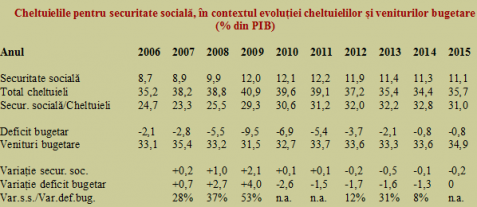

The social security spending increased over the ten years of EU membership by slightly more than two percent of GDP and about a quarter of the allocations for pre-accession, all in relation to the country’s economic outcome.

The social security spending increased over the ten years of EU membership by slightly more than two percent of GDP and about a quarter of the allocations for pre-accession, all in relation to the country’s economic outcome.

This change took place almost entirely in 2009, the increases from 2008 being offset by the negative change from 2012-2015 (see table).

*

- Social security spending, in the context of the budget revenue and spending

- Year

- Social security

- Total expenditure

- Social security/spending

- Budget deficit

- Budget revenue

- Change – social security

- Change – budget deficit

- Change – s.s./ Change – budget deficit

*

The maximum level of allocations for protecting people who needed the state support has been reached, somewhat paradoxically, not in 2009 or 2010, but in 2011. Precisely in a moment considered the point of maximum austerity. That in terms of GDP share, meaning that it has been given the maximum they could give. However, by reference to the total spending of the public budget, the peak year of social allocations was 2014.

The change, after eight years of consecutive growth in this indicator that is more relevant for prioritizing the money, was from 23.3%, in the year of the EU accession, to 32.8% of the public spending. A change equivalent to an increase of about 40% in the share of state allocations, reflecting the move toward the European social model.

This effort to increase the importance given to the social security (six percentage points of the allocations over only two years) was, though, countering the significant decline of the budget revenues, which shrank during the economic crisis by almost four percentage points between 2007 – 2009.

That contributed to bringing the budget deficit to the record low of -9.5% of GDP, in 2009. When we examine the data carefully, we see a big surprise, though. The increased expenditure for social protection was NOT the main cause of deepening the negative result for the public finances.

Specifically, in these three years, 2007 – 2009, the additional share allocated by the state to the social protection (the increase of pensions, the social benefits, etc.) increased by only 3.3% of GDP, while the deficit of the consolidated budget went up by 7.4% of the same GDP. It means that only 45% of the deficit was caused by the social protection measures and only in one year (2009), it represented a slight majority share (53%).

In other words, things are much more confusing than the simplistic theories circulated, in which some people emphasize on the unsustainable costs that the state committed in a time of economic difficulties and others on the waste and/or theft of public money, happened in various forms.

Ironically, the share of GDP allocated in 2010 and 2011 to the social protection was NOT affected by the relatively rapid change in the budget deficit. Specifically, although counterintuitive and instinctively challengeable on the public perception side, social security spending increased by 0.2% of GDP, while the deficit shrank by no less than 4.1%.

Neither for the period 2012 – 2015 the idea that the belt tightening to comply with the draconian deficit rules and the fiscal compact agreement (let us recall that we were heading towards a deficit of -1% of GDP) would have been obtained by massive limitations of the social protection options cannot be sustained.

To their decrease by 1% of GDP cumulated for the four years, it corresponded an additional decrease in the budget deficit of 4.6 percent of GDP. More specifically, only 22% of the budgetary adjustment has been made by reducing the social benefits. Benefits that last year were 2.4% of GDP higher than in the year preceding the accession to the EU and 2.2% higher than in the first year after the accession.

That means that social protection was anyway about a quarter higher than in the pre-accession context. For 2016, it remains to be seen when draw the line how much of the further deficit increase of 2% of GDP (which annulled the previous efforts and put on hold the commitments to maintain a cautious budget balance) will be reflected in an increased social security.

The fact is, before making any definite statements and getting fooled in either way by those who want to prioritize the use of public money with one purpose or another, we should be very careful. Especially when they either bring forward or anathematize the increased spending on social protection while behind, in the back of public finances, there are other developments occurring more discreetly.