The general consolidated budget registered in the first half of the current year a deficit of about RON 45 billion, equivalent to 4.2% of the estimated GDP (in the version of a real-terms decrease by only -1.9%) for the current year. The result is more than twice as weak as in the same period last year when it stood at about -1.9% of GDP.

The general consolidated budget registered in the first half of the current year a deficit of about RON 45 billion, equivalent to 4.2% of the estimated GDP (in the version of a real-terms decrease by only -1.9%) for the current year. The result is more than twice as weak as in the same period last year when it stood at about -1.9% of GDP.

In this context, given that the final result, without pandemic, was last year -4.6% of GDP on operational data (-4.3% of GDP according to Eurostat data) and on the current trend with worsening cases of infection, it is very likely that the target set for the first budget adjustment in 2020, of -6.73% of GDP, will not be achievable and a new increasing level of the budget deficit will be communicated with the adjustment in August this year.

By contrast and to be noted, revenues on six months (which accounted for 13.5% of GDP instead of 14.0% of GDP) were less than two percentage points lower than in the same period of the previous year in nominal terms, but expenditures increased somewhere to 14% in nominal terms (from 15.9% to 17.7% of GDP).

Deficit „distribution”

Thus, about 10% of the deficit increase came on the side of declining revenues, while 90% came from the expenditure increase.

Moreover, surprisingly and notably, budget revenues in June 2020 (RON 26.66 billion) were HIGHER than in June 2019 (RON 24.82 billion).

*

- Evolution of monthly budget implementations in Q2 2020 (billion RON)

- 4 months ’19 5 months ’19 6 months ’19 4 months ’20 5 months ’20 6 months ’20

- Revenues

- Expenditure

- Deficit

- (% of GDP)

*

Which clearly shows that, despite the efforts made by the economic environment to pay its tax obligations and the amounts received from the EU, increased since the beginning of this year by 21% or RON 1.56 billion, expenditures be they social and in the election year CANNOT be increased without major consequences for the budget balance. And the bill will come in time to pay back the loans and with the speed with which we will have to tighten back the belt to fall within the threshold of -3% of GDP.

Attention, already, BEFORE the new increases in pensions and child allowances, more than half of the deficit increase (RON 13 billion out of the extra RON 25 billion in H1 2020, without counting to “the last penny”) came on the social assistance side from a GDP supposed to be lower (for now) by RON 60 billion. For reference, the deficit from the National Health Fund in pandemic conditions was somewhere around one-third of this amount, about RON 4.7 billion.

Revenues issue

The lower amounts collected from the corporate tax (RON -607 million or -7.5% compared to the same period of the previous year) were covered by the receipts for the salary and income tax (RON +1,155 million or + 10.4%). Despite social distancing measures and payment facilities granted, the receipts from property taxes decreased by only RON 78 million or -1.9%.

Insurance contributions, the most important component of revenues to the general consolidated budget (RON 54.84 billion or 37.5% of budget revenues) ended the first half of the year at the zero level compared to the same period last year, from -2.1% in nominal terms after the first five months of the year, with the resumption of the economic activity at the end of the second quarter.

For indirect taxes, the decrease was -15.8% in VAT (RON 4.8 billion less, but improving as a percentage by -18.9% in May and -19.4% at the end of April), while excise duties remained on a downward trend (to be analysed) (+12.5% at the end of April, then -0.1% in May, and ended S1 at -3.3%).

Slowed down wage growth in public sector. Social assistance, already expanded

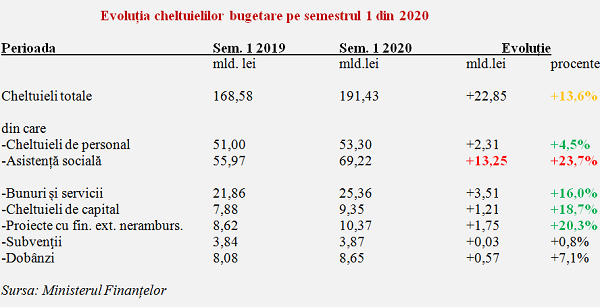

In the first half of the year, the moderation in the increase of salary expenditures in the public sector was welcome (+ RON 2.3 billion or + 4.5%, given that at the end of the first quarter they had already reached +RON 2 billion). The amounts for social assistance advanced by over ten billion RON (+ 23.7%), significantly above the general level.

*

- Evolution of budget expenditure in Q1 2020

- Period S1 2019 Sem 1 2020 Change

- Total expenditure

- of which

- – personnel expenditure

- – social assistance

- – goods and services

- – capital expenditure

- – projects with foreign non-reimbursable financing

- – subsidies

- – interest costs

*

Full half of the glass: European investments and projects

Very important, however, for the effort made by the state to limit Covid19 effects and lay the foundations for future economic recovery, growth rates of projects with non-reimbursable financing (+ 20.3%), capital expenditures (+ 18.7%) and those for goods and services (+ 16.0%) were above the average of the allocations made.

This approach has contributed to the positive signal given to international markets and the reduction in the medium and long-term interest rate.

Interest payments on loans increased by 7.1%, below the advance of general expenditure and obviously better than at the end of the previous month (they were at + 11.4%).

Which shows reasonable management, coupled with the decrease of long-term interest rates below the threshold of 4%, especially in the perspective of bringing the budget deficit back to the threshold of -3% of GDP in the medium term.