The business equation that brought farmers out to the streets is the result of 2 years of turbulence that the lack of modernization of the ecosystem and economic chains could not avoid:

As seen in the graphs below, agriculture costs went up under the pressure of crises in recent years, production sale prices dropped, all due to productivity decrease: the average Romanian farm cannot reach the minimum profitability threshold without irrigation and lower input prices. This is what happened in 2023 – farmers were faced with great difficulty in resuming production.

All this despite the fact that Romania ranks high in the European top of grain and sunflower production. But not when it comes to productivity. For example, we are first in the EU in terms of the maize cultivated area, but we come third in production.

Romanian agriculture structure in the Europe context

Romania ranks fifth in the EU 27 regarding arable land area, with nearly 9 million hectares, outranked by France (18.2 million ha), Spain (12 million ha), Germany (11.7 million ha) and Poland (11 million ha).

Despite its high agricultural potential, Romania has modest results, far below possibilities.

For example, European Commission preliminary data for 2023 shows we reached only 7% of EU’s total grain harvest (19 million tons), far from Germany (43.5 million tons) or Poland (35 million tons).

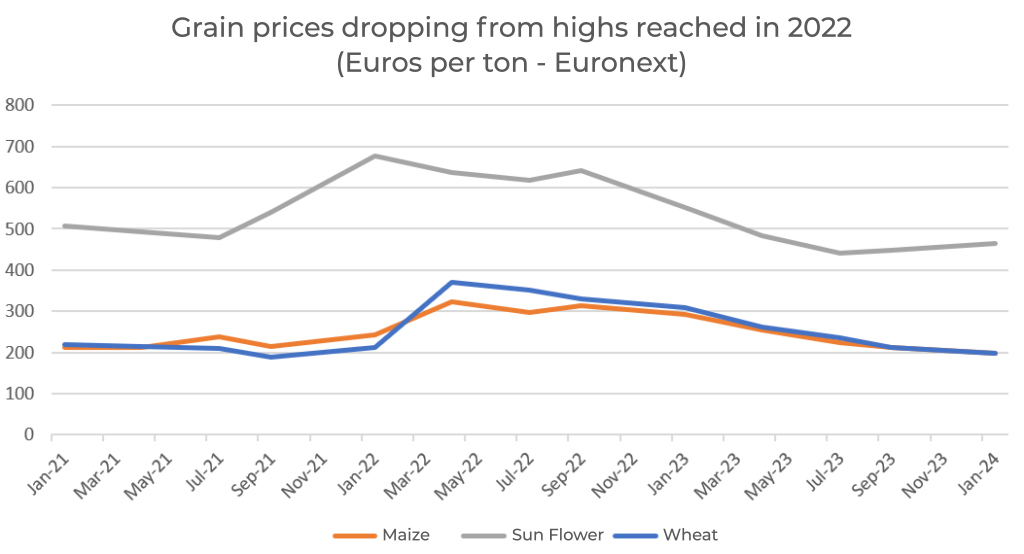

The combination of a relatively poor harvest in 2023 and Romania’s crop structure, consisting mainly of wheat, maize, rapeseed and sunflower, with decreasing prices after 2022, caused losses for farmers this year who run the risk of not being able to continue activity due to the lack of funds for new crops.

The average farm has become unsustainable: Costs tend to exceed revenues

Romanian agriculture’s big problem is that costs have increased sharply over the last 2 years, driven up by inflation and the energy crisis, while product prices on the grain exchange market have dropped steadily – all due to productivity decrease and the irrigation programs’ blockage.

The three charts below reveal the average producer’s path to bankruptcy:

The costs for setting up fall/spring crops vary from RON 5,000/ha to RON 6,000/ha, according to Ministry of Agriculture data. Official statistics also reveal that the wheat production reached 5 tons/ha, while maize was at 7.3 tons/ha.

While expenses increase year-on-year, production sales prices on the Euronext exchange in March 2022 continue to drop:

Euronext exchange product sales prices evolution:

The current acquisition price for wheat and maize is approximately RON 0.80/kg, so that farmers receive on average RON 4,000 per production hectare, but have to spend over RON 5,000 (on seeds, diesel, salaries, etc) for new crops.

