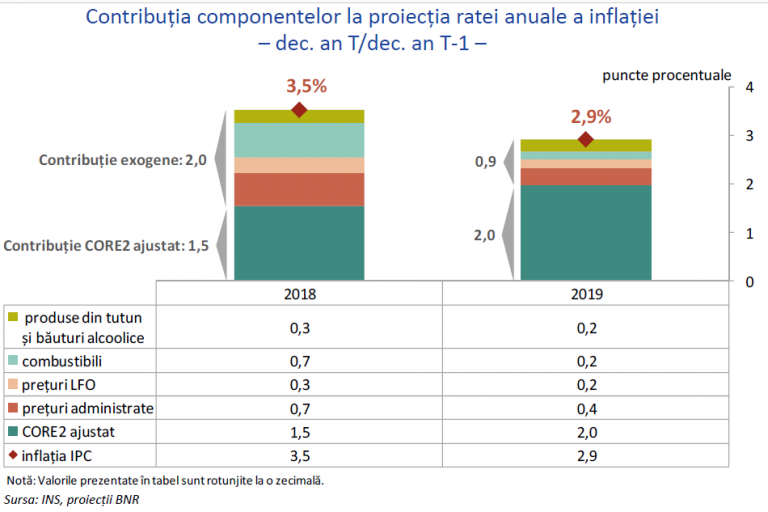

The National Bank of Romania (BNR) has maintained the inflation forecast for the end of 2018 at 3.5% but has raised the forecast for 2019 from 2.7% to 2.9% under the pressure of the administered prices, labour market tensions and oil quotations.

The National Bank of Romania (BNR) has maintained the inflation forecast for the end of 2018 at 3.5% but has raised the forecast for 2019 from 2.7% to 2.9% under the pressure of the administered prices, labour market tensions and oil quotations.

Consumer Price Index (CPI) is expected to reach 3.1% “at the forecast horizon (3rd quarter 2020)”, according to the 2018 edition of the report on inflation published by BNR on Thursday.

However, the general trend is a decrease in inflation, but „á la long, we predict that the Romanian economy will not have an inflation of, let’s say, 2%. It is an economy that is running to close the gaps and it is inevitable to have a higher inflation,” BNR Governor Mugur Isarescu said at the presentation of the report.

„We will be like that for about 10 years,” Mugur Isarescu said.

Inflationary pressures

„For the current year, wider reconfigurations at the level of exogenous components (against the monetary policy, editor’s note) targeted the dynamics of fuel prices (a revision of the contribution by 0.2 percentage points compared to the previous report), while for 2019 the differences are explained almost entirely by the evolution of the administered prices (adjustment of 0.2 percentage points),” the report says.

Natural gas could have the main contribution to inflation, among administered prices.

„The administered prices, although they should be the easiest to predict, have come to being for us the component with the biggest surprises, up and down,” BNR Governor Mugur Isarescu said at the presentation of the report.

„The administered prices, although they should be the easiest to predict, have come to being for us the component with the biggest surprises, up and down,” BNR Governor Mugur Isarescu said at the presentation of the report.

The Governor of the National Bank of Romania gave the example of the surprise from the surge in the energy prices occurred the summer. „Now we are discussing the gas price.”

Added to these, we include the labour market tensions and the contribution of raw material prices and especially oil prices, which can provide surprises, even if they are now going back from USD 80 to USD 70 a barrel.

„From the beginning of 2019 to the horizon of the forecast, the annual CPI inflation rate will be repositioned and maintained in the upper half of the target range” (1.5 – 3.5%), says the report of the National Bank of Romania.

Arguments of a downward trend

The downward trend in inflation is more evident in the adjusted CORE 2 index (which excludes the administered prices), which fell from 2.9% in June to 2.7% in September.

The BNR analysis also projects an increase in CORE 2 contribution to the total inflation from 1.5% (of a total of 3.5%) in 2018 to 2% (of a total of 2.9%) in 2019.

