According to data published by the National Institute of Statistics, Romania’s trade exchanges with Hungary, Poland and Slovakia caused almost 43% of the deficit registered by our country in the foreign trade last year.

For comparison, we should remind that the negative result cumulated for the trade with the four largest EU economic forces (Germany, the UK, France and Italy) is only 1.8%.

An economy with a GDP of less than two-thirds of Romania’s, the Hungarian one, produces more than a fifth of the deficit (20.8%) and ranks second after China, a country with which most of the world’s countries register a deficit.

Poland, with a size of the economic results two and a half times bigger than Romania, also contributes with sixth (16.6%) of our trade deficit and is the only state with which we have a significant trade besides China, with which we register a coverage ratio of imports by exports of less than 50%.

Finally, from the trade with an economy that is 2.2 times smaller than ours, the Slovak one, we registered last year a deficit of 5.5% of the total, placed between the deficit registered with Germany (which has an economy 17 times larger than ours but brought us a minus of only 6.1% of the total) and Italy (nine times stronger according to the official Eurostat data on GDP in 2017 but with a contribution of only 4.2 % of our trade deficit).

Surprisingly, Romania has a rather pronounced surplus with the United Kingdom (6.7% compared to the trade deficit of last year, namely more than we registered in the exchanges with the European driving force, Germany) and a favourable position in the trade exchanges with France (1.8% on the total deficit).

Therefore, not the economic exchanges with the big European economies raise problems to us, but rather those with our former colleagues from the socialist bloc, in relation to which we only manage to have exports at some worryingly low proportions compared to imports (54.3% with Hungary, 49.7% with Poland or 62.5% with Slovakia).

We mentioned Slovakia, because, very interestingly, we are significantly better in our exchanges with the Czech Republic (2.9% of the deficit, at a coverage ratio of 86.4%).

Romania as a market

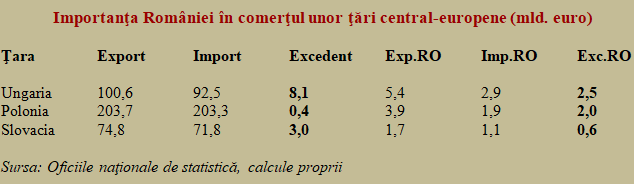

Going further, it would be interesting to see the importance of the sale market which Romania represents (the seventh EU country by population) for Hungary, Poland and Slovakia (it is not the case with the Czech Republic, to which we are a less important trade partner).

The data collected from the national statistics offices show that from the trade with Romania:

- Hungary obtained over 30% of the surplus registered in 2017 in its foreign trade,

- Slovakia, 20% of its own surplus

- Poland (pay attention! about 500%, given the relatively small size of its trade surplus).

Incidentally, you can see how all these states, unlike Romania, register foreign trade surpluses, with beneficial effects in Hungary’s case for the forint and in Poland’s case for the zloty (both having a floating rate regime, like us).

*

- Romania’s importance in the trade with some Central European countries (billion euro)

- Country Export Import Surplus Export Romania Import Romania Surplus Romania

*

To Hungary, we are even the second trade partner after Germany. With 5.4% of Hungarian exports, we surpass Slovakia, France and Italy (which oscillate around 5% each).

In our trade with Poland, we do not make it to top 10, a ranking which ends with the US (EUR 5.5 billion), but their result from the trade with us is very important, as the annual surplus of about EUR 2 billion from this relationship is five times higher than the overall surplus.

But Slovakia has the most interesting situation, the smallest of the economies that manage to place far more products on our market than we can manage to do on their market. For them, we are on the 10th position by export destinations but with the second largest annual growth rate (+15.3%) after the US and we have already got ahead of the Netherlands in the first two months of 2018.

However, last year, we did not count as a surplus source for Slovakia because we had to stay behind Germany (about EUR 3.6 billion), the UK (EUR 2.7 billion), Austria (EUR 2.5 billion), France (EUR 2.4 billion), Italy (EUR 2.2 billion), Poland (EUR 2 billion, pays for Slovakian products what it collects from the sales to us), USA (EUR1.3 billion), the Czech Republic (EUR 1.3 billion) and Spain (EUR 1.1 billion).

In this context, perhaps we should pay closer attention to the markets from our immediate vicinity, where we could easier develop our exports, even though it does not seem like that to us (Ukraine has a surplus of EUR 165 million euros with Slovakia) and reach a level of goods deliveries to other countries closer to the GDP we have reached.

Of course, it is easier for smaller countries to focus on export (Slovakia has a 105% export share in GDP and Hungary 81%, while Poland reaches only 44%).

But even so, the competitivity test on markets somewhat similar in terms of revenues is very important, and our position (33% ratio between exports and GDP) should be somewhere between Hungary and Poland. Which would also balance the chronically deficient trade exchanges with these countries.