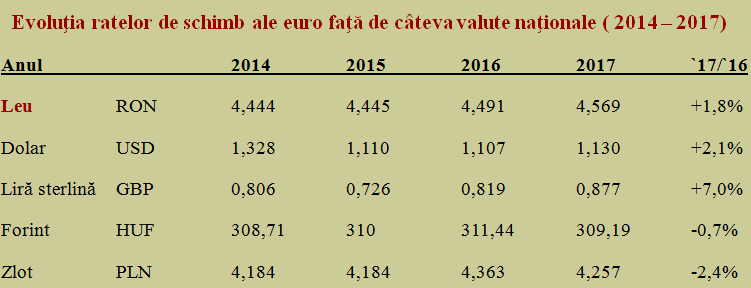

Romanian leu has depreciated against the euro in the past year by less than two percent, as an annual average, a similar value to the US dollar and much lower than the pound (the latter affected by the announcement regarding the exit from the EU).

Romanian leu has depreciated against the euro in the past year by less than two percent, as an annual average, a similar value to the US dollar and much lower than the pound (the latter affected by the announcement regarding the exit from the EU).

Unlike the leu, the Hungarian forint and especially the Polish zloty appreciated last year compared to the European single currency. Apparently, the Poles had a superior evolution, but if we look more closely at the evolution in recent years, this is just about a recovery of the devaluation that was somehow higher in 2016 (more than four percent compared to just one percent in the case of the Romanian leu).

*

- Evolution of euro exchange rates against some national currencies (2014-2017)

- Year

- Leu

- Dollar

- Pound

- Forint

- Zloty

*

Incidentally, the similarity between the leu and the zloty (both having the mention “new” added in the acronym and parities extremely close to each other, which in terms of retail prices makes us feel in Poland as home) was completely remarkable in 2014-2015, with the stability of the annual average euro exchange rate close to perfection.

If we look at the gains and losses of the dollar and pound, we can notice a much higher exchange rate stability in the Central European countries (where geographically we fit better than in the Balkans), with a floating exchange rate regime than in the big Western economies, less influenced by such fluctuations. Where the population does not even notice minor exchange rate variations, of one or two percent, which they consider normal.

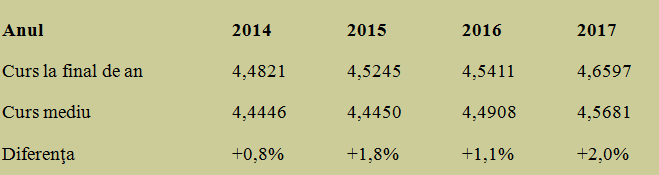

In other words, from the perspective of the international practice, nothing special happened and there are no reasons for concerns for now. Although the gap is slightly bigger, there is no obvious difference compared to the previous three years, if we consider the difference, in terms of exchange rate, between the annual average and the end-of-year values, the latter being systematically more increased for seasonal reasons.

*

- Year

- Exchange rate at the end of the year

- Average exchange rate

- Difference

*

Romania’s competitiveness and real effective exchange rate

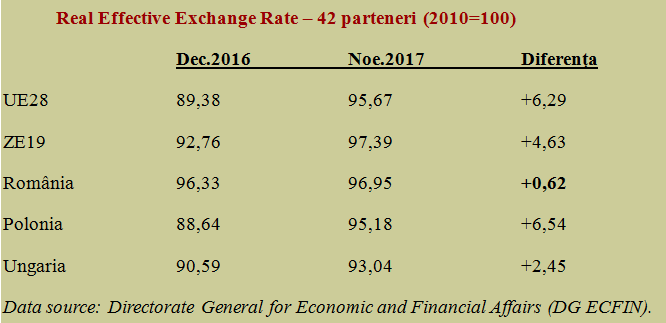

Let us now see to what extent the evolution of the exchange rate has affected or not Romania’s international competitiveness through costs or prices, relative to the main rivals on the international markets.

This is technically done by the so-called real effective exchange rate (REER abbreviated).

The indicator calculated based on the internationally harmonized rules from 42 countries (28 EU members + 14 industrialized countries, from USA and Japan to China, Russia and Turkey) with double weights in terms of exports (to correctly reflect the whole and not to give too much attention to the competition in the domestic market), shows an insignificant loss in competitiveness for Romania last year, according to the latest data processed and published by Eurostat.

*

- Real Effective Exchange Rate – 42 partners (2010=100)

- Dec 2016 Nov 2017 Difference

- EU28

- Eurozone 19

- Romania

- Poland

- Hungary

*

The technical interpretation is a deterioration in competitiveness along with the increase of the indicator and vice-versa, the value of 100 being set for 2010. The relative appreciation of the single currency has quite clearly affected the competitiveness of the Eurozone countries and a little more the value registered for the whole EU.

The change in the latter was similar to that in Poland (which also had the highest appreciation of the exchange rate against the euro), higher than in Hungary (whose forint appreciated three times less than the zloty) and much more than in Romania, which chose the option of the acceptable depreciation but maintained its competitiveness.

Of course, it may not be the best way to preserve competitiveness and we would have the sustainable options, somehow more efficient on mid and long-term, for investments in modernisation, improving the business environment or expanding the infrastructure. But, in the meantime, balances are a daily challenge and are maintained with the means that we have available.

Unfortunately, by the channel of imported goods, all the more desirable in terms of price-to-value ratio the lower the euro exchange rate, and the one of the income growth rate that is double the GDP growth, the risk of the general price index inflation occurs.

Which makes the adjustment of the monetary policy difficult and sends us back to the economic fundamentals of the restraint in increasing wages and pensions, so as not to affect the competitiveness and not to weaken the national currency.