*

- The contribution of components to the projection of the annual inflation rate

- – Dec. year T/ Dec. year T-1-

- Percentage points

- Exogenous contributions

- Adjusted CORE2 contribution

- Tobacco products and alcoholic beverages

- Fuels

- LFO prices

- Administered prices

- Adjusted CORE2

- CPI inflation

- Note: values in the table are rounded by decimals

*

Other arguments:

- Most components of core inflation recorded monthly price increases, but of lower amplitude compared to the same period of the previous year.

- Aggregate demand has come closer to the potential of the economy: „Excess demand is no longer 4% but 2%,” but we need to stimulate the potential of the economy, not just the demand, otherwise we create jobs abroad (by imports) or generate inflation”, reminded BNR Governor

- Even the annual dynamics of administered prices have stopped its upward trend, although it was one of the main sources of inflation acceleration over the last year. But this is also a base effect after the electricity „high” price increase in the second half of 2017

- The slowdown in the consumption demand: „We need to stimulate the potential of the economy, not just the demand. Otherwise:

- we create jobs abroad (we import more to cover the excess demand, or

- we generate inflation (higher prices),” explains Mugur Isarescu.

- BNR’s attention to the exchange rate stability under the conditions of financing the current account deficit „by solid, permanent, not volatile flows”. Under the current conditions, „we can hope for further stability of the exchange rate. When fundamentals change, of course, we need to be careful,” the Governor also said.

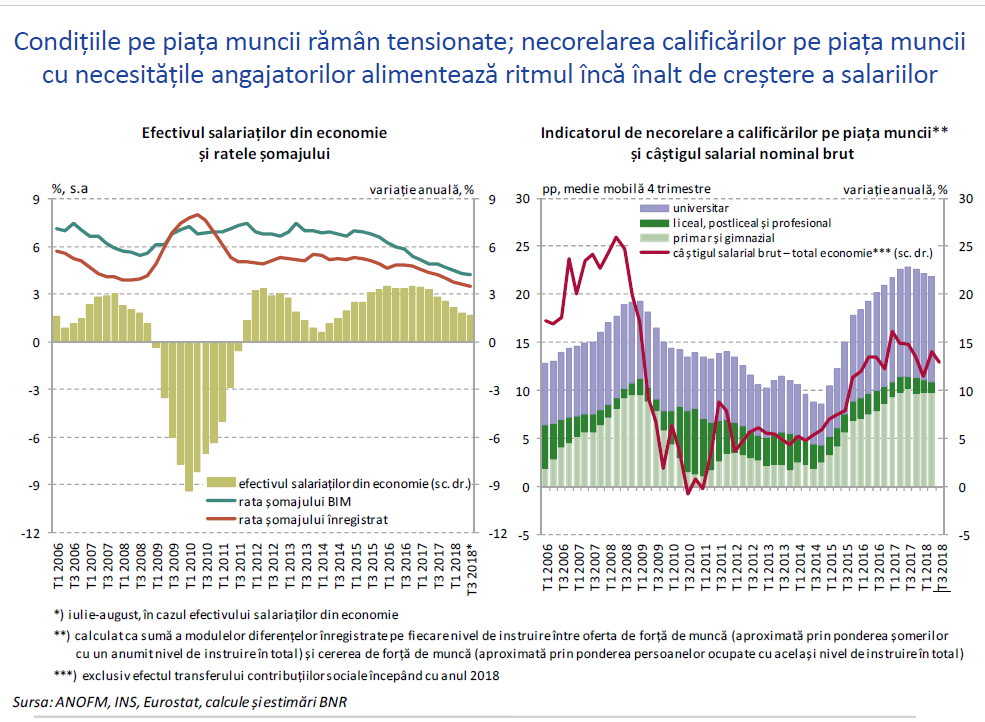

Risks: Tensions in the labour market

One of the biggest inflationary risks is the result of the tensions in the labour market:

- on the one hand, the lack of correlation between labour market qualifications and employers’ needs fuels a still high increase rate of wages

- on the other hand, the misalignment between wage increase and income increase is an aggravating factor.

