The National Bank of Romania (BNR) will adjust its monetary policy and the floating exchange rate policy to the developments in the imbalances resulting from the Government’s tax policy, according to the analysts of the most important banks in Romania.

The National Bank of Romania (BNR) will adjust its monetary policy and the floating exchange rate policy to the developments in the imbalances resulting from the Government’s tax policy, according to the analysts of the most important banks in Romania.

„The monetary policy looks a little like an exercise of walking on a rope placed at a high height,” says Horia Braun Erdei, BCR Chief Economist, in the most recent report of the bank’s research department.

Risks

If by the end of this year we could hope for a mitigation of the monetary and currency pressures, next year the domestic financial market will face a complicated mix of risks.

Thus, at the domestic level, we already have the well-known risks related to the tax policy – reminds Horia Braun, Chief Economist of BCR (photo).

„The Government will have to take additional corrective measures to avoid budget slippages, and this will happen in the context of a gradual erosion of the economic growth, which we see in a slowdown next year at 4.1%, from 6.1% forecasted for this year,” according to BCR’s baseline scenario.

In other words, the Government will try to obtain money by any means. And yet: the risk of an economic growth erosion is preferable to a „hard landing” which follows a possible continued stimulation of the unsustainable growth.

„This scenario would bring us closer to the risk of a hard landing, because it would almost invariably mean a widening of the current account deficit, an increased inflation in the future, a weaker exchange rate but also obviously higher interest rates, given that BNR will have to bear in this case the whole burden of anti-cyclical policies,” writes Horia Braun.

And if „during all this time, winds on the seas of the international markets will also turn against us, our ship will face the mother and father of a pitching. Respectively, a volatility of which we should get scared,” concludes the quoted economist.

Signs of „more aggressive state intervention in the economy” and also the risks “to the mid-term macroeconomic stability” were also reported by Andrei Radulescu, Senior Economist at BT.

To all these, there are also added the external risks, which could become decisive and even more important than domestic ones.

External reasons for concern in 2018 „are multiple”, and as more important as „the investors’ sentiment on international markets will be the determining factor for the direction the local financial markets will take,” according to Horia Braun:

- „At the European level, besides the Spanish-Catalan soap opera, we shall also have fierce and high-stakes elections next year in Italy plus a likely increase in the market speculation on the end of the ECB’s quantitative easing program, not to mention the Brexit chaos;

- on the other side of the Atlantic, we are likely to see an increase in Trump’s efforts to impose anti-globalization disruptive ideas, plus changes in the Fed leadership (US central bank) and the implementation of the US central bank’s balance sheet reduction policy.”

As both BNR’s monetary and currency policy depend on inflation, Andrei Radulescu (photo) summarizes the risk factors to the short and mid-term inflation, to which BNR also draw attention:

- decisions in the field of fiscal budgetary and revenue policy,

- dynamics of administered prices and food prices in the domestic area;

- macro-financial developments (global and European), including the economic policy decisions (rebalancing the monetary policy in the main blocks of the world) and geopolitical tensions from an external perspective.

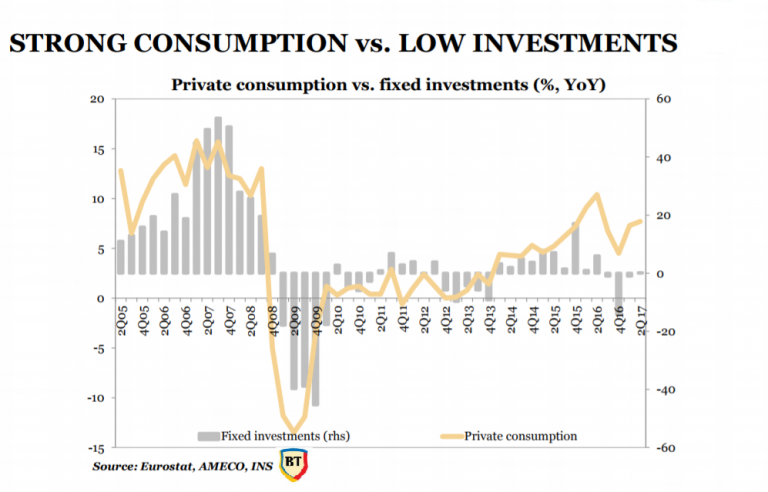

Here is the graph of the imbalance between consumption and investment, stimulated by the Government’s fiscal policy

So, BNR will try to mitigate the effects of the risks and prevent them, as far as possible, while avoiding radical moves as much as possible.

So, BNR will try to mitigate the effects of the risks and prevent them, as far as possible, while avoiding radical moves as much as possible.

„Prevention is, as in many other situations, more efficient and less costly than intervention, and a minimally invasive intervention procedure creates the premises for faster healing, not only in the medical situations,” said Florian Libocor (PHOTO) recently, Chief Economist of BRD – SocGen, for Cursdeguvernare.

Balancing act

All these risks require the central bank to continuously adjust its own policies to the Government’s policy balancing act. And economists’ expectations are leaning more and more toward the concessions made to the RON depreciation.

On the one hand, the recent increase of inflation at a faster rate than expected implies the tightening of monetary policy, namely the increase in the BNR policy rate:

- in two increments of 0.25% each, in the first quarter of next year, up to 2.25% – according to BCR’s estimates, or

- up to 2% even by the end of the year and up to 3.5% in 2018 – according to the current scenario of Banca Transilvania (BT).

„We do not rule out the possibility of an increase in the reference interest rate in the last meeting of this year” on BNR’s monetary policy, in November – says BT Senior Economist.

In both scenarios, BNR will first narrow down the corridor of interest rates between its deposit facility offered to banks and the lending facility (Lombard).

Narrowing the BNR corridor of interest rates „would raise the threshold to which interest rates on the money market can decrease, a relevant aspect considering that the Government will spend in the last two months of the year much of the annual fiscal deficit, which is equivalent to an injection of liquidity into the banking market,” says Horia Braun.

On the other hand, depreciation pressures on the local currency are on the rise and, given the Government’s urgent need for this currency, the RON-euro foreign exchange market could take over more of the shocks resulting from the macroeconomic (budget, trade, current account) deficits.

Against external circumstances as calm as now and provided the budget deficit is maintained below 3%, the increase in the interest rates will save RON from high depreciation, at least until the spring, due to the interest rate differential favourable to international RON deposits.

At a rate of 2.25%, „the official RON interest rate would probably be the highest in the region in nominal terms” Depreciation pressures would ease and thus allow the RON/euro pair to stay within a range of 4.58 – 4.62 at least until the end of the first quarter of 2018 – according to the BCR Chief Economist.

BT’s main scenario sees the average euro exchange rate at 4.56 this year and 4.6 next year before the possible adjustments in the October version.

„Once the increase in the interest rates has already been delivered by the market, and considering the public opinion hassle caused by the sudden increase of ROBOR, also due to the increasing relevance of RON lending (over 60% of the total non-government credit stock) we believe that in the event of emerging pressures, the central bank will opt for a more balanced distribution of these pressures in the various local markets in the future and exert more control over the interest rates,” writes Horia Braun.

In the baseline scenario of BCR, „ROBOR interest rate would converge to the new monetary policy rate by the end of 2018”, while the euro/leu exchange rate might maintain for the rest of next year (in Q2) “within a slightly higher range than in the first quarter, of about 4.62-4.68″.