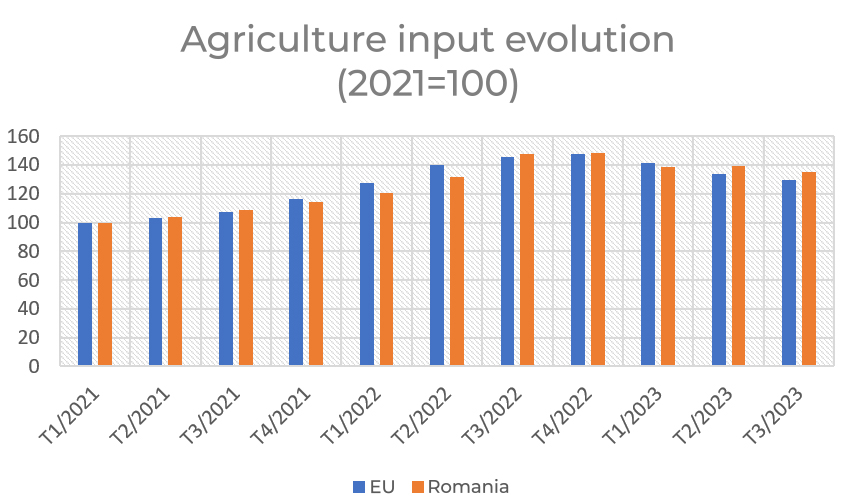

To these are added input cost pushed up by inflation, including those of chemical fertilizers – the cost of which is dependent on gas prices to the extent that Azomures was forced to halt production until markets settled.

It is noted that these costs increased faster in Romania than in the European Union:

“To cover my expenses I have to harvest the equivalent of 6,000 kg of wheat from one hectare, which is impossible if it doesn’t rain when it should”, say the farmers.

Efficiency background: falling productivity amid rising costs. And due to lack of irrigation

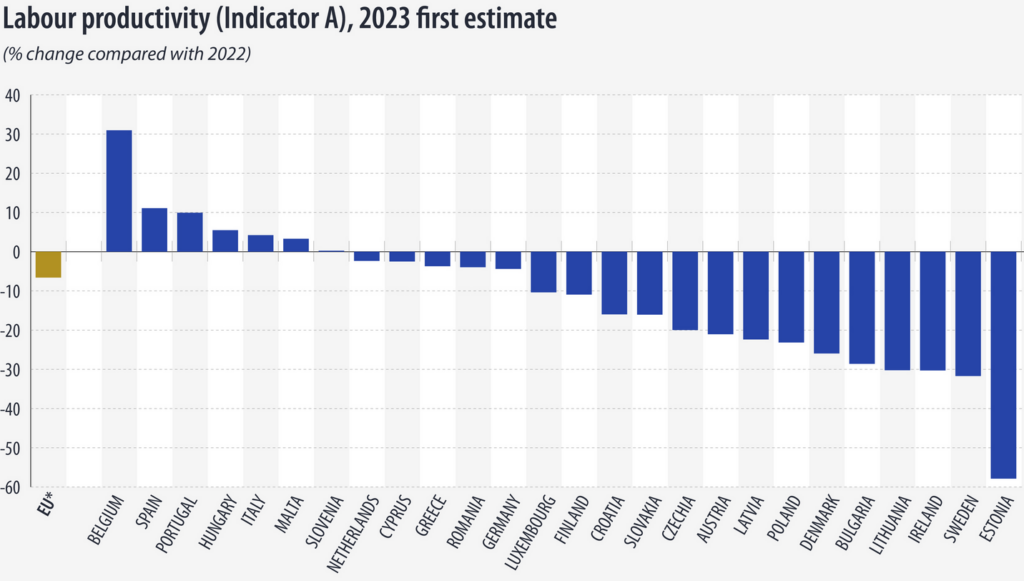

Labor productivity in Romanian agriculture dropped in 2023 compared to the previous year. Moreover, the decrease was registered at EU level, where the annual drop was 6.6%.

