Next, we will analyse Romania’s position from the point of view of the current account deficit, in a European context and then in a global one. Our analysis is based on data from the World Economic Outlook publication, April 2017 edition, of the International Monetary Fund.

Next, we will analyse Romania’s position from the point of view of the current account deficit, in a European context and then in a global one. Our analysis is based on data from the World Economic Outlook publication, April 2017 edition, of the International Monetary Fund.

We will define as countries with current account deficits those countries with a foreign trade deficit in 2016 or in two of the last three years; Countries that do not fall into any of these categories will be defined as having a surplus. Our analysis covers 175 states (of the 196 countries of the world).

The main conclusion to be reached is that belonging to a certain cultural-geographic area is a good predictor of a country’s external position.

There are four large regions with countries having a high probability of foreign trade deficits:

Anglosphere, Latin America, Africa and the states from the former Ottoman Empire.

There are also two large areas of states with a high probability of foreign trade surplus:

Central and Western Europe, respectively East and South-East Asia.

Finally, there are three mixed areas where it is less clear whether the current account surplus or deficit will prevail:

The Indian subcontinent, the states from the former USSR, and the Gulf countries.

The map below shows the geographical areas with high probability of deficit in orange, the geographic areas with high probability of surplus in green and the intermediate zones in yellow.

With regard to the Central and Western Europe, we shall define it as including the EU28 countries, minus the UK, Bulgaria, Cyprus, Greece, Romania, Estonia, Latvia, Lithuania (which, geographically and culturally, belong to other areas), plus Iceland and Norway.

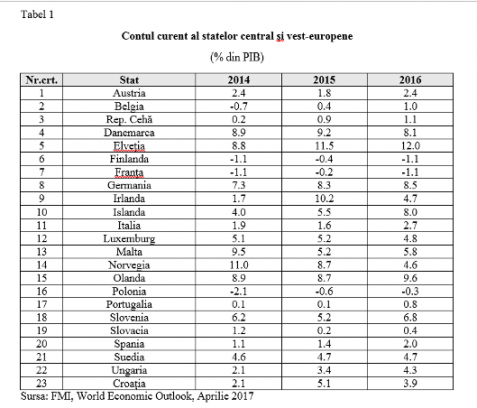

The following table shows an obvious feature of this area: out of the 23 countries analysed, 20 have a current account surplus and only 3 have a current account deficit.

Current account of the countries from the Central and Western Europe (% of GDP)

Current account of the countries from the Central and Western Europe (% of GDP)

(click to enlarge)

All the above indicate that a structural convergence of Romania with the Central and Western European states also implies, among other things, adopting a growth pattern based on exports (and less on consumption) to generate surpluses of the current account.

4 Remarks and related explanations

Romania got very close to this performance in 2013-2015, when it was about to become like the Visegrád states, the production workshop for Austria, Germany, France and other Western European countries.

Of course, this potential still exists, but it is overshadowed by the policies of promoting especially consumption, which departs us from the objective of reaching a surplus of the current account. The basic idea is that a genetic compatibility of Romania with the Western and Central Europe implies a change in our economic DNA in a way that puts the emphasis (more) on exports.

Remark no. 1: First, it is necessary to somewhat keep the equilibrium of the trade balance, of the goods (strongly deficient on some components such as the chemical industry), as services already provide a surplus of 4.5 percent of GDP. All those who talk about Romania’s reindustrialization should add: „to improve external competitiveness”.

Remark no. 2: Whereas we have been an attractive production base due to two advantages of an underdeveloped country (cheap labour and low taxation), nobody could stop us become attractive due to the advantages of a developed country (good infrastructure, predictable regulations, R&D and innovation, etc.)

The second region with states having a surplus is the East and Southeast Asia. Of the 17 countries in the region, 12 have a current account surplus (Brunei, China, South Korea, Philippines, Hong Kong, Japan, Malaysia, Macao, Singapore, Thailand, Taiwan and Vietnam) and only five have a deficit (Cambodia, Indonesia, Laos, Mongolia and Myanmar).

They are, for the most part, states that have started from a very low level of development (below that of Romania in the 1950s to 1960s) but which, by long-term policies and the population’s acceptance, have avoided the so-called middle-income trap and become prosperous countries especially due to the export competitiveness.

