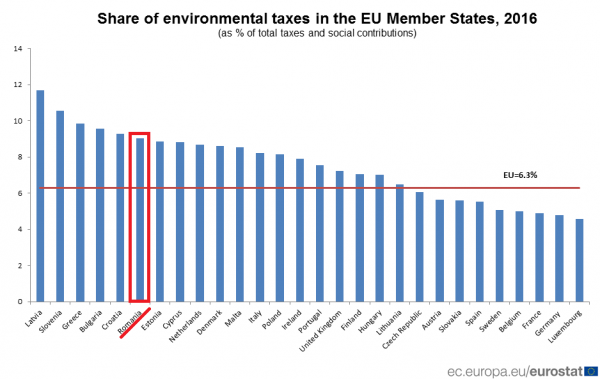

The Romanian Government benefits from the fifth largest share of environmental tax revenues, with 9% of total taxes and contributions, according to the data released by Eurostat on Wednesday.

The Romanian Government benefits from the fifth largest share of environmental tax revenues, with 9% of total taxes and contributions, according to the data released by Eurostat on Wednesday.

However, Romania is threatened with the infringement procedure because of air pollution in large cities.

In Romania, government revenue from environmental taxes exceeded EUR 3.9 billion in 2016, up 59% compared to 2007 and 1.9% to 2015, according to Eurostat data.

Romanians pay 17 environmental taxes at different levels of the administration, according to the National Institute of Statistics (INS).

There are taxes on transport (excise duties on car imports and car sales from domestic production, car registration tax, road taxes, tax on cars), energy taxes (excise duties on imports and electricity sales, over-excise to fuels, revenues from the single tax on fuels delivered, consumed or imported by producers, development tax, revenues from the sale of greenhouse gas emission allowances), taxes on resources (tax on oil from domestic production and natural gas, tax on the activity of prospecting, exploration and exploitation of mineral resources) and a pollution tax (taxes and other revenues from the environmental protection).

Governments of Latvia (11.7%) and Slovenia (10.6%) have the largest share of tax revenues. They are followed by Greece (9.8%), Bulgaria (9.6%), Croatia (9.3%).

The European average has declined from 6.4% in 2006 to 6.3% in 2016.

The lowest share is 4.6% in Luxembourg, followed by Germany (4.8%), France (4.9%), Belgium (5.0%) and Sweden (5.1%).

On the other hand, Romania and other eight states should submit their plans for improving air quality to the European Commission by 5 February. Otherwise, Romania, Hungary, the Czech Republic, Germany, Spain, France, Italy, Slovakia and the UK will be sued in the EU Court of Justice.

Government revenues from environmental taxes in the EU member states amounted to EUR 364.4 billion in 2016 compared to EUR 296.5 billion in 2006.

Energy taxes accounted for over three quarters (76.9%) of total environmental tax revenues, followed by taxes on transport (19.7%) and taxes on pollution and resources (3.4%).