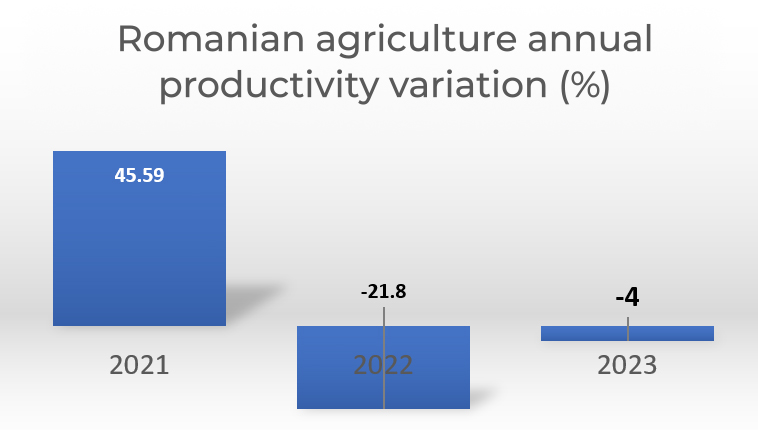

In Romania, agriculture labor productivity measured by the real value index of revenues generated by units engaged in production activities has fallen sharply in the past two years.

Thus, contraction was 21.8% in 2022, while last year the decrease reached 4%. These drops are due to the nearly 46% jump in productivity achieved thanks to record harvests of that year that benefited from ideal rainfall for each crop individually. Over the following year, the lack of irrigation systems left vegetable agriculture at the mercy of precipitations:

The drastic drop in productivity was also due to crop structure in our country, where grain, soybeans, rapeseed and similar crops are predominant, whose prices decreased sharply under the pressure of cheap imports from Ukraine. The phenomenon repeated in 19 EU states in 2023.

However, some EU member states recorded productivity increases last year thanks to lower prices for fertilizers and other inputs and higher prices for products in which countries specialize, such as olive oil, potatoes or swine.

This is the case for 7 countries: Belgium (+31.0%), followed by Spain (+11.1%), Portugal (+9.9%), Hungary (+5.5%), Italy (+4.2%), Malta (+3.3%) and Slovenia (+0.3%).

In Romania, the drop in productivity was massive in 2022 due to the base effect, the year 2021 having brought on record production, with an annual increase of over 45%.

Agricultural companies turnover to exceed RON 80 billion in 2023

Inflation determined a 15% increase in vegetable production value in the European Union in 2022 yoy, according to Eurostat data, despite lower harvest volume: corn (-29%), sunflower (-11%), soybeans (-8.1%) and wheat (-3.1%), rapeseed being one of few crops to register annual advance (+14.5%).

Agricultural companies’ turnover registered the second highest annual nominal growth in the past 10 years, over RON 8 billion, reaching the all-time high of RON 68 billion in 2022, 48% higher than in 2018.

Agricultural production structure will not improve swiftly

It is estimated the sector will continue to grow in 2023 and exceed the record reached in 2022, close to the RON 80 billion threshold, based on inflation persistence pressure and on the estimated 24% increase in annual grain production, being the third largest annual advance among member states according to forecasts for this year made by the Directorate-General for Agriculture and Rural Development within the European Commission.

The structure of agricultural production in Romania had the second lowest increase in vegetable production value in the European Union, of 1.1% and dropped to 7th place in the EU, with 5.3% of the total, being surpassed by the Netherlands that reached 5.7% of the total in 2022.

In terms of wheat production at EU level, Romania still ranks 4th, with 6.5% of the total and a harvest of 8.7 million tons in 2022.

Romania continues to hold first place among member states of the European Union in terms of maize cultivated area, but ranks 3rd, after France and Poland, with a harvest of 8 million tons.

Moreover, Romania was the second sunflower producer in the EU, with a harvest of 2.1 million tons in 2022.

****