The estimates by economists of most important banks in Romania on the depreciation of the local currency for this year range between 4.73 and 4.77 RON/euro.

The estimates by economists of most important banks in Romania on the depreciation of the local currency for this year range between 4.73 and 4.77 RON/euro.

The depreciation of the Romanian Leu in the past few days is the effect of uncertainties regarding the soundness of the state budget in 2019, amid macroeconomic imbalances gathered over the last period, according to analysts of large banks in Romania.

Also, the new fiscal restrictions provided by „Teodorovici Ordinance” have worsened the prospects on trade and current account deficits, which are already steadily increasing, as well as the deficit of the consolidated budget.

Effect of imbalances

Moreover, further severe tax measures are inevitable in 2019, according to a report by Banca Transilvania (BT), issued on Thursday, signed by Andrei Radulescu, Senior Economist of the bank.

„For 2019 fiscal year there are signs of budgetary fiscal consolidation, after the relaxation in recent years that has led to a deepening of the deficit (with the risk of exceeding the threshold of 3% of GDP, set by the Stability and Growth Pact),” the BT report said.

The evolution of the Romanian Leu was „mainly driven by the challenges from the macroeconomic balances area and the uncertainties in the domestic economic policy, in a context marked by volatility in the international financial markets,” Andrei Radulescu also explained in a statement for Agerpres.

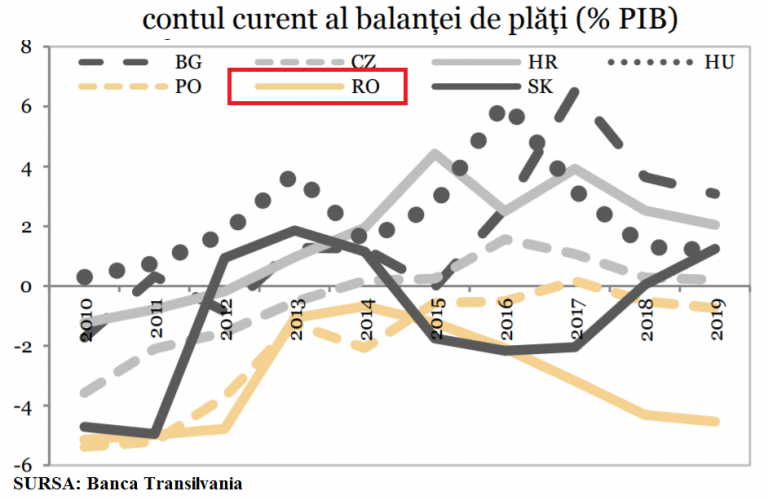

In 2018 Romania recorded the highest current account deficit (4.8% of GDP) among the countries from the region that are also EU members and was also at the top within the EU in terms of the budget deficit (3% GDP), notes the BT report.

*

- Current account of the balance of payments (5 of GDP)

*

In addition, the absence of a draft budget for 2019 contributed to increasing the perception of risk regarding the evolution of the budget deficit in 2019, says Andrei Radulescu.

Depreciation rhythms

The BT report estimates the exchange rate at a maximum of 4.73 RON/euro and an average of 4.71 in 2019, respectively at maximum levels of 4.78 in 2020 and 4.84 RON/euro in 2020.

Estimates were adjusted upwards from the previous central macroeconomic scenario, which saw an average of 4.70 in 2019 and 4.74 RON/euro in 2020.

Banca Comerciala Romana already estimated the exchange rate at 4.77 RON/euro at the end of 2019, even before the comments made by BNR Governor on Tuesday, on the impact of the ordinance, to which he referred by using harsh words, after the monetary policy meeting of the central bank.

A few days before, BCR economists were expecting for RON to „have in 2019 a moderate depreciation trend against the euro (2-3%), explained by the budget deficit, the current account deficit and BNR’s undermined capacity to follow an independent monetary policy.”

„Of course, many things depend on BNR’s willingness to allow for larger variations of RON in the market,” wrote Horia Braun Erdei, Chief Economist and Eugen Sinca, Senior Economist of BCR in a report from January 7.

For its part, BRD expects that RON depreciation „could test the level of 4.70 (RON/euro), and for 2019, the threshold could move to 4.75 in the context of economic problems (a slower economic growth, the increase in twin deficits),” according to a report by the bank’s research department.

After remarking that „the EUR/RON ratio has consolidated above 4.67”, an ING note issued Thursday adds:

„Because this is rather uncharted territory, we would expect for the central bank to improve volatility and enter the market at a certain moment, to indicate the limits of its tolerance.”

BNR’s reaction

„The new measures that came into effect earlier this year change the data on the two markets – foreign exchange and monetary interbank ones, which are closely correlated and consequently new levels of balance are being sought in these markets,” explained Dan Suciu, the spokesman of the National Bank of Romania, quoted by Agerpres.

Further, the BNR official implicitly confirmed the possibility mentioned above by the ING note, which is allowed by the controlled floating regime of the Romanian currency.

„Under the circumstances of maximum uncertainty, BNR’s role is to mitigate the excessive movements that may appear in these markets,” said Dan Suciu.

The BNR official drew attention in this context to the relative stability of the exchange rate registered last year, „following the improvement of some fundamental indicators, such as the inflation rate, as well as a stability in terms of interbank interest rate variation, including a slightly positive margin compared to other markets in the region.”