Anglosphere is the first region characterized by persistent foreign deficits. Of the 17 countries analysed, no fewer than 16 have a current account deficit (Australia, Canada, the United Kingdom, New Zealand, the US but also Bahamas, Barbados, Belize, Fiji, Guyana, Jamaica, Samoa, Tonga, Trinidad and Tobago, Tuvalu, Vanuatu) and only one has a current account surplus (Papua New Guinea due to the export of precious metals).

Obviously, if we refer to the developed countries from this group, they could reach a current account surplus, but they do not want or do not need it. When you have world’s reserve currencies (the US dollar, the pound sterling and, to some extent, the Australian dollar), it is very easy to finance your imports.

Equally easy it is induced a situation in which the population lives beyond their means, go into debt to support this unsustainable standard of living, the current internal saving is neglected, and the pre-existing (abundant) capital is invested abroad in search of higher yields.

Obviously, this situation is very different from the poorer states in Anglosphere, which have current account deficits not because they want that, but because they cannot do more, a situation that we also see in other three large cultural-geographical groups.

Latin America has 21 states, all having a current account deficit (!): Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Dominica, Dominican Republic, Ecuador, El Salvador, Grenada, Guatemala, Haiti, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Uruguay and Venezuela.

In Africa, out of 53 states, 51 (we no longer make the effort to list them) have a current account deficit and only two (Botswana and Nigeria) have a surplus due to the export of raw materials (diamonds and oil).

The states succeeding the former Ottoman Empire are 18. Of them, 16 have a current account deficit (Albania, Armenia, Bosnia-Herzegovina, Cyprus, Greece, Jordan, Iraq, Kosovo, Lebanon, Macedonia, Moldova, Montenegro, Romania, Serbia, Syria, Turkey) and only two have a current account surplus (Bulgaria and Israel).

Remark no. 3: Many will be offended by this mix between of the Balkan countries – Romania among them – and the Near East countries. Of course, the region can be split in two, but the conclusions remain the same: a certain historical underdevelopment cannot be overcome without developing the competitiveness, expressed by an advance of the exports compared to imports.

Moving to the analysis of the three intermediate zones (where we cannot know a priori the likelihood that a country is a net importer or a net exporter) we shall start with the Indian subcontinent. Of the 7 states, 4 have current account deficits (Bhutan, India, Pakistan, Sri Lanka) and 3 have a surplus (Afghanistan (!!!), Bangladesh and Nepal). Of course, the situation of these countries is influenced by the oil price that is low at present. Otherwise, as net energy importers, these countries would most likely fall into the category of those with foreign trade deficits.

In the Gulf Zone, surprisingly, out of seven states, only three have a current account surplus (UAE, Iran, Kuwait), while four countries have a current account deficit (Saudi Arabia, Oman, Qatar, Yemen). Again, we are talking about the low price of oil, in the absence of which the region, considered as a whole, would probably have a surplus.

Finally, out of the 12 countries from the former USSR (excluding Armenia, Georgia and Moldova, but including the Baltic States), only three have a surplus (Estonia, Russia, Uzbekistan), while nine have a current account deficit (Azerbaijan (??), Belarus, Kazakhstan, Kyrgyzstan, Latvia, Lithuania, Tajikistan, Turkmenistan, Ukraine). Again, the current price of oil seems to explain many things.

Remark no. 4: Of the exporting regions, only two (Central and Western Europe, respectively the East and South-East Asia) are genuine exporters, as they export finished services and products, not raw materials which are subject to market fluctuations.

Altogether, out of the 175 countries analysed, not less than 129 are countries have current account deficits and only 46 have a current account surplus (and almost half of them are in Europe). Incidentally, this distribution makes the saving glut theory little reliable, a theory which would explain the current low interest rates by invading the western countries with savings made in developing countries.

A study by the World Bank showed that out of 101 developing countries, only 13 managed to overcome the „middle income trap” and became developed countries. The recipe for success is clear: structural reforms, external competitiveness, a disciplined population and a political class with a long-term thinking. The fact that only one eighth of the countries succeed in this process shows how big is the challenge that Romania faces.

***

Valentin Lazea is the Chief Economist of the National Bank of Romania.

The views presented are personal and do not involve in any way the National Bank of Romania.