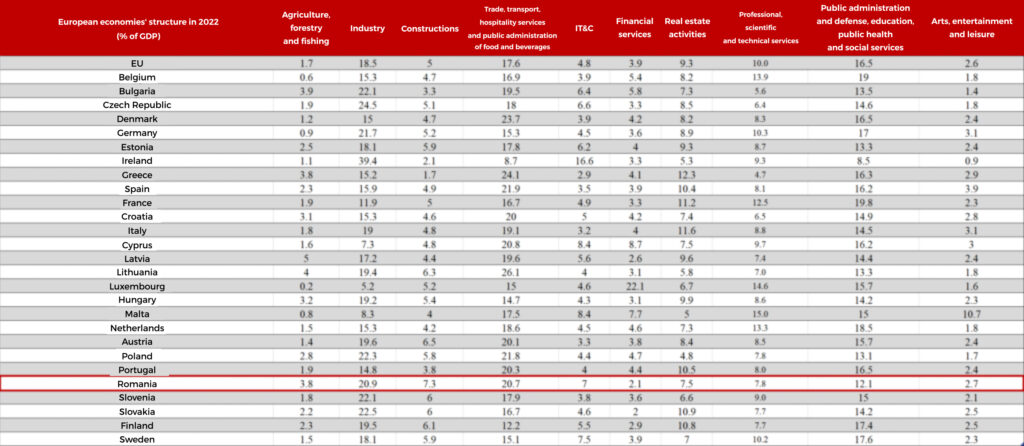

In the last decade, Romanian economy has undergone one of the most pronounced structural changes at European level.

Between 2013 and 2022 (the most recent year with data available from Eurostat), the share of industry and agriculture in the GDP saw the sharpest decline in the EU, while trade, IT, transport and hospitality services recorded the fastest advance, according to estimates by CursdeGuvernare, based on official data.

The industry’s contribution to the formation of GDP has subsequently dropped from 25.2% in 2013 to 20.9% in 2022, considering that, in the analyzed period, industry has strengthened its importance at European level, registering an advance of 0.8 percentage points (pp) of the GDP.

If in 2013, Romania ranked second in the EU in terms of industry share in the economic mixture, after the Czech Republic, we barely rank eighth one decade later.

In turn, Czech industry lost ground to other economic branches (3 percentage points of GDP in the analyzed period), but maintained one of the largest shares at European level. In 2022, the Czech Republic was outranked only by Ireland, a small economy with heavily skewed data due to the presence of US multinational companies headquartered there for tax reasons.

Hungarian industry in turn reduced its share in the GDP, while Poland and Bulgaria strengthened their manufacturing sector, which generated higher added value in 2022 than in 2013.

The industry of major European economies, in decline

However, the German industry engine slowed down significantly. In the analyzed period, the share of industry in the GDP decreased by 1.1 percentage points, to 21.7%.

France reported a similar evolution as well, the share of industry in the GDP dropping by 0.8 percentage points.

Italy, on the other hand, reported the strongest advance of industry among major economies, of 2.3 percentage points of GDP, between 2013 and 2022.

Excepting Ireland, the top three positions at European level in terms of strengthening the role of industry in the economic mix were held by Greece (+3pp of GDP, to 15.2% of GDP in 2022), Bulgaria (+2.7pp of GDP, to 22.1% of GDP in 2022) and Latvia (+2.6pp of GDP, to 17.2% of GDP in 2022).

Romanian IT advanced, but not fast enough to cover the industry gap

The field of IT&C experienced a favorable evolution in the analyzed period, but Romania still lost ground in terms of importance in the economic mix. Between 2013 and 2022, the share of IT&C in GDP rose by 1.9 percentage points, nearly three times more than the EU average.

With a share of 7% of GDP in 2022, Romania ranked fourth in the EU (not counting Ireland), one position below the one recorded in 2013.

However, Romania is the strongest player in the region in this respect, closely followed by the Czech Republic (with a share of 6.6% of GDP).

Other branches recording significant shifts in the analyzed period:

- financial services: a decrease of 1.9 pp of GDP, to 2.1% of GDP, the second lowest level in the EU;

- professional, scientific and technical services: an increase of 1.5 pp of GDP, to 7.8% of GDP;

- public administration and defense: an increase of 1.5 pp of GDP, to 12.1% of GDP in 2022.

The agricultural potential is increasingly less harnessed

Agriculture is another branch that experienced significant decrease in importance during the analyzed period. In 2013, Romania ranked first at European level, with a share of 5.5% of GDP (compared to the EU average of 1.8% of GDP), this share dropping by 1.7 pp of GDP one decade later, the sharpest decline in the EU.

States in the region reported similar developments, the most conspicuous drops being recorded by Hungary (-0,7pp) and Bulgaria (-0,6pp).

Overall, the share of agriculture in the EU GDP remained constant during the analyzed period. However, states with strong agricultural sectors experienced divergent developments.

Consequently, the share of French agriculture in the GDP registered an advance of 0.4 pp, the third highest in the EU. On the other hand, Dutch agriculture reduced its contribution to GDP formation, recording a decrease of 0.3 pp. In both cases, the share of agriculture does not exceed 2% of GDP.

The trade decade

Romania also stands out in terms of the evolution of trade, transport and the sector of hospitality and public administration of food and beverages.

Between 2013 and 2022, the share of these sectors registered an advance of 0.7 pp of GDP at European level, while Romania registered an almost tenfold increase, that is, 6.6 pp of GDP. A similar percentage was recorded in Denmark, while the third position, held by Greece respectively, lagging behind, with an increase of only 2.8 pp of GDP.

The Baltic states, namely Latvia, Lithuania and Estonia, reported a decrease of these sectors within the economic mix. Poland also posted a drop, of 1.3 pp of GDP.

Otherwise, Polish economy seems to have undergone significantly more moderate shifts in terms of structure than Romanian economy. Over the analyzed decade, the fields of IT&C (+1.2 pp of GDP) and financial services (+1 pp of GDP) registered increases as well. Construction decreased, while the state’s role in the economy diminished.

In the region, the Czech Republic and Hungary also reported increases in terms of trade significance.

In 2013, Romania was second to last in the EU in terms of trade share in GDP, with only 14.1% at that time. The last place was held by Germany.

With a share of 20.7% in 2022, Romania rose to seventh place at European level, while Germany maintains a lower position in the ranking, with a share of only 15.3% of GDP.

***