The consolidated general budget ended the first month of 2018 with a surplus of 0.21% of the estimated GDP for the current year, according to data released by the Ministry of Finance.

The consolidated general budget ended the first month of 2018 with a surplus of 0.21% of the estimated GDP for the current year, according to data released by the Ministry of Finance.

The result reported is much weaker than the same month in 2017, when the surplus (a result based, the same as now, on quarterly payment receipts but spent on a monthly basis) was 0.35% of the GDP of the previous year.

To keep in mind, although much higher than the economic growth, revenue growth rhythm was significantly lower than the spending growth (+16.8% in revenue versus 26.4% in expense). This also explains the significant reduction of the surplus, by more than one billion lei compared to the same month of the previous year.

*

- one month 2017 one month 2018 Difference

- Total revenue (million lei)

- Total expense (million lei)

- Surplus/ deficit

*

If we correlate the positive balance of the budget in January 2018 (RON 1,979.0 million) and the spectacular increase of the amounts received from the EU within the 2014-2020 financial framework (RON 1,225.0 million, a plus of RON 1,168.3 million, which means an increase of more than 20 times the amounts in question!), it can be seen that about 60% of the surplus comes from external sources.

To keep in mind, contrary to the expectations generated by the very good economic growth rate (estimated somewhere around 7% for the last year), payment receipts from the corporate tax decreased by 23.1%. That raises the issue of the Romanian paradox, an economy that grows rapidly without being more profitable and must be financed from external sources to solve the budgetary commitments.

The „supplementation” of the payment receipts through the salary increases applied over the last 12 months resulted in an advance of 12.6% in salary and income tax collection so that the ratio between the money coming from these types of income and the corporate tax increased from a 10 to 1 level in January 2017 to over 14 to 1 in January 2018. At the same time, property taxes increased by 41.4%.

On the indirect income side, we can note the evolution of VAT payment receipts below the income increases (only 7.8%) and the bizarre decrease in the amounts collected from excises (-14.9%) are noted. This may indicate a certain increase in tax evasion that deserves to be investigated more closely, as these taxes contribute about one-third to the total state revenues.

The picture of the most important components of budget revenues shows, by and large, the effect of the economic policies diligently conducted to a questionable direction. Basically, they embarked on a strategy of strong labour taxation, moderate in consumption and of a reduced corporate taxation (which does not „fit” to left-wing politics).

If we also look at the gap between the income and expenditure growth, there is a major trend problem of ensuring the generously committed spending (see increases in the budget sector, where the health sector has steadily increased to the salary scale scheduled for 2022), based on some incomes that do not seem to keep up the necessary rhythm.

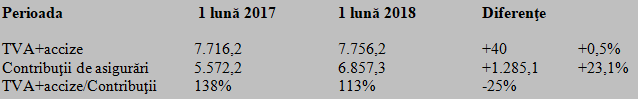

The substantial change in the ratio between the dimension of the main taxes on consumption (VAT + excises) and the insurance contributions (a ratio that will go toward 1 to 1), amplified by 23.1% after the transfer of the contributions to the employee, should also be emphasized. It seems a lot but considering that the full transition would have been done with an increase of 22.75% while the salaries increased somewhere around 14%, we can see that the expected results have not been achieved yet.

*

- Period one month 2017 one month 2018 Difference

- VAT + excises

- Insurance contributions

- VAT + excises/ contributions

*

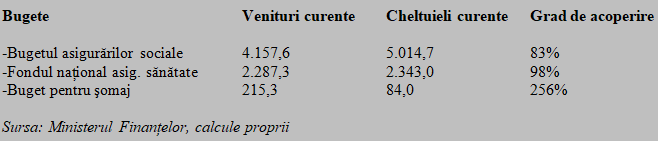

Despite the massive transfers of funds meant to increase the amount from contributions to the social security budget, it ended the first month of the year with a deficit of RON 857.1 million or 17% of the amount needed to cover the state’s obligations.

In the health field, the situation was relatively balanced (including on the basis of the deficiencies in hospitals), and in terms of unemployment, the excessive surplus tradition has maintained.

*

- Budgets current revenue current expense coverage ratio

- – social insurance budget

- – national health insurance fund

- – unemployment budget

*

It remains to be seen what will happen in the healthcare system after the strong increase in salaries will considerably reduce the money for the material base and for ensuring some conditions as civilized as possible for hospitalised patients. Will local authorities be able to use the surplus of RON 1,696.8 million registered in January at the level of all administrative-territorial units?

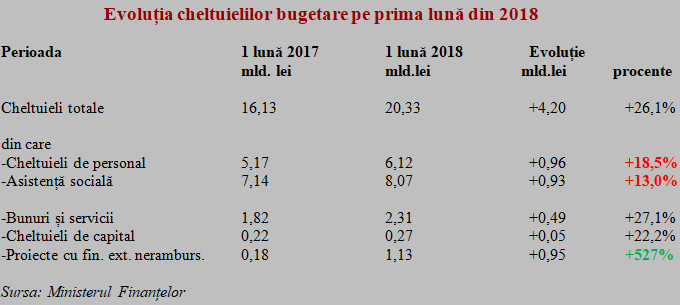

Salaries and social protection granted beyond possibilities

A selection of the expenditure in the first month of the year shows an increase in the wage bill, two and a half times higher than the economic results, and a nearly double growth rate in the social assistance relative to the GDP growth (the ratio of 13% -7% suggests the lack of sustainability in the mid and long-term, after we nearly missed last year to maintain the deficit within the 3% of GDP threshold.

That was even though the consistent but unplanned pension increase has been applied in the middle of the last year, which also explains the delay in applying the indexation of the pension point, also for the second part of the current year’s budget implementation.

*

- Evolution of budget expenditure in the first month of 2018

- Period one month 2017 one month 2018 Difference

- Total expenditure

- Of which:

- – personnel costs

- – social assistance

- – goods and services

- – capital expenditure

- – projects with foreign non-reimbursable financing

*

It is worth welcoming the return to better levels of the expenditure on goods and services, especially the acceleration of the allocation of funds to projects implemented with non-reimbursable financing (an extra amount of almost one billion lei), which recover from the modest performances recorded in the previous years.