Government’s hunger for money causes a growing demand on the market, which increases the borrowing cost for the state and encourages distrust in the national currency.

Government’s hunger for money causes a growing demand on the market, which increases the borrowing cost for the state and encourages distrust in the national currency.

The Ministry of Finance has borrowed 487.4 million lei on Monday, over the programmed volume of 300 million, by reopening a bond issue due in February 2025, and the average annual cost of the loan is rising to 3.59%, 13 basis points compared to the level at the bid in mid-July.

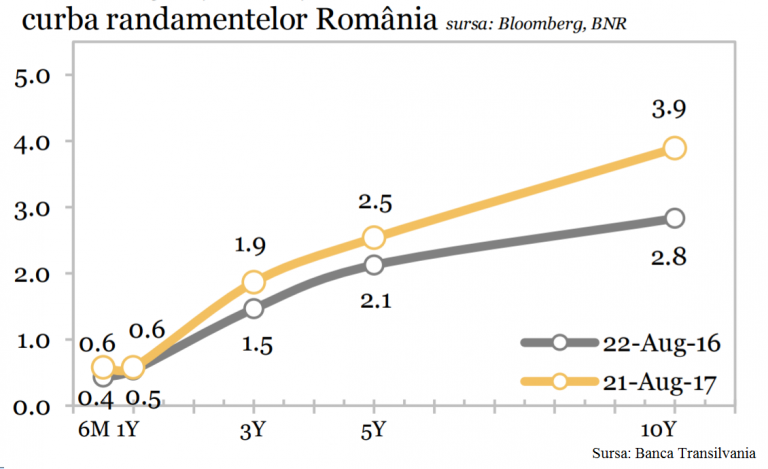

At the same time, the yield curve strengthened with an interest rate on 10-year government securities at a high level of 3.89%. One year ago, the rate was only 2.8%.

*

- Yield curve – Romania

*

The growth trend of the government financing costs will continue. „In the financial economy, we forecast the continuation of the growth trend in the financing costs (given the monetary policy perspectives)”, according to the macroeconomic scenario of Banca Transilvania.

This scenario is subject to the risk factors linked to the „mix of economic policies, the intensification of twin deficits and the domestic political climate” and the „post-crisis monetary cycle (including the reduction in the volume of assets), the inflection of the monetary policy in the Eurozone and global geopolitical tensions.”

Leu exchange rate

On the other hand, although it has calmed down after the government crisis in spring, leu exchange rate is on a firm depreciation trend toward the level of 4.6 lei/euro.

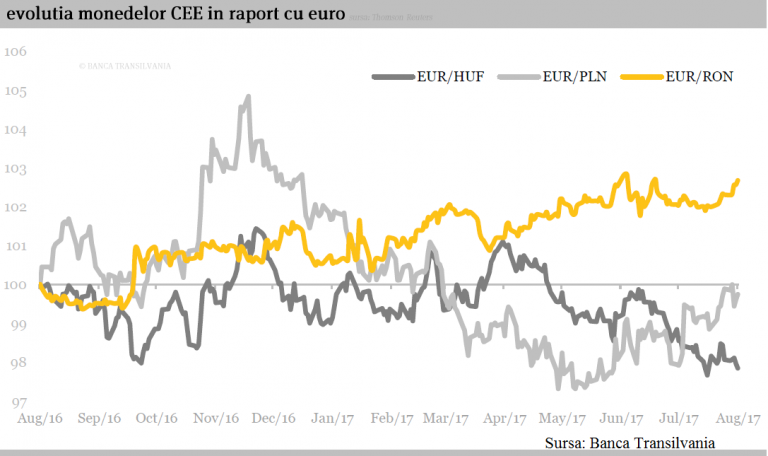

Evolution of the interbank foreign exchange market in the last 12 months:

Worse, foreigners withdraw their money from Romania.

Worse, foreigners withdraw their money from Romania.

„The quarterly exchange market balance (Q2/2017) has strongly increased its negative value exclusively on the account of the non-residents’ net demand of foreign currency, whose broad growth has been only slightly offset by the return of the residents’ net supply of foreign currency to a positive value,” says the National Bank in its latest August report on inflation.

Already, „the leu/euro exchange rate showed a generally increasing trend during the second quarter, in contrast to the trend followed by the exchange rates of the other currencies in the region, under the predominant influence of the internal developments/events, which are likely to disturb the sentiment of financial investors towards the local economy and the financial market,” the report says.

*

- Evolution of currencies in the CEE region in relation to euro

*

Although the level of 4.6 lei/euro could be visited, be it insistently, in the next period, Banca Transilvania estimates an average annual exchange rate of only 4.56 lei/euro in 2017, 4.58 in 2018 and 4,6 lei/euro only in 2019. Instead, Erste Group Research already sees an exchange rate of 4.61 lei at the end of the year and 4.65 lei over one year.

Estimates are above the forecasts at the end of last year

BNR warns that „due to the adverse consequences on investors’ confidence and a rise in global aversion to risk, some developments could lead to portfolio reallocations at regional and/or global level, with consequences for the future trajectory of the leu exchange rate and, implicitly, on the forecasted inflation rate. For these reasons, it is necessary to maintain a balanced mix of domestic policies that will ensure the economy’s resilience to potential turbulences.”

This is what we can see that the current state leadership can guarantee increasingly harder.

„The deepening of the current account deficit due to the acceleration of the consumption and the increase of the budget deficit has the potential to endanger the macroeconomic balances, with a direct impact on the capital flows addressed to the Romanian economy”, says BNR.