*

- Conditions on the labour market remain tensioned; the lack of correlation between labour market qualifications and employers’ needs fuels a still high increase rate of wages

- Chart 1

- Number of employees in economy and unemployment rates

- % annual variation

- Number of employees in the economy

- BIM unemployment rate

- Registered unemployment rate

- Chart 2

- Index of the lack of correlation between labour market qualifications and the nominal gross wage

- pp., mobile average four quarters

- university

- secondary education, post-secondary education

- primary and secondary education

- gross wage – economy total

- *) July – August for the number of employees in the economy

- **) calculated as the sum of the modules of differences registered on each education level between the workforce offer (approximated by the share of the unemployed with a certain education level in the total) and the workforce offer (approximated by the share of employed persons with the same education level in the total)

- ***) exclusively the effect of transferring social contributions as of 2018

*

„Because of the lack of supply-demand matching (in the workforce), we may have deviations from the correlation we keep between the productivity and wages. When you have a tense situation, it is wise not to aggravate it”, Mugur Isarescu merely commented, cautiously, „the delicate situation” on the labour market.

Risks: Deficits game

Besides, journalists’ questions made the BNR Governor to launch his warnings in the form of definitions.

„One of the definitions of the foreign deficit: is equal to the deficit in the governmental segment, with the deficit or surplus in the non-governmental one. So the two of them are getting balanced externally,” says Mugur Isarescu.

Foreign deficit means either a budget deficit and a balance in the non-government sector or deficits in both segments.

„In our situation, this is the equation, that you have about 3% budget deficit and the foreign one is 3.5%. You have a budget deficit of 3% plus 0.5 deficit in the non-government sector. You can have a deficit in the non-government sector and a surplus in the public sector, the Czech Republic is going closer, for example, to this situation.”

A deficit in the foreign exchange market could have „behind” a budget deficit.

„We need to have a balancing program just like when we had an agreement with the IMF. I cannot say that we are now far from this situation. Frictions still occur,” warned the BNR Governor.

- Other explanations from the Governor

- We are in the economic growth phase. Here is a big danger. If you have a budget deficit when the economy is growing and you are on the edge of 3%, then when the economy would start to decline, there would be an almost permanent pressure to exceed the 3% threshold.

- We welcome the Government’s intention to have a lower budget deficit next year. It would be a process of gradual adjustment of the economy that has grown beyond potential and had pro-cyclical, not anti-cyclical incentives.

- We are on the side of those who say that macroeconomic policies, as well as the monetary and fiscal ones, are anti-cyclical. That is to stimulate the economy when it tends to go down and temper the impetus when the economy tends to grow too fast.

- We believe that the normalization of the monetary policy also means reaching positive real interest rates. (…) However, the only country that tends to move towards a normalization of the monetary policy defined this way is the USA.

- At least two countries if not three, all with a floating exchange rate regime, have the central bank’s interest rates and market interest rates well below the inflation rate: Poland, Hungary, and the Czech Republic. The Czech Republic went towards one or so, as the inflation is over 2%.

- Should we detach from the region ourselves and go with lively steps towards real positive interest rates calculated as a ratio between inflation and the monetary policy rate? Our answer is: No! An indicator that we would influence is the short-term capital movement.

- We do not want to fight inflation by aggravating the current account deficit and affecting competitiveness. If we raise the interest rate too much, we shall have capital inflows that tend to appreciate the exchange rate. Unlike Hungary, Poland, the Czech Republic, we are a country with a current account deficit. There are not many countries in the EU with a current account deficit of 4%.

- What would that mean? After having a deficit in the food products balance, the exchange rate would appreciate; we would stimulate food products imports from Hungary, Poland, and kill those market players in Romania that are competing with them. This is where a lot of attention is needed.

- We are not a central bank with blinkers and not looking only to CPI: I want to reach the target! Exchange rate appreciation would be the easiest method.

- We shall see the tolerance of a possible increase in the monetary policy interest rates with market interest rates through the control of liquidity. Otherwise, we would be glorious. We would say: it is so good that we have a stronger Romanian leu that is appreciating and pushes prices down.

- That would not last; it would further damage the current account and result in an unpleasant